China, Semiconductors, and the Push for Independence - Part 1

Guest post by Jordan Nel of Vineyard Holdings

Hi folks, I’m on holiday for the rest of August (billings are paused for premium subscribers and no premium sign-ups until then). I’m happy to introduce our first guest post by Jordan Nel, writer and analyst at Vineyard Holdings. Jordan first came up on my radar from his epic post on Tencent, which is well worth checking out. I thought I did long deep-dives but Jordan’s work on Tencent, ethereum and Cartrack brings new depth and word count to the form.

Today is the first of a two-part series on the choke-point technology that all of China tech has been buzzing about in the 2020s: Semi-conductors. Will let Jordan take it away!

This essay is a two-part deep dive into the Chinese semiconductor supply chain. It began as a niche look at Chinese semicap (the equipment necessary for manufacturing semiconductors) but has grown to encompass the broader ecosystem. Part 1 will be on the broader ecosystem for context, and on why China is pressing for independence. Part 2 will unpack China’s role within this context, who the various Chinese players are, and what their respective trajectories look like.

This is an incredibly complex industry, with stacks of literature out on every domain and angle, and this essay pulls from a variety of experts and sources. As often as I can, I’ve tried to link them. If I have left you out, please pop me a message on Twitter, and I’ll link you ASAP.

Big thanks at the outset to mule, Dylan, Chris, Jon and Dan Wang.

Introduction

Chip costs are rising. The number of players who can compete is becoming fewer. The market is becoming less cyclical. There’s an upcoming boom in demand from AI/5G. China has a large mismatch in local supply/demand.

Workers must own the means of production. This is the basis of Marxism, which became Communism, which became Socialism. To this, sprinkle on some Chinese characteristics and you have the basis of the world’s fastest-growing large market. It is little wonder China is chasing technological independence. Broadly, they’re doing a remarkable job at it barring perhaps in the field of semiconductors. And what is the crux of all modern tech? Semiconductors.

The advent of COVID-19 hammered home the need for redundancy in many a supply chain globally. Yet, the executive push from the CCP for an in-house integrated circuit (IC) manufacturing capability is not a new thing. It has been mentioned, even if nominally, in every 5 Year Plan (5YP) dating back to the ’70s. This time actually is different though. The 14th 5YP is the first to emphasise complete self-reliance and suggest building a near end-to-end chain locally. It is also the first time where China is in a strong enough position nationally to fund this foray and the first time where it is considered a matter of national security.

The Chinese semiconductor supply chain is a rather complex thing. To understand it, one need first to see how it nestles into the global supply chain and understand the supply and demand dynamics incentivizing Chinese independence (both in semiconductors, and technology generally). Once these backgrounds are set, we are able to look at the specifics within China’s supply chain and their prospects for the future.

As a reader of Chinese Characteristics, you’re probably interested in tech. You’ve also likely got a decent understanding of semiconductors already. For the uninitiated, I wrote an introductory thread to semiconductors earlier this year:

