An introduction to Bilibili (゜-゜)つロ 干杯~

A deep-dive into the Chinese Gen Z "Youtube"

How have I spent my two weeks in quarantine you ask?

By binge-watching parodies, film criticism, startup history and viral videos on Bilibili.

What is Bilibili?

Grossly simplified, it's the Chinese equivalent of Youtube. Except it's not. It's like if Youtube, Twitch, Steam, Patreon, TokyoPop and Netflix had a CRISPR-baby, and that baby was a weeb, but that weeb is also super down with Chinese Gen Z and is listed on the Nasdaq with a market cap of $15bn. That is Bilibili.

But is it interesting?

Oh it's interesting - you need to pass a 100 questions entrance exam to be a member, it's a user-generated platform not dependent on ad revenue, Tencent and Alibaba took a break from their long-standing beef to invest $1bn+ combined in it, and most videos look like this at a glance:

Clickbait one-liners aside, I think Bilibili is an interesting example in intentional community cultivation while effectively monetising that community (Reddit is the counterexample). As a latecomer to the streaming wars in China, its growth strategies and innovative business models are also a useful reference for second movers in established markets. Also, since the children are our future, it's never too early to find out what the Gen Zs are up to.

Have I got your curiosity? Let's deep-dive!

Background

Bilibili (or B站 aka B station as it is also known) was founded in 2010 by avid Anime, Gaming and Comics (AGC) fan Yi Xu from a frustration that the mainstay Chinese anime platform at the time (ACFun aka A Station) kept crashing. Young Yi Xu could not get consistent access to his beloved vocaloid Miku (Bilibili's prototype was called Mikufans.cn), and in good old fashioned nerd rage, committed to building his own website, with blackjacks and h******. Sorry, I mean, he committed to building a more robust website that's genuinely dedicated to the hardcore AGC fans of China.

A turning point for B station came in 2011 when Rui Chen became an angel investor. Not only was Rui Chen a serial entrepreneur and an experienced operator, but he was also more importantly, at least in the eyes of Yi Xu, a fellow weeb. Yi Xu had long shunned investors but had a change of heart once Rui correctly identified the origin of Bilibili as from the anime "A Certain Scientific Railgun". Watching anime = Laying down foundations for winning deals.

As the users and community grew, issues with copyrights, scaling and costs also increased. In 2014, Rui Chen took over as CEO from Yi Xu (who is still with the company but focuses his attention on community building), and brought on additional VC investments from IDG and Qiming and started scaling Bilibili to the next phase of growth. More details on Rui Ma’s great podcast on this topic.

From the outside, currently, Bilibili looks like a success story, my initial bland summary for it reads: "today Bilibili is probably one of the biggest mainstream entertainment portals for the Chinese Gen Z with a range of offerings including user-generated video sharing, live streaming, mobile gaming, online comics and event ticketing. It’s also diversified its content coverage to attract more mainstream audiences with coverage on beauty, e-sports, pop culture and many others. It listed on the Nasdaq in 2018, and has a current market cap (as of writing in August 2020) of $15bn." But that's not the happy ending, it's just a snapshot in time, and indeed, great perils lie ahead for our hero.

You see, Bilibili started as a passion project, and came relatively late into the commercialisation game (only beginning to earn money in 2017 through game licensing). Their story to investors has been about building an intentional community and then monetising that community; the challenges come in how they would do that effectively. "Effectively" here means continue to grow their users without too much culture dilution, all the while trying to monetise a time-rich but cash-poor user base in an ad-fatigued world. It's a massive ask, and many have faltered before on the path.

Market snapshot comparison

Zooming out, Bilibili is still small in the context of the Chinese video streaming and live streaming space. They stand out for their relatively young user base (81% of users are born after the 90s based on SEC filings in 2017) and their high levels of user-generated content (over 90% of views comes from user-generated content from Q1 2020 investor report).

I've pulled some competitors stats to benchmark their MAUs and subscribers. Still, these are not apples to apples comparisons since iQIYI, Tencent Video and Youku Tudou are freemium OTT streaming platforms focusing on professional content. At the same time, Huya and Douyu are two pure-play e-sports live streaming offerings. Bilibili, as we'll see below, has a much more complicated monetisation model.

We can see that Bilibili is still quite a small platform relative to its content streaming peers but comparable to the pure-play live-streaming folks. It's growing at ~70% year on year (outpacing the ~4-5% yoy growth of iQIYI) and it seems like there’s a lot of space for expansion in the future.

Business model and strategy

Overall I think Bilibili's strategy and business model has the following logic, and we'll look at each stage in depth below:

Stage 1: Entrenchment into the community by creating an in-group

Bilibili has an incredibly sticky and engaged community (cohort chart below from Q1 2020 investor presentation), and it does so by cultivating buy-in into an internet sub-culture that from the outside seems esoteric and bizarre. I think the bizarreness is a feature, not a bug. Two expressions of this are the subscriber entrance exam and the bullet commentary, which shows Bilibili (at least for the time being) prioritises community engagement over user experience friendliness.

