Bilibili deep-dive

Community-as-a-moat, the golden triangle of social media products and attracting and retaining creators

On 22nd March, Bilibili completed a secondary listing on the Hong Kong stock exchange and raised $2.6bn, a long-heralded homecoming. I'm fond of Bilibili; it’s the article that kicked started my introduction to Chinese tech and this newsletter. It put forward concepts such as community as a differentiator, owning the user and diversifying revenue streams that we continue to explore today. (Also, read the previous article before starting this deep-dive, it makes more sense this way)

So seven months on, how has it fared? And how has my view on it changed?

What is Bilibili?

Grossly simplified, it's the Chinese equivalent of Youtube. Except it's not. It's like if Youtube, Twitch, Steam, Patreon, TokyoPop and Netflix had a CRISPR-baby, and that baby was a weeb, but that weeb is also super down with Chinese Gen Z and is listed on the Nasdaq with a market cap of $15bn. That is Bilibili. - An introduction to Bilibili (゜-゜)つロ 干杯

Their market cap has increased 180% to now $42bn. Revenue has increased by 77% YoY to RMB 12bn ($1.8bn); with 17m paying users and an MAU of 202m (growing 55% YoY), they continue to make headway into owning the Chinese Gen Z population (though now it’s Gen Z plus, those born in 1985-2009 relative to 1990 to 2009). 91% of the video viewed on the platform comes from Professional User Generated Content (PUGC). The rest are professional content such as anime and e-sports streams that Bilibili has purchased the rights to. They’ve further diversified their revenue base around mobile games, Value-Added Service (premium content and livestreaming), advertising and e-commerce. Gaming revenues accounted for only 29% of overall revenue in Q4 2020 compared to 62% in Q4 2018. In short, things have gone well.

As for myself, I have reframed Bilibili’s product from a video platform with a community to a community-based platform with video. The former is focused on video as the product, while the latter positions video as a communication medium and focal point for the community. The community has come to the forefront. As such, I place Bilibili in a market of its relative to Douyin, Kuaishou. For the first part of this piece, I’ll explore how Bilibili has achieved this through community-as-a-moat, the golden triangle of social media products and attracting and retaining creators.

Bilibili is on the Snap journey in China in many ways, a youthful community finding a camera-first technology platform to call their own. The same macro enablers for Kuaishou and Perfect Diary supported their rise, namely the advent of 4G, better short video creation tools and a new demographic looking for self-expression. Like Snap, being tied to a generation can limit expansion, as we’ll explore in the second part of this piece.

Have I got your curiosity? Let's deep-dive

The Bilibili product playbook

Community-as-a-moat

"We are focused on fulfilling the diverse and expanding interests of our users. We attract users with engaging content, retain them with our vibrant community, and curate the right content to satisfy their consumption needs. We have achieved diversified commercialization, primarily generating revenue from mobile games, value-added services, advertising, e-commerce and others. Capitalizing on the videolization trend and our in-depth understanding of highly engaged users, we believe we will capture more of the growing consumption needs of young generations in China." - Bilibili website

This is how Bilibili creates a community-led video flywheel, come for the content and stay for the community.

How does one cohort of users lead to another cohort of users? - Growth loops, Reforge

Over time, the growth loop compounds as more users join the community; more creators are likely to join or arise from the community. Each cohort's contribution to the bullet commentary collaborative hivemind makes the content even more unique and the platform experience differentiated. The data generated can feed into additional gaming and content development for the platform, allowing more relevant content to be created and be picked for licensing.

Through deliberate community cultivation, Bilibili holds a scarce and increasingly lucrative Gen Z audience captive. Its fostering community efforts are not limited to offline events or hosting an iconic New Year's Eve gala or having a cohesive brand identity with an elaborate in-group slang culture (though it does all of this). But it also includes heavy content moderation through its 2,413 FTEs (as of Q4 2020) and willingness to sacrifice fast user growth by keeping the 100-questions test.