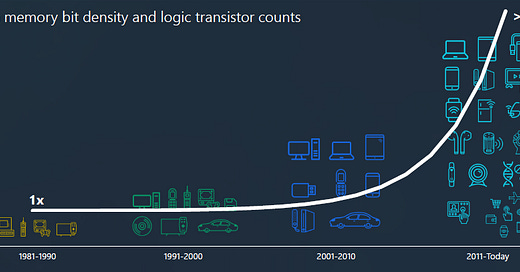

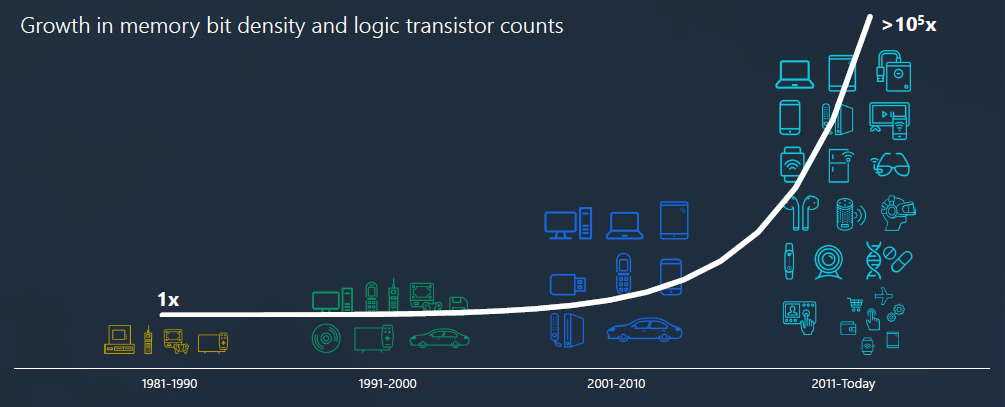

The TL;DR of it is that semiconductors are the tiny bits of conductive material that form the building blocks of integrated circuits – the little chips that power basically everything that runs on electricity. To date, the name of the game has been “cramming more components into integrated circuits”. This is Moore’s Law: that the number of transistors on an IC doubles roughly every two years. Notoriously, Moore’s Law is now dead.

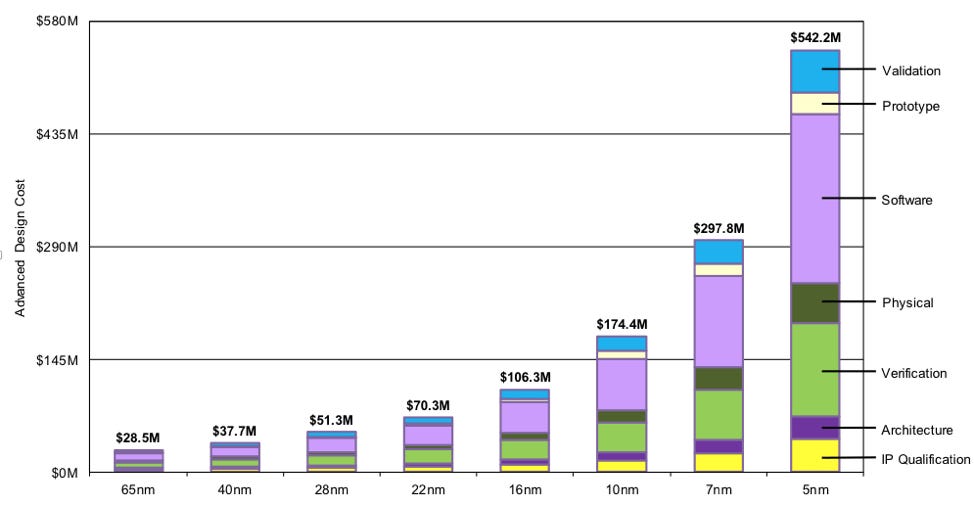

The idea that we could double the transistors per chip every couple of years led companies to take this growth for granted. Optimisation was expected to happen at a chip-size level and not a code or process level. As we’ll see though, physics has constrained continued chip shrinking to a point where better performance must increasingly be eked out from process improvements, packaging, and software. All this has made the cost of chip production exponentially more expensive (Figure 1).

Figure 1: The increasing cost of production by process node (SemiEngineering, 2020)

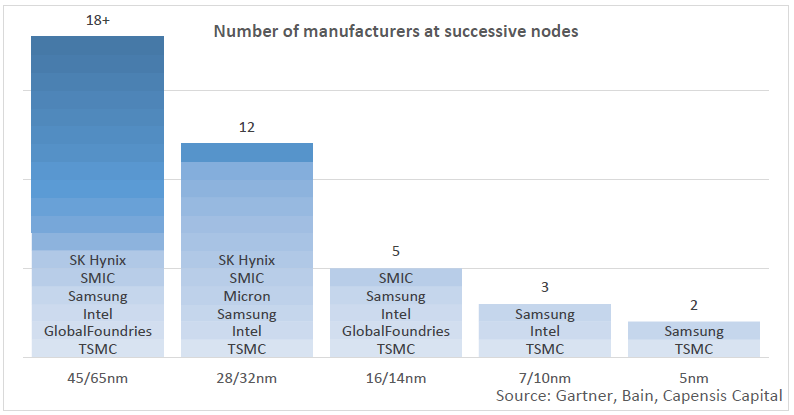

Figure 2: Chips get increasingly hard to make in the leading edge (Capensis Capital 3Q2020 Letter)

