Welcome to the new subscribers! I write a longform analysis about tech in China from the perspective of a 🐢 VC. For the 10th edition of our newsletter, we bring a special 2-part report on Ant Group. The first piece is done in collaboration with our friend Mario over at The Generalist. If you like the content, please share with friends!

Intro: The IPO

"I'm retired. If you think what I'm saying is crazy, just pretend you didn't hear it."

As corporate speeches go, Jack Ma's galvanizing pre-IPO address was remarkable in its frankness and vision. In the lead up to Ant Group's offering, Ma outlined the issues with the current global financial system:

"China's financial system development used to follow that of Europe and the US, with the thinking that we needed to catch-up. But just because it's European or American doesn't mean these financial systems are still relevant. We need to create the systems of the future…[The current frameworks] are a set of rules for the geriatric."

Though mired in the wonkish details of the "Basel Standards" — a regulatory framework adopted after the global financial crisis — the thrust of Ma's message was clear: China must lead the way when it comes to financial innovation. And no one is better positioned than the humble, mighty Ant.

It is hard to overstate just how unique Jack Ma's second generational company is, both in terms of scale and scope, a data-visualist's nightmare: all scale breaks and subproducts.

Look, for example, at the transaction volume of Ant's Alipay product compared to payment's stalwart PayPal. While PayPal processed $712 billion in 2019, Alipay saw $17 trillion move through its pipes, in Mainland China alone. It's enough to make you wonder, Derek Zoolander-style, which company should be considered the financial formica.

Indeed, if Ant lists at the pricing expected, it will eclipse PayPal's market cap on day one. At the time of writing, PayPal's valuation registers a tick north of $230 billion; Ant Group is slated to raise $34.5 billion through its dual-listing on the Shanghai and Hong Kong stock exchanges, setting the company's market cap at $313.37 billion. That eclipses such sober financial bulwarks as JP Morgan ($297.32 billion), Citigroup ($87.46 billion), Goldman Sachs ($65.22 billion), and Bank of America ($203.48 billion). Given the love-in for IPOs bearing the whiff of tech multiples, there's every reason to expect a short-term run-up that creates even more separation between the software developers in Hangzhou and wizened Wall Streeters.

It's worth wondering: is such a valuation merited? Though there's a cleanness in the narrative of the new world supplanting old, technology gobbling banking, reality is rarely so unmuddied. In search of an answer, we'll discuss the story of Ant's founder, the Chinese historical payment landscape, the conglomerate's product line and playbook, the company's performance, and the risks faced.

The Man Behind the Company: Jack Ma

As he tells it, the first time Jack Ma considered building an internet business was when held at gunpoint.

Born to a working-class family in Hangzhou in 1964, Ma's career up to 1995 had been eventful if unremarkable. After learning English by listening to Voice of America and offering tours of his home city in exchange for lessons, Ma attended college only after failing the entrance exam twice. He would later say that he'd applied to Harvard ten times, racking up a decade of rejections.

He had similar struggles when seeking full-time work, considering working for local law enforcement as well as a foreign colonel:

"I went for a job with the police; they said, 'you're no good...I even went to KFC when it came to my city. Twenty-four people went for the job. Twenty-three were accepted. I was the only guy [that wasn't]."

Eventually, Ma secured a position as an English teacher earning $12 a month. Blessed with an entrepreneurial streak, he parlayed that expertise to open a translation agency, a business that sent him to Malibu, to a mansion, to a man flourishing a gun.

Ma had been dispatched to recuperate debts on behalf of a client, but the American partner had a rather blunt way of demonstrating his dissent. Ma was held at the house for two days, only escaping after promising he would start an internet company in China with his jailer as his partner.

That ability, the gift of persuasion, of speaking, is central to the Ma story. Liberated and now keenly interested in learning about the technology he had just consented to build a business upon, Ma returned to China and set about exploring the web. As with his education and employment, it took him a few tries to get it right. China Pages was his first formal attempt and may have been the country's first internet business. Though that internet directory didn't work, success was not too far behind: in 1999, four years later, Alibaba was founded, funded by a $60,000 friends and family round.

Ant would arrive on the other side of the millennium in 2003, announcing itself under a different name: Alipay. By then, Jack Ma was earning his nickname "Crazy Jack," granted for his speech's enthused, vivid manner. Alipay was a small but significant feature at that juncture, essentially an escrow account between customers and merchants interacting on Alibaba's core site. In the years that followed, led by some of Alibaba's senior team, Ant wildly outgrew that premise, attacking new sectors with manic vigor; more infestation than upstart.