People make sense of their lives through communities. Bilibili is a known and beloved brand in itself; that’s why its cohort retention is impressive. New start-ups can emerge and offer the same utility, social status and entertainment structures (more on this below), but they wouldn't have the same community dynamics. Douyin and Kuaishou don’t have bullet commentary, while IQiyi, Tencent and Youku have poor community engagement. This makes Bilibili a unique asset in the same vein as Twitter, Linkedin, Reddit and GitHub - there's inherent value in being the only one that does what they do. Whether they can effectively monetise, is the ultimate question. It's not a coincidence that all three western examples I've mentioned are frequent targets of acquisition or have been acquired already. The altruism that powers community and monetisation have never been easy bedfellows.

The golden triangle of social media product

In his seminal blog post, Status-as-a-service, Eugene Wei stipulated the following principles about human behaviour:

People are status-seeking monkeys

People seek out the most efficient path to maximising social capital

To paraphrase Wei's nuanced article, what social networks really delivers to users is Status-as-a-service alongside utility. All social networks need status signalling functionalities since status accumulation is a crucial driver of adoption. People come for the utility (example: picture filters in Instagram) and stay for the status (getting the most likes in the feed); status is the rocket fuel for take-off. Since status is valuable and, therefore by definition scarce, platforms must devise a proof-of-work system that depends on actual skills to differentiate among the users (think the ability to write witty tweets in 280 characters or less). The young are also disproportionately drawn to platforms that provide them with status as they lack status signifiers in the real world. They have an abundance of time to conduct proof-of-work, are mentally flexible early adopters and typically use video and image-based platforms since they generate quick ROI.

Wei outlines the three-axis on which he judges social networks, which are social capital (status), entertainment and utility, though only goes on to tantalisingly explain the relationship between social capital and utility as "entertainment axis adds a whole lot of complexity which I'll perhaps explain another time". As we're on year 2 of waiting for the sequel where all will be revealed, I'm going to have to write some fan-fiction.

Let's go back to Wei's two principles, to which I want to propose a third:

No one wants to admit to the previous two principles

Seeking status is like The Game; as soon as you admit you're seeking status, aka remember you're playing the game. You've lost. (Apologies for making you all lose the game). This is why status games are inherently precarious. If the game is too static, the goals too clear, it will allow wannabe status maximisers to climb the ladder a tad too quickly. Those at the top will see their order and control being upset, and that wouldn't do. (Example, a clubhouse is the cool new place to be, leading to a crowd of scenesters all trying to get an invite.) But a fate worse than social death is to admit you cared about such a game in the first place. The better strategy is to change the game, leave for greener and hipper pastures. Reassert your dominance and leave the status climbers scrambling. (The cool people already invited into the Clubhouse leave, claiming they are over it). This means the most efficient way to play the status is through illegibility; the best way to play the status game is to claim you're not playing the status game even though that is all we're ever doing.

This is where entertainment comes in; entertainment creates a surface-level goal of 'fun' and redirects the attention away from the status games being played. In effect, it legitimises and neutralises a whole lot of endeavours. Entertainment also provides the benchmark and scoring system by which proof-of-work content is judged and thus allows it to be ranked (aka the funniest and wittiest tweets gets the most likes), which then converts it into status (tweets with the most likes wins the most status). While social capital on its own is volatile (scenes and communities emerge as quickly as they dissipate), the addition of entertainment stabilises it. Combining these two traits has resulted in the modern gaming industry and what makes Chinese consumers app so addictive.

When we go back to social media platforms, the golden triangle of utility, social capital and entertainment provides a potent mix. People come for the tools, stay for the social capital, which is stabilised, obscured and legitimised by the entertainment on the platform. I'm not on Twitter to grow my followers and be important; I’m there to connect with cool people and read funny tweets. I say as I write tweet-storms deep into the night, desperately eyeing my follower count. I believe the most powerful social networks will have the product golden triangle of being a tool, status signifier and fun in equal measures (a longer piece for another time if Wei aka OP continues not to deliver). From spending hundreds of hours on Bilibili, I think the platform possesses all of these traits in abundance.

Bilibili's offering historically indexed highly on the entertainment and social capital axis, given their AGC and gaming background. In recent years they've ventured deeper into utility with educational lessons, merchandising and additional content topics on lifestyle, knowledge and tech. This is a good move as it will allow the product to move past the invisible asymptotes created by social status and entertainment content and features.