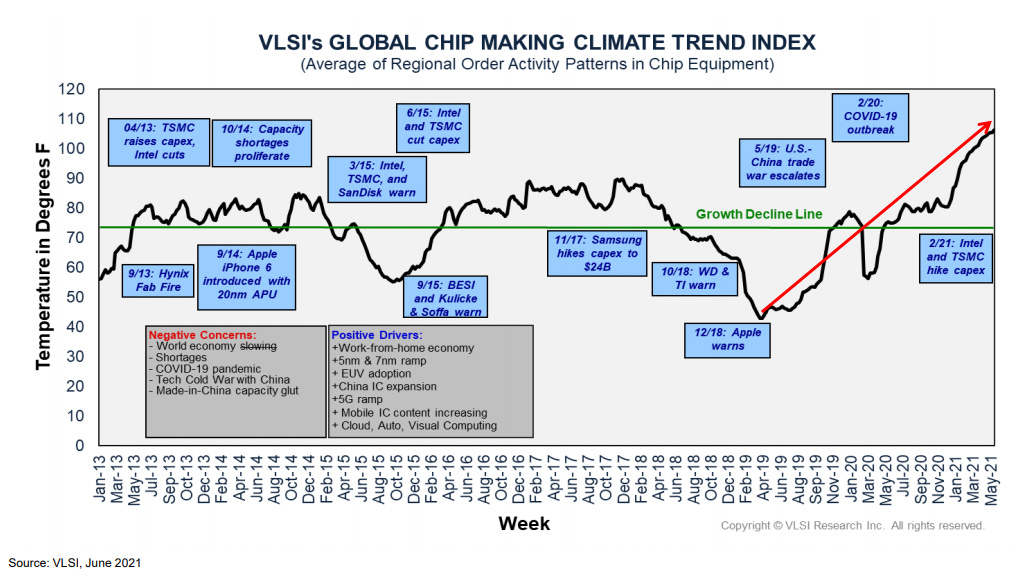

Historically, the industry for chips has been highly cyclical. Manufacturers have had to contend with exponential improvements in technology, managing some of the most sophisticated engineering known to man, and extreme R&D costs. In the past, these all combined to create a rollercoaster of booms and busts. Chipmakers have had to try to time the years it takes to develop a foundry with the long lead times, supply constraints, and surge in demand when a new chip (called process node1) comes out. This is exacerbated by the fact that “leading edge” chips – the really small ones, say <7nm – are way harder to produce than the “lagging edge” ones of a couple of years prior. Many elements of the supply chain would peak and trough at different times because of these constraints.

Figure 3: Besi Investor Presentation June 2021.

The trifecta of high CapEx, cyclical investment, and extreme process sophistication has led to a consolidation of the industry over many years. Very few companies now have the IP, talent, ecosystem, or money to compete. On the flip side of this, there has been a burgeoning of demand over the last five years. The promises of AI/ML, IoT, 5G, and many other acronymic tech buzzwords have started to come to the fore.

The combination of supply-side consolidation and demand-side explosion has led to a shift in industry dynamics from the cyclicality of yesteryear. Even more importantly, however, the physical limits of size (chip shrinkage) are pretty much hit. This, largely, is why Moore’s Law is considered dying. To butcher a turn of phrase: this is not your grandfather’s semiconductor industry.

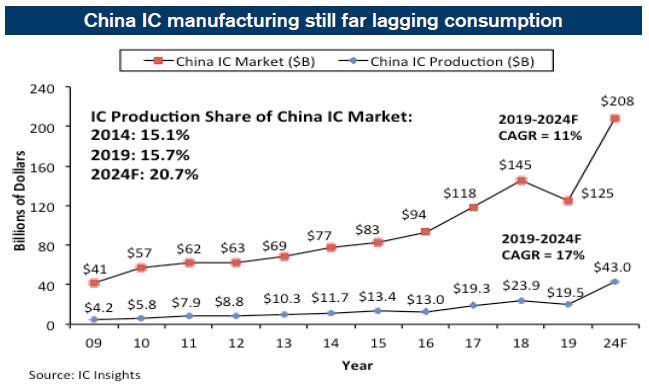

It is within this new industry, where consolidated global monopolists control all supply, that China creates roughly $310 billion in demand. The world total for chips sold in 2020 was $440 billion. At the surface, this looks like China has 70% of the world’s demand, but roughly half of that is exported back out of China to the rest of the world after being packaged and assembled. This is why China is so intent on technological independence. They have a chronic mismatch in local supply/demand, they compete for world leadership in semiconductor-dependent tech, and chips are a recognised chokepoint that the US (who create the majority of the equipment for chip fabrication) have over them.