While videos are free to view on the platform, the registration process to be a commentator for Bilibili is perhaps the most demanding one for any social media platform today. It involves passing a 100 multi-choice questions test with at least 60 correct answers within an hour. Topics covered in the test include copyrights, commentary etiquette, platform neologism and niche questions based on topics of your choosing (a sample question from when I took it recently: In Game of Thrones, which of the following is not part of the Faith of Seven?). It’s little consolation to know that the test has been significantly watered down from the early days of hardcore AGC fandom which required 80 correct answers for passing. (Below says I passed with 60 right answers which was higher than 77% of people who’s taken the test)

Every single social platform in the west that I can think of focuses on reducing the registration friction, it seems like a no-brainer esp if your priority is the growth of the platform. Bilibili’s process seems counter-intuitive until you factor in that its aim is sustainable growth. Sustainable growth means that they want to let in dedicated members who will engage earnestly with the content, and having a pretty time-consuming quiz does filter for that. It's an initiation ritual that signals and cements the bond users have with the platform. New users are also more culturally aligned with the existing community, which means fewer flame wars and less exodus of the original community. In other words, it deters the trolls.

One of the big draws of registering as a user on Bilibili is that the user can now write bullet commentary (obligatory Chinese translation for authenticity: 弹幕 or danmu) on the videos. Bilibili didn't invent the bullet commentary, it “borrowed” the feature from ACFun, who in turn “borrowed” it from the Japanese anime platform Nico Nico Douga. Bullet commentary allows comments from users to appear on top of a video at the time stamp of when the comments were written ( link for further details on bullet commentary).

The feeling from watching a video with bullet commentary, after the initial chaos, is one of tapping into the hive mind, or sitting in a rambunctious movie theatre, or following a show's live tweets. What Twitch, Rabbit and Bilibili all know is that seeing the real-time reaction of others make you feel like you're watching amongst friends. The collective response and commentary is also a form of meme generation that often makes the original material even funnier.

Bullet commentary is now a prevalent feature in Chinese online media with iQIYI, Tencent Video and a slew of other mediums (music and comics nothwithstanding) all adopting it on their platform. The crowdsourced creation component and the hypervisibility of bullet commentary means a high-quality community who can generate good commentary is essential. Bilibili has cracked the formula with entrance exam for registration -> culturally aligned community -> appealing bullet commentary -> attracts more users to the platform. The virtuous feedback created by these features impacts not just the user growth but also the user’s engagement and emotional connection with the platform.

Stage 2: Owning the user by capturing a stage of life rather than a field of interest

Relative to western consumer tech companies, who tend to focus on “serving a function” as their core mission, Chinese companies tend to focus on “owning the user” as their core mission (though the initial wedge into the consumer is always through a function - Meituan through food delivery, Ofo through bike-sharing, etc.). Owning the end-user and their attention is what led to the rise of the super apps and Bilibili is no different. As to why this is the case, that is a future post on to itself (as in, I don't quite know yet but I can probably make, I mean, thought leader something up).

Suppose we view Bilibili's product strategy as being focused on owning the user rather than engaging all users who have a specific functional need. In that case, their choice of expanding into verticals with less relevance to UGC makes a lot more sense. Put another way; they want to own the Chinese Gen Z population's attention through providing a comprehensive entertainment service rather than be the platform that caters for all Chinese UGC video needs.

What other things does an anime-and-games-UGC-watching Chinese Gen Z like to do for fun? They probably like anime, like non-moving anime aka manga, like playing games, like watching professionals play games aka e-sports, like watching esports in real-time aka live streaming, like buying anime and games related merchandising, etc., the list goes on. Translated to a product range, they might look a bit like the below:

I also think there's a lot more bi-directional influence between monetisation and product development choices than what I've highlighted so far. It's entirely probable that the most easily monetisable products are adjacent products rather than deeper UGC platform offerings, and that was the substantial factor in the product expansion strategy for Bilibili. Also entirely likely that had advertising revenue been enough to sustain the platform, they might have never considered other strategies.

Overall though, I do view the divergence on core focus as being the key difference between Bilibili and Youtube. The former building their competitive advantage on owning an engaged and youthful population, (similar to the strategy of Snapchat and Tiktok) and the latter building to be a monopoly on UGC video for any user in almost any location.

It's a strategy that's already bearing fruits - Bilibili has received $1.5bn + post-IPO strategic investment from Alibaba, Tencent and most recently Sony. The fact that both Alibaba and Tencent have video platform subsidiaries themselves (in the form of Youku Tudou and Tencent Video respectively) indicates that Bilibili has a unique position in the ecosystem. From Bilibili's perspective, the investments are a way to serve the user additional content (from Tencent Video) and also provide AGC merchandising capabilities (from Alibaba’s Taobao and Tmall). As long as they are the first stop for the user for entertainment, they can delegate the rest with a best of breed approach.

Stage 3: Effective monetisation of the user while still retaining the other stakeholders

Effective monetisation is something that Bilibili is still in the process of figuring out. They started the commercialisation “journey” by being the Chinese game distributor for Fate / Grand Order in 2017 and has only begun to branch out into other channels. Arguable their golden years are ahead of them for when the Gen Zs hit their earning stride and there's still a lot of time for things to change and for Bilibili to pivot until then. However, their diversified revenue streams are still enviable for many companies who are in a similar stage of trying to figure out the mythical paths towards getting money.