I can spend many more pages writing about the intricate dynamics of status that appear on platforms. Between the creators and their audience in mutual feedback of validation. Between creators as they vie for more followers and platform prizes. Between users themselves as they seek to outcompete each other for their creator’s affection. The power of everything is magnified since most users and creators are young Gen Zers. But I shall spare you my musings on platform induced mimetic desires apart from saying it is powerful stuff.

This framework is another way to understand how Bilibili "owns the user" by catering to their list of implicit and explicit needs. Social status and entertainment? Games, badges collection, levelling up of membership (access to different coloured bullet commentary). Entertainment and utility? Funny educational videos, ACG e-commerce. Social status and utility? Follower count and direct messaging capabilities. The list goes on and on. By catering to the user’s needs, there are fewer reasons to leave the platform and all the more reasons to embed in it deeply.

Attracting and retaining unique creators

The essential words in Professional User Generated Content are "User Generated". After all, creators are the geese that lay the golden eggs. Creating a unique community and engaging products are two factors that enable the ultimate step - attracting and retaining creators. A note on language here, Bilibili called their creators “Uploaders”, and we’ll use this term to denote Bilibili creators explicitly going forward.

On attracting Uploaders, Bilibili has been pushing their Uploader outreach programs. Anecdotally in my seven months of Bilibili immersion, the number of videos encouraging viewers to become Uploaders have drastically increased. We see steady Uploader growth on the platform, and the proportion of Uploaders to official members ratio has risen from 1.23% in Q4 2018 to 1.75% in Q4 2020.

In an era of creators as a professional labour class, platforms need to provide creators with the ability to grow and monetise effectively to retain them consistently. Bilibili has taken Kuaishou's approach to creating decentralised communities by giving 70% of their algorithm traffic to new Uploader' content and letting Uploaders have their own community space that fosters private traffic.

Bilibili has focused on ensuring compensation since Uploader Necromancer Financial’s high-profile departure in June 2020. With 3m followers, Necromancer Financial was one of the most popular finance-related Uploaders; he left for Xigua Video (a Bytedance long video competitor) on an alleged $14 million contract. The break-up was acrimonious. Necromancer Financial lamented the unviable economics of being an Uploader, while Bilibili claimed breach of contract for the defection. The whole saga spurred Bilibili to formalise a series of Uploader monetisation initiatives. Fireworks initiative is the most interesting - it’s a platform that provides a formalised workflow for native advertising deals between advertisers and Uploaders.

"Uploaders can view all the native advertisement order invitations on their personal business order page. They can accept and enter the formal delivery process, communicate order details, upload scripts/samples, and get feedback from their client on the platform... After the project is completed, the platform will release the Uploader or their MCN organisation’s settlement fee. The platform only charges advertisers a 5% service fee." - New Business Trend article in Chinese.

Platform to connect creators and advertisers that streamlines the engagement, negotiation and contracting process

Provocative segway here: Programmatic advertising is adversarial to nurturing creators. This is not obvious because the programmatic world existed long before the creator monetisation trend in the west. The incumbent platforms' business models, weak payment layer, the idea that content should be free made advertising the only viable path for creators on Youtube and Instagram. The advertising model allowed some creators to get paid, but it's a feast and famine model with the gains accruing to a few. A Youtube or Instagram creator with 1,000 true fans can not make a living; everyone has to go big or go home. Programmatic advertising means that platforms are paid on a Cost per impression (CPI) basis, which means a wide net of ad inserts. This type of revenue comes at the expense of user experience and monetisation opportunities for the creator with a medium following. With programmatic advertising and readily available inventory, advertisers have much less incentive to work with creators to get reach.

A few things are different in China - businesses typically pay on a sales conversion basis and mobile-first walled garden super apps mean that inventory is scarce. As I talk with international marketing agencies here in China, they tell me there's no centralised DSP, and each platform has a different marketing methodology. They spend far more time working with creators on these platforms to reach their audience.