Figure 4: Randy Abrams, Credit Suisse (2020)

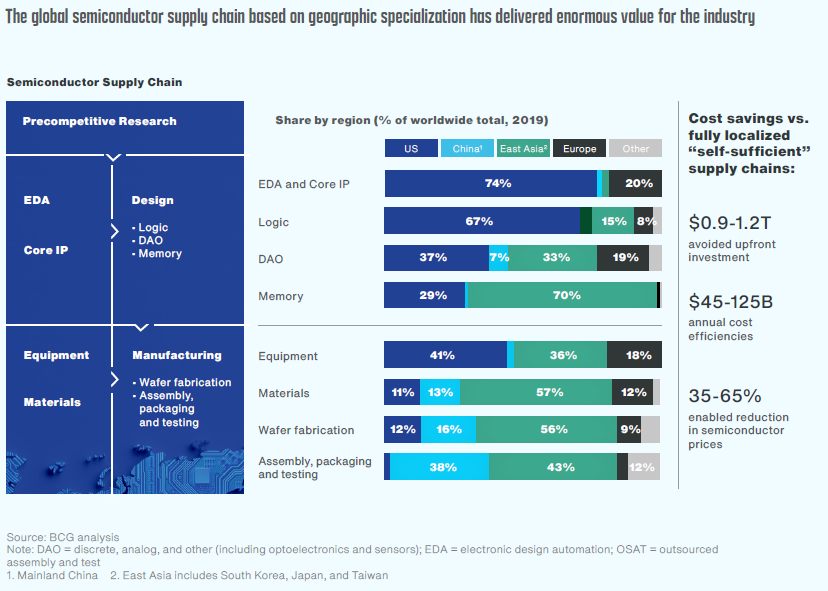

Having grown capabilities in packaging, design, and lagging-edge fabrication, China is now making a bid for leading-edge independence. The point of this essay is not to give a nuanced and comprehensive look at the entire global supply chain. For that, I recommend these reports by BCG/SIA and Deloitte. However, it’s tough to get an understanding of the Chinese role in the industry without understanding the industry as a whole. So where necessary, I’ll borrow from more comprehensive overviews.

The point of this essay (part 1) is to look deeper into what China is trying to gain independence from, and why they want that independence. Part 2 will dive into who the key players are in China, how they expect to progress, and when one can expect them to compete with the current leading-edge monopolists.

Global Semiconductor Supply Chain

The “what” that China is trying to disrupt. The supply chain boils down to a handful of key monopoly players with huge moats of cost, talent ecosystems, and complex IP. Butchering nuance, there are different types of chips: large (analog), medium (memory) and small (logic). China is trying to become competitive in all three. All three have different barriers to entry. China will struggle to compete with the parts of the supply chain furthest from the consumer, and will become more competitive with the parts closer to the consumer, which require less extreme expertise.