In 2014, Alipay was rebranded as Ant Group, going on to raise $4.5 billion in outside capital the following year. Today, the conglomerate boasts 1.3 billion users, spanning wealth management, insurance, payment processing, and beyond.

A brief history of Ant and China's payment history

It's hard to understand the behemoth product line of Ant Group without knowing what China was like in the 2000s. So let's go back to the beginning.

In 2003, China had a non-robust financial system barren of credit agencies like FICO and Experian, burdened with UnionPay, a nascent but lethargic clearing and settlement system. Without an established credit system, loans remained the privilege of established enterprises with real cash flow and the documentation to prove it. Individuals and SMBs resorted to the "bank" of friends and family, as Ma did. Fraudsters were seemingly everywhere: in the papers, on the street corners, running off with life savings in the blink of an eye. Wealth management was, well, for the wealthy, with a barrier to entry set above the average salary. For most, buying a home was the investment of choice, as well as the appropriate signifier of a life adequately led.

It's with this backdrop that we can better understand precisely how radical Ma's Alibaba was. The initial version required buyers to place orders online but receive them in person. Few relished the prospect of sending money to a stranger and potential swindler.

Alipay's escrow service was a breakthrough, holding the buyer's money until they confirmed they'd received the goods. Which is not to say that Alibaba remained a seamless platform. Indeed, plenty of issues remained: a digital bank account was required to shop (which took weeks), and transferring money to the escrow account was a tedious process. Payment processing was patchy under the new bank clearing process, and only 60% of the platform payments went through. Consumers couldn't access credit, meaning that bigger purchases remained beyond most. Finally, SMBs struggled to receive loans, constraining their growth on the platform.

Call it laddering or call it owning the user. Within a few years, Alibaba had built out a set of online payment rails, collaborating with Sun Microsystems and a consortium of other banks. Alipay became a payment gateway, allowing customers to seamlessly open a digital wallet, conduct quick-payments, and pay utilities. These features lived in a standalone super-app, which in turn, opened to enable third-party "mini-apps." It's fair to say that the Alipay team was pretty busy.

A seismic transformation had been made. By introducing digital payments into every facet of life from food delivery to school fees (there's currently over 1,000 daily life services and over 2 million programs on the Alipay app), Alipay ensured that the digital wallet replaced the physical one for many. And with that change assured, a host of adjacent opportunities opened. Want to invest your spare change in a mutual fund? No problem. Need a line of credit to buy the latest gadget on Taobao? Of course.

Ant owned the consumer. Since then, the company's been able to understand and serve them to an unparalleled degree. In the process, become the ultimate aggregator.

What does Ant do?

We've spoken a great deal about Ant's history and development, alluding to their product span. It's time to dig into the details.

Digital payments

Launched in 2004, Alipay allows merchants to transact with consumers both on and offline. Online, whether within the standalone Alipay app or on partner sites, users can select the Alipay e-wallet as a payment method at checkout and complete the transaction instantly. Offline, users leverage Alipay to scan a merchant's QR code or have their Alipay e-wallet QR code scanned. (A phrase ubiquitous in China: "Do you want to scan me or should I scan you?"). Merchants can also receive payment via the app or POS terminals.

Ant earns revenue from digital payment by charging merchants and platforms a transaction fee, as low as 0.1% per transaction. In turn, users are charged for transfers to bank accounts and credit card repayments.

CreditTech

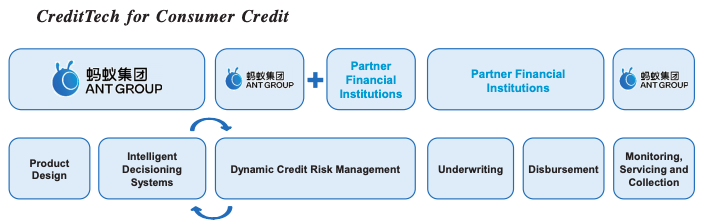

Since 2014, Ant has offered a range of unsecured revolving credit products for consumers and merchants. They target underserved populations (typically SMBs or consumers in lower-tier cities in China) who don't have access to bank cards or access to wealthy friends. Ant operates a marketplace where they originate loans, but rely on third-party financial institutions to underwrite them. Ant typically doesn't hold a balance sheet or provide guarantees. As of June 30, 2020, approximately 98% of credit balance originated through their platform was underwritten by other parties or securitized.