A few interesting conclusions if we take my statement seriously:

Platforms that do not depend solely on ad revenue will have a better creator community, as they are not in direct competition with their creators for revenue

Growing programmatic advertising will diminish the role of creators. Creator platforms will benefit in the long run by prioritising direct creator monetisation versus increasing their programmatic advertising inventory.

With their diverse revenue base, Bilibili can afford to divert their incoming advertiser money to nurture a whole generation of Uploaders. This is good on several accounts 1) it ensures that the monetary gains are more evenly distributed to the Uploader base and diversifies power away from the top Uploaders 2) minimises everyone's defection risk as they are being compensated 3) over time Bilibili can taper down direct payouts to Uploaders in favour of directly more advertisers to them. (Currently, Bilibili pays their Uploaders based on the amount of ‘coin casting votes Uploaders receive from viewers)

As long as Bilibili can enable its Uploader to monetise effectively through direct payout monetisation and other status-boosting opportunities like award shows, they have a good shot at Uploader retention. The Uploaders, for their part, enjoy the community and know that Bilibili is keen to please. After Necromancer Financial left, Bilibili turned on the traffic floodgates towards a new batch of finance and knowledge-related Uploaders and has minted a few stars in a few months.

Competition

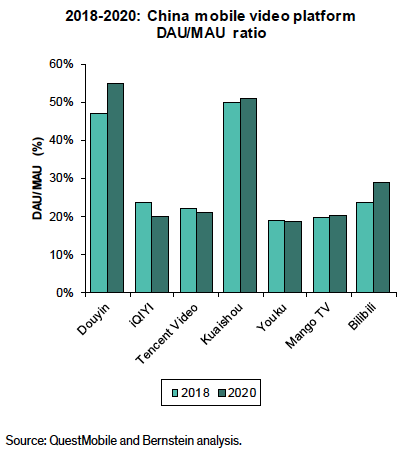

Ultimately, every consumer-facing platform is in a collective war of attention. While there are similarities between Bilibili and other short video apps and games distributors the critical differentiator is around unique content and experience. In terms of both MAU and engagement rate in the video platform space, Bilibili does well but lags behind Douyin and Kuaishou.

The most significant risk from the competition is Douyin taking up advertising spending and Xigua and Kuaishou trying to poach successful Uploaders. Bilibili can play defence with a good product strategy (though getting an ad sales team to rival Bytedance’s professional salesforce is no easy feat) and keeping Uploaders happy (aka compensated and validated). Douyin and Kuaishou are in direct competition; both are converging on trying to become new media platforms (every new Kuaishou update has been cloning Douyin, and it disheartens me). Their focus is more on each other than Bilibili, though both have lengthened their maximum video time to up to 30 minutes. Bilibili has also been trialling a short video feed in beta. 2021 might see the precipice of a new Tale of Three Kingdoms. (More info in video bank)

Investment thesis

Bilibili will grow its user base through increased spending on sales and marketing, new professional content, games and esports content

A steady stream of creators will emerge who will be nurtured and retained by the platform

Bilibili’s professional content acquisition in anime and games yields a steady stream of hits; this increases the number of paying users and also ARPU

The community continues to be a moat and allows Bilibili to acquire and retain users at a lower cost than its competitors

Advertisers flock to Bilibili's attractive base; their spend on native advertising generates a cohort of middle-class Bilibili creators

As Gen Z hit their earning stride, ARPU on the platform increases through premium advertising and sales of higher GMV items such as financial products, cars and home furnishing to name a few new avenues

Risks

As users grow, they may age out of the platform and churn - this is a question of how well Bilibili can capture the life stage desires of Gen Z as they age. The platform has been adding additional topics such as lifestyle, finance and knowledge to broaden its appeal. In general, people’s interests are more homogenous while young and expand as they mature; thus, this issue is a long burn for Bilibili.

Penetration rate and market size of Gen Z population - how much further can Bilibili grow, focusing just on the Chinese Gen Z population? The evolution of reclassifying their focus from Gen Z (1990 - 2009) to Gen Z+ (1985 - 2009) is an admission that they are expanding their market scope. Can Bilibili ever get the ~500 MAU that Kuaishou and Douyin command just focusing on the Gen Z+ section?