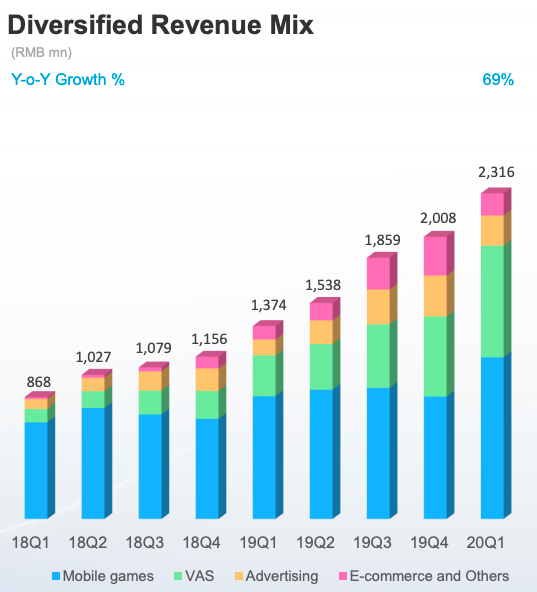

This is what Bilibili's current revenue mixture looks like (VAS is value-added services, which refers to revenue from live streaming and premium membership):

So the first thing to note is that unlike Youtube, Bilibili is not dependent on advertising. The most compelling reason for this is that Bilibili does not want to alienate the community as it pursues monetisation. It also can't afford to. Bilibili has to deal with a fickle user base who have plenty of other free content platforms filled with advertising they can choose from; they don't enjoy the same monopolistic benefits that Youtube does. Bilibili also probably can't rely solely on advertising. Given what we know about the youthful demographic on the platform, it's not a money rich crowd, and only certain sets of advertisers (FMCG, education, gaming and other entertainment products) are likely to get real ROI by investing there. Instead, Bilibili prefers to spare the user from excessive advertising and instead focuses on alternative routes to monetisation.

It is also uniquely well-positioned to know which products would be appealing to its user base given the amount of data on user interests it has access to. Picking the blockbuster game Fate / Grand Order for Chinese distribution was the genesis of this strategy and will be a focus for them going forward.

Value-added services is the fastest growing revenue segment for Bilibili, at a whopping 171.9% increase yoy, the bulk of which is coming from membership fees that allow users to access premium content. This revenue stream has led to increased investments into proprietary content (such as purchasing rights to LoL livestreams as well as commissioning exclusive anime for their platform), and it will be interesting to see whether this moves Bilibili more towards an Netflix model in the future.

The other influential stakeholders for Bilibili on the platform we haven’t mentioned yet are the content creators (or Up group in Bilibili slang, short for uploaders). Without large volumes of advertising revenue, something that Bilibili lacks is how to compensate content creators adequately. New features that they have introduced to entice and retain creators include direct donations to creators from users, a marketplace for brands to find creators with standardised settlement procedures and dedicated account managers for high ranking content creators. I’m not too worried about the Up group leaving Bilibili, since anecdotally a lot of them seem to derive intrinsic value from being in the community and engaging with it through their creations. But the bigger question is “would the incentive structures be enticing enough to encourage new types of creators to join Bilibili?” - that is less clear to me.

Conclusion

Bilibili's story is far from over and is by no means a qualified success. I think they are a very interesting counterexample of how to grow, curate and monetise a community. It goes against a lot of the well-trodden paths western tech companies have taken and continue to make, such as monetisation through advertising, letting the platform moderate itself, focusing on serving a function and growing the user base as fast as possible.

Currently, Bilibili is going through the classical motions of crossing the chasm after finding product-market fit from an enthusiastic group of early adopters. They walk the tight rope of needing more users to grow to profitability but risk diluting the core community in the process. There are already reports of the die-hard AGC fans moving away as they feel newcomers to Bilibili are destroying the vibe.

The future is uncertain, but Bilibili is a remarkably sweet and wholesome platform despite their scale. There's a general feeling from reading the bullet commentary (which are curated for appropriate content by ~1,220 FTE content moderators btw) that the strangers on there are playful and supportive. I've been surprised by the range of content on there during quarantine, from birthday songs for the two Bilibili mascots to discussions on feminism in China and a Daoism reading of Fight Club. As I sat in quarantine purgatory, often anxiously wondering what was waiting for me on the other side, Bilibili was that most rare of social media platform these days, it was reassuring and positive. It made the internet, for me, a better place.

Interesting links:

Gen Z using bad ratings to kill their online education software during COVID

The decline of middle America and the problem with meritocracy

Note: I don’t own any Bilibili stocks as of the writing of this article.

Acknowledgement to DannyData’s Zhihu answer which shaped my thinking and Alex T and Noah S who helped with reading through my drafts.

Awesome writing, precisely translated, really informative and fun to read!

I'm very surprised how you write very light , opinion based on solid data and somehow funny it's the total opposite when I heard your interview in one podcast (sinica) , I wish you well in your new adventure in China