Ant Group has developed its own dynamic consumer credit risk approach with over 100 credit assessment models.

"Based on customer insights and risk rating in terms of spending, assets, liabilities, occupation, and other parameters such as financial stability, we categorize all Alipay users into different risk categories. For each category, we design customized models as well as tailored strategies for credit line approval and pricing. For example, as consumers with a small initial Huabei credit line transact, repay and build credit histories, we assess their creditworthiness on an ongoing basis and dynamically adjust our credit approval process and limits." - Ant Group prospectus p193

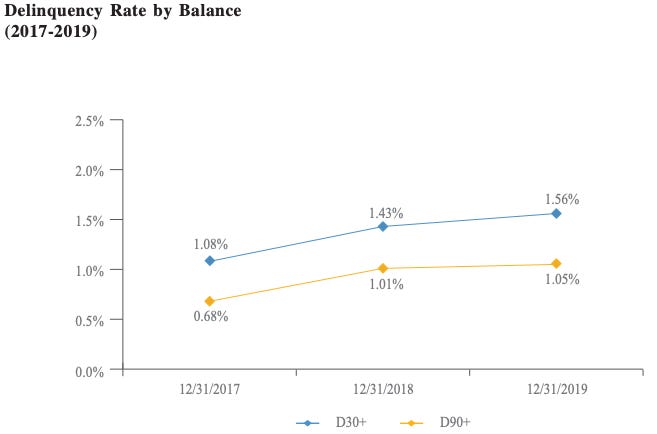

So far, the delinquency rates for these loans have historically been impressively low at ~1.5%. Compare that to the US consumer of average ~2.5% for credit cards. However, the first half of 2020 has seen an uptick in defaults, rising to ~2-3%, likely from COVID-19 related cash crunches. Q3 2020 saw a slow return to normality.

For SMBs, Ant offers unsecured and flexible loans with instant drawn-downs. For the most part, these loans' daily interest rate stood around 0.03% (an annual rate of around 11.6%). Average loans were paid off in 3 months.

MYbank (a partly owned subsidiary of Ant Group) is a crucial player in this function, providing the loans and operating off of the "3-1-0 principle." Borrowers complete their online loan applications in 3 minutes, obtain approval in 1 second, with 0 human interactions. Pretty nifty. The assessment relies on data, reviewing a user's transaction history with 3000 variables at play. While it's easy to dismiss this as a modern Faustian bargain — privacy traded for cash — the reality is that most SMBs have no reasonable alternative. Many operate small Taobao shops or are rural farmers without a credit history. The low delinquency rates range from ~1 - 2% is staggering to a development economist used to the double-digit default rates seen in micro-finance loans.

References products:

Huabei ("Just Spend") is the consumer-facing credit product for daily expenditures. Users can borrow between RMB 100 to RMB 10,000 ($7 - $7,000) in credit to spend on Taobao or other shopping platforms, allowing the user to build a credit history.

Jiebei ("Just Lend") is also a consumer-facing credit product for larger transactions, suitable for lump-sum payments for things like electronics or school fees. Jiebei is only accessible to users with a Sesame score over 600 (similar to FICO, Sesame credit assigns an individual a score between 300 and 750), with a possible outlay of $10,000 and above.

InvestmentTech

Ant's answer to wealth management, InvestTech gives consumers and businesses access to over 6,000 investment products from over 170 asset managers. Via the Alipay app, consumers benefit from personalized investment options with low minimum investment thresholds. Ant uses AI to intelligently match customers and products based on risk tolerance.

Ant initially launched the service by creating their licensed asset management subsidiary called Tianhong in 2013. Tianhong was the cornerstone fund for the offering, and while there are now plenty of third-party providers on the platform, Tianhong remains the biggest mutual fund in China.

Reference product:

Yu'ebao lets consumers generate yield on un-utilized cash in their Alipay e-wallet, while still allowing the funds to be instantly available for everyday purchases. The minimum investment threshold to participate is RMB 1 ($0.15). It's a simple proposition but powerful given that the yield of ~1.7% is higher than most current account's interest rates. It is the biggest money fund product in the world by AUM as of June 2020.

InsureTech

Ant's insurance platform offers more than 2,000 customized and accessible insurance products for users, including health insurance. The platform even offers pension options. The company's breakthrough was to target the underserved markets in rural China. Those populations were not typical insurance buyers, excluded by monetary and educational barriers.

For insurers, the platform provides an opportunity to access millions of customers cheaply and process claims digitally. Ant uses NLP to assess the authenticity of claims records and flag fraudulent claims.