Growing content costs will decrease margins and needs a growing portfolio to maintain the hits - Content requires significant upfront investment costs with uncertain pay-off due to the hit-driven business model. Bilibili’s initial luck was scoring the blockbuster Fate/Grand Order for China. They are betting that they can pick winners in the content business better because of their access to fans’ sentiment data. It’s partly the mythical Netflix model, and uncertain whether Bilibili can make this work.

Content regulation risks - Much in the prospectus has been made about the increased risks from the government, especially given the introduction of Notice 78. Which stipulates platforms that engage in livestreaming should ensure real-name registration for all live-broadcasting hosts and prohibit minors or non-verified users from virtual gifting. Most crucially, it sets a limit on the maximum amount of virtual gifting per period. This will curtail livestreaming monetisation for VAS. Given they already employ over 2,100 moderators for the platform, additional content regulation may entail extra costs or cut entire genres.

Sustaining the unique Bilibili community while scaling and monetising - communities have fragile dynamics, too few people and there's not enough velocity, too many people and the culture gets diluted. The biggest worry for Bilibili in the Chinese tech analyst circles is that as it reaches a broader audience, the community loses its lustre. This is an existential risk and requires some fundamental product redesign if Bilibili wants to cross the chasm. One of Reddit’s achievements is they contain many subcultures under the same Reddit umbrella. If Bilibili can use the entrance test as a sorting hat and personalised landing pages to create and sustain a long tail of niche subcultures within the broader corpus of Bilibili Gen Z, that could be a good way forward.

Difficulty of internationalisation - Bilibili’s distinctive bullet commentary does not lend itself well to internationalisation. English and other romantic languages are much less information-dense than Chinese or Japanese. It’s hard to see how this platform can scale internationally, which confines its market size to China.

Increased competition from short video competitors - As time spent on Douyin, Kuaishou and Bilibili all approach ~80 minutes, something’s got to give. While their Gen Z core users may view Bilibili as unique, their newly acquired peripheral users are much less monogamous. The competition will be happening for audiences via the proxy war for creators and MCN, and it is just beginning.

Business models and financials

Bilibili operates four segments of business:

Mobile games: Bilibili publishes primarily third-party mobile games on their platform though they have moved into creating their asset. The mobile games are generally free to download and play with Bilibili accounts. Revenue is from in-game purchase. Cost of revenues from mobile games includes revenue-sharing costs, content costs, server and bandwidth costs and other costs. Revenue-sharing costs for mobile games mainly consist of fees paid to game developers and distribution channels (app stores). Content costs for mobile games mainly consist of amortised purchased, licensed content from copyright owners or content distributors.

Value-added services (VAS): VAS comprises i) subscription to view exclusive content, ii) live-streaming virtual items purchase, and iii) sales of paid content and virtual items on video, audio and comic platforms. VAS’s cost includes revenue-sharing costs, content costs, server and bandwidth costs, and other costs.

Advertising: Brand advertising primarily appears on the opening page or top banner of the mobile apps and home page, and performance-based advertisements primarily appear as inline video feeds. Cost of revenues from advertising includes revenue-sharing costs, content costs, server and bandwidth costs and other costs. Revenue-sharing costs for advertising mainly consist of fees we share with content creators and copyright owners for revenues from advertising. Content costs for advertising mainly consist of amortised purchased, licensed content from copyright owners or content distributors and our production costs.

E-commerce and others: Online sales of ACG-related merchandise and offline performance events and activities. Cost of revenue from e-commerce and others includes the cost of goods sold.

From a revenue concentration perspective, Bilibili has made headways diversifying away from mobile games to a more balanced spread between VAS, advertising and e-commerce. This has also shown up in their sales and market figures for new content acquisition and a series of investments (such as game distributors like Tap Tap and League of Legends World Championship China streaming rights, strategic collaboration with Sony post their investment).

As I've discussed before, Bilibili's revenue lines revolve around owning the user by providing them with whatever forms of entertainment, utility and status-as-a-service they desire. As Gen Z grows up and their interests shift, we'll probably see more growth first in VAS and then e-commerce. While I know the consensus is that advertising is a short term growth lever, I expect more native advertising from creators and less programmatic inventory growth based on factors highlighted earlier.

In recent management calls and HK listing report, Bilibili highlighted the following investments:

Chinese anime MAUs have surpassed Japanese anime MAUs and has become Bilibili No.1 category within OGV ( occupationally generated videos aka fan videos)

Bilibili is introducing 33 new anime titles to be released over the next two years

A series of games coming through the pipeline, 43 exclusive distribution titles and 700+ jointly operated games

A series of investments into mobile gaming companies, content production companies and consumption/e-commerce companies

Stating the obvious, Bilibili’s future monetisation strategy is acquiring professional content and mobile games and then upselling their current base on this. This puts them in the entertainment business of scoring hit-makers, which is risky and could quickly eat into their margins (like it has done for IQiyi, Youku and Tencent videos). Their gross margins have been improving from 2019 to be at ~25%, but I’d be carefully monitoring this going forward.

Other metrics

In general, the metrics for Bilibili are going in the right direction, with steady user growth and conversion. Suppose we view the user journey as a funnel from finding the platform (becoming an MAU figure) -> becoming an official user (through taking the 100 questions test but not paying) -> becoming a paying user (across all categories of gaming, VAS and e-commerce. Premium members are VAS only) -> spending more revenue on the platform and not churning. Each stage’s growth trend looks steady, though Paying User’s taking a slight dip through official members’ conversion ratio is growing.

I have potential concerns in terms of increasing acquisition costs for net new pay users (though my calc is relatively imprecise, I haven’t accounted for the churned premium members) and the decreasing average revenue per user (though a customer revenue cohort analysis can be more precise, this could just be that paying members have grown quicker and haven’t fully ramped up). The DAU/MAU engagement ratio has also wobbled slightly in recent months, but this is not large in the grand scheme of things.

Relating to the previous risk sector, trends that would concern me would be:

Decrease in DAU / MAU ratio and higher CAC shows that Bilibili are finding it more costly to acquire new and engaged users

Engagement metrics of community activity such as relative comments left by users and level of DMs between users are steady

Slowing growth of creators, paying users and decreasing conversion rate of free users to paid users

Increasing content costs in gaming and doesn't translate to new user acquisition or retention

All of the above looks relatively positive, while their MAU growth relative to Kuaishou and Douyin has been slower, which has to be put in the context of their lower S&M costs, which are 29.1% topline revenue relative to Kuaishou's 54% in 2020.

Summary

How does a platform be all things to a generation? Can a platform be all things to a generation?

That’s the fundamental question Bilibili faces as it grows.

It has gone from a community-led video platform and moving perhaps into a content platform with the community. It seeks to monetise through additional sales of games and premium content. They’ve executed the prior version well using community-as-a-moat, the golden triangle of social media products and attracting and retaining creators. The question now is, can they systematically pick or create winners in the content space, expand credibly into new niches of a growing generation’s life, and all the while still retaining the warmth of the original Bilibili community. Tall asks, especially for a company that was started by a guy who just loves Miku.

I have spent a substantial amount of my life on the internet - from the early days of Newgrounds, 4Chan, Something Awful and scanlation communities to Youtube, Twitter to now Kuaishou, Douyin and Bilibili. So from a member of Gen Z+, Bilibili is excellent. There are entire fan communities devoted to their mascots 22 and 33 (blue-haired anime girls). The contents are unique and varied from mental health, the intricacies of the Indian economy and how to think about index funds. The (moderated) comments are lovely and warm. To paraphrase Liz Lemon of 30 Rock, people want to go there.

I’m not saying what Bilibili has to achieve will be easy; what inspired the love was a focus and willingness to exclude to create an in-group. Growing the user base through is perhaps the antithesis of their initial approach. They start from such a high base of goodwill though, users love it, and users want it to succeed. As Gen Z grows up, they’ll realise that we all grow up to become people we once hated in some way.

Thanks a lot for the deep dive! What do you think of current valuation?

Excellent deep dive, thank you