Reference product:

Haoyibao is Lifetime Cancer Protection, the first health insurance product in China that is guaranteed to be renewable for the lifetime of the policyholder, with an annual premium starting at RMB 89 ($13).

The Ant playbook

After looking through their product lines, a few themes emerge regarding Ant's building process and the advantages on which they rely.

Data is the true superpower

Digital payment remains the foundation of Ant Group, not for its revenue but because of the insights it provides. Data and meta-data from trillions of transactions powers the selection algorithms for the rest of the Ant machine. Consumer transactions reveal everything from demographic to social-economic status; incredibly useful information to leverage in serving other products. After augmenting Alibaba's data (Ant has a data-sharing agreement with Alibaba for 50 years), their understanding of users is almost unparalleled.

Even seemingly small tidbits are vital: postal codes suggest the value of the consumer's property, while social graphs might indicate whether they live alone or with roommates.

The same is true on the merchant side; the number of orders a merchant received in the past six months can be used to predict future cash flow. This level of data has created an Ant-Group-Singularity. Ok, not quite, but the next best thing: an inimitable working credit model.

'Our digital payment services have been critical to us in attracting a large number of users, while the high activity levels and engagement on our platform provide us with the consumer insights for us and our partner financial institutions to serve them in new ways. Our Alipay platform generates powerful and self-reinforcing network effects, providing us with strong competitive advantages.' - Ant Group Prospectus p169

Be your own first, best customer

Ant's playbook looks much like Amazon's: they are their own first-and-best customer in each market. For every product marketplace they build, they bootstrap it by providing their own offering first. Be it an SMB neo-bank (though MYBank was also initially part of Alibaba before being subsumed into Ant) or an asset management fund. You can even see this in the growth of Ant itself: Ant's first-and-best customer is Alibaba, whose needs and data drove subsequent innovations at Ant.

This makes a lot of sense. Firstly, it's hard to convince legacy financial institutions to become tech-first. Secondly, the platform gets well-tested before being opened to third parties. Thirdly, once the doors are opened, Ant transforms from financial entity to platform, freeing the company from pesky financial regulations (the reason behind the initial rebrand from Ant Financials to Ant Group). Lastly, it gives Ant a first-mover advantage with customers. It's not surprising that Tianhong is still the largest asset manager on the platform.

Aggregator Ant

Ant is a classic aggregator. Using the advantages that entails to its advantage. Ben Thompson defines aggregators as:

Having a direct relationship with their users

Zero marginal costs for serving users and modularizing

Commoditizing suppliers through their ownership of a large user base

Ant Group's product offerings nail this dynamic in every vertical from credit to insurance. By owning Alipay users, Ant has leveraged their 1 billion customer base repeatedly to entice banks, mutual funds, and insurers to their yard. Their sizable demand clout has also meant they could squeeze supplier margins, resulting in accessible products with low minimum entry fees.

Performance

Part of the excitement about Ant's listing comes from the scope of their product. But their numbers also give investors cause for excitement: this is a rapidly growing, profitable business with market-leading positions.

Revenue

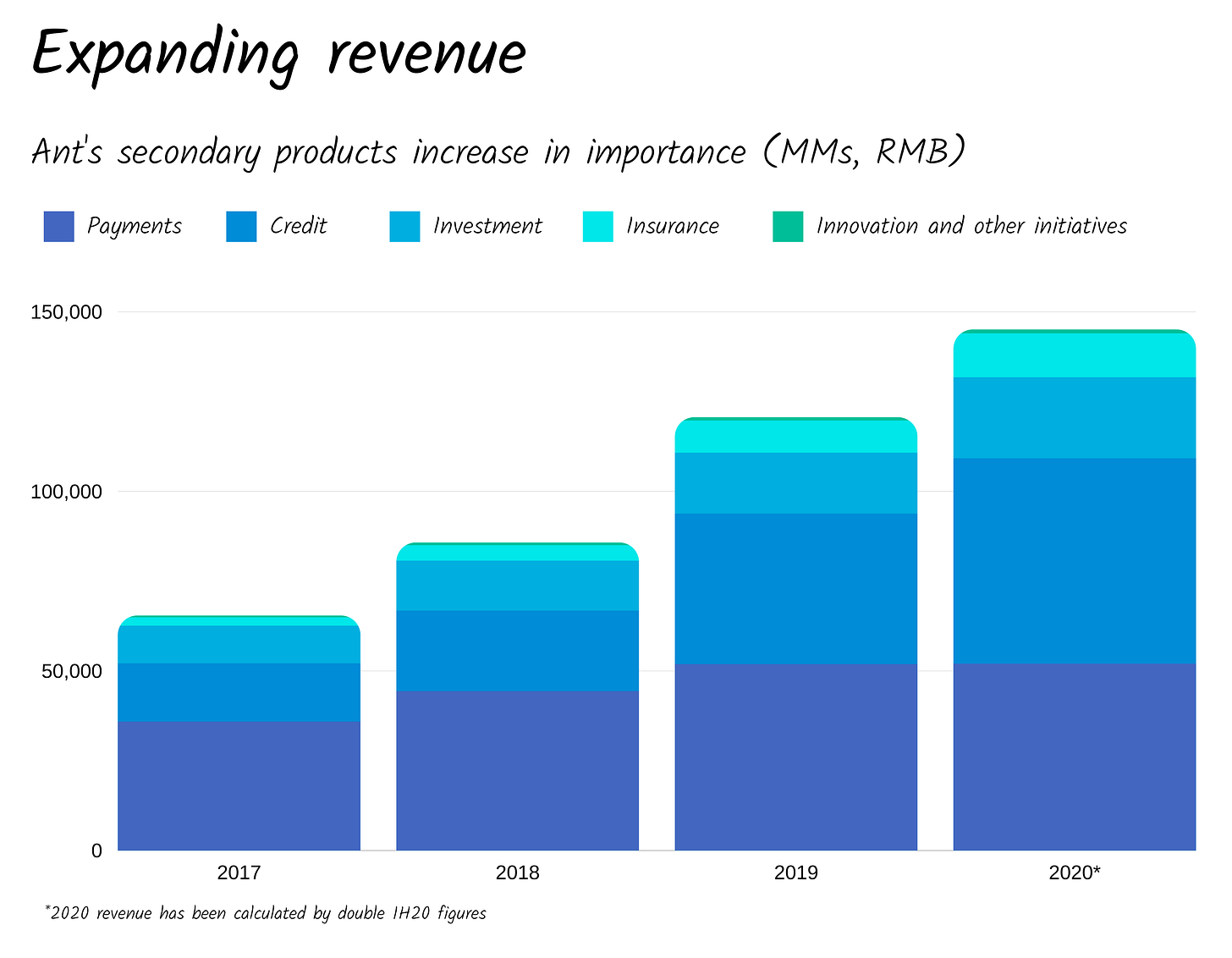

In 2019, Ant brought in $18 billion in revenue, up from $12.8 billion in 2018. That represented a 40.6% increase. The company has continued its growth in 2020, with the first six months of revenue at $10.8 billion, an increase from $7.9 billion over the same period a year earlier.

Per Ant's most recent figures, CreditTech makes up the largest revenue percentage at 39.4%, with "digital payment and merchant services" lagging just behind at 35.9%. This represents a reversal; in 2019 payments contributed 43.0% of revenue while credit made up 34.7%. To some extent, this progression can be explained by Tencent's aggressive movement into payments via the WeChat app, as well as the relative growth of Ant's product suite.

Alipay users and payment volume

As you'd expect given the revenue growth above, users have scaled, too. Monthly active users have grown from 499 million as of the end of 2017 to 711 million by mid-2020.

Total payment volumes have increased from $10.2 trillion in 2017 to $17.6 trillion by mid-2020. This figure incorporates payments across platforms including Alibaba, Taobao, and elsewhere. These numbers make Ant the largest payment provider in China, giving the company good reason to claim they are "synonymous with digital payments" in the country.

Profitability

Ant has achieved net profit rates of 30% as of mid-2020. This is an improvement from 3.6% over the same period in 2019, a startling jump. Looking at figures from 2017, Ant's profitability is choppy: in 2017, net profit rate was 12.5%, dropped to 2.5% in 2018, then rose to 15% in 2019.

Total net profit has also been turbulent, collapsing from $1.2 billion in 2017 to $322 million in 2018. As of mid-2020, net profit stands at $3.3 billion. Despite those fluctuations, the fact that Ant is profitable at all is something of novelty this year: among 2020's class of high-growth, zero-profit tech IPOs, Ant stands out.

Other platforms

Beyond payments, Ant has had success scaling its other product lines, notably credit, investment, and insurance, as outlined above. The company claims a "#1" market-leading position on all three product lines per a methodology leveraged by Oliver Wyman.

Risks

Regulatory risks

In the Ant Group prospectus, "Regulatory Risk" takes up ~40% of all the risks listed. That makes sense given how many different financial products it offers and how much of an ever-shifting beast Chinese regulation is. While this is to be expected for a nascent financial system, the speed of change can be abrupt. Ant has made several pivots in this respect, previously moving away from the securitization of loans since regulations for required capital holdings emerged. Regulators blocked Ant's virtual credit card offering, and new rules are coming requiring Ant to hold more capital on their books.

In the future, as Ant potentially sets its sights on more international grounds, regulation will become an ever more pressing and complex factor. But perhaps we should not be overly concerned: Ant Group has hurdled every obstacle on its way to financial domination. Necessity is the mother of innovation, after all.

New digital currency and payment standards from the CCP

The Chinese government is currently experimenting with a digitized form of RMB called DC/EP. The new currency will be issued and backed by the People's Bank of China (PBOC) and may replace physical banknotes and coins.

This initiative is still in the pilot phase, and its implementation is not clear. There's also no clear indication of how this will play into the current digital landscape. A new currency might dethrone Alipay from their digital payment divan.

A new Fintech Development Plan (2019 - 2021) from the PBOC also mentions an initiative to unify technology standards and promote QR codes' interoperability. Such a move could blow open the defensibility Alipay has built up over the years, permitting a crop of new payment players into the field.

Geopolitical tensions

Though Ant has succeeded in extending its reach across much of Asia, the US remains out of reach. The Trump administration's confrontational approach to China has thwarted expansion. Indeed, in 2018, the company's planned acquisition of MoneyGram, a Dallas-based money transfer company, was blocked over national security concerns. The Alipay app remains off-limits to US users.

In October, tensions looked set to rise as reports emerged that the US State Department had proposed adding Ant to a "trade blacklist." Members of the Trump administration are keen to deter US investors from taking part in the listing. For the record, that doesn't seem to be happening: there's a mad dash for allocation, globally.

As it stands, a walled-off US may not make much difference to Ant's ambitions. The company seems set to focus its efforts primarily on Mainland China, with just 10% of the $34.5 billion IPO-windfall earmarked for secondary markets.

Privacy concerns

In September, Li Kai-Fu, former head of Google China, stated that his venture capital fund had helped a facial recognition company, Megvii, leverage information provided by Ant. Megvii is the provider of Face++, a computer vision platform reported to have been used to monitor and harvest data on the oppressed Uighur community. Ant and Alibaba represent "substantial shareholders" in Megvii through subsidiaries.

Ant denied Li Kai-Fu's claim stating:

"Ant Group has never provided any facial recognition data to Megvii, and prior cooperation between the two parties was confined to Megvii licensing its image recognition algorithm capabilities to Ant for independent deployment and usage."

Whether true or not, some find Ant's close connections distasteful and representative of larger privacy concerns. While that may worry investors in the short-term, it could lead to sanctions, a rise in consumer distrust, and political pushback.

LL aside: I actually don’t think competition from Tencent and other super apps are that risky given market saturations. Let me know if you don’t agree.

Conclusion

In a year of financial anomalies and record-breakers, Ant somehow manages to jump the shark all the same. In its scale and scope, it is a mind-bender of a business, more a protocol than a company, the default financial rails for the world's most populous country.

It demonstrates both the idiosyncrasies and might of China's tech scene, and in turn, a rather dark reflection on Western financial innovation. While the US and Europe might celebrate slick, seamless, indistinguishable neo-banks, China has birthed a conglomerate playing offense against traditional systems. Jack, and his wild visions for a revamped, China-first financial system, seems saner by the day.

Next week we’ll explore the future of Ant Group, stay tuned and grab a friend in the meantime.

Thanks to my great collaborator Mario this week <3. Reply to this email to let me know what you think. If you haven’t filled out my reader survey to unlock some extra Chinese B2B software content, what are you waiting for?

"Capitalism with Chinese characteristics !" 🤠

Very well written, dark Western look-alike fintech v. wild Chinese innovation.

New frontier: What can Alipay or Tencent do about emerging markets financial transactions via opening up their APIs and underwriting resources ?

Given that the US is locked out and EU is also antagonistic, growing less developed markets seems the logical choice along side the BRI Silk Road?

Have you looked back into the history of the company at an acquisition Ant made of a company called Zhejiang Rongxin Technology? I think this was owned by Jack Ma personally prior to the acquisition and brought Hundsun into the fold.