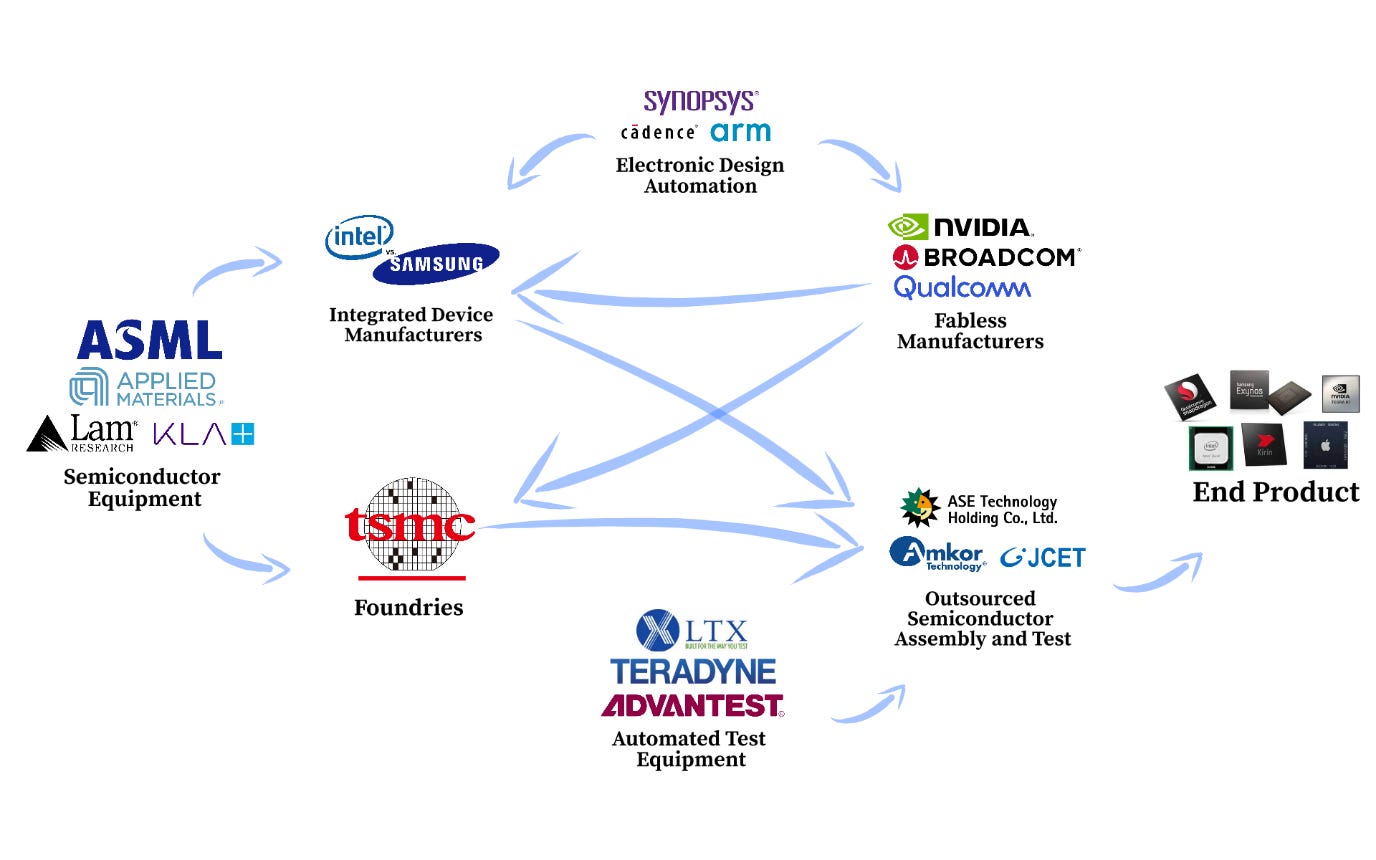

So, what does today’s industry look like? There are five broad buckets into which semiconductor companies are grouped:

Electronic Design Automation (EDA)

Chip Design (Fabless Manufacturers)

Fabrication Plants (Integrated Device Manufacturers and Foundries)

Equipment (“semicap”)

Outsourced Semiconductor Assembly and Test (OSAT)

Here is a little graphic I made to paint a bit of a picture.

Figure 5: Global logic chip semiconductor supply chain (Vineyard Holdings)

In a nutshell, the people who design the chips (the “fabless manufacturers) which go in your smartphones, cars, and laptops, do so on EDA software. If they can design and fabricate the chips, they’re called Integrated Device Manufacturers. Samsung and Intel are the two biggest names here.

If they can’t fabricate the chips themselves (most people can’t) then they then send the designs to people who can. These are the foundries, the most important of which is Taiwan Semiconductor (TSMC). I recommend this deep dive into the composition of a foundry for those interested.

Anyone who can fabricate the chips can only do so because they have bought hyper-sophisticated equipment from a handful of suppliers. This equipment is known as semicap, short for Semiconductor Capital Equipment. The foundries combine equipment with specialised materials and process expertise and out pops the chip.

This chip still has to be assembled, tested, and packaged. As this is a different competency to fabrication, the foundries outsource this part of the process to those specialising in it. This is the OSAT crew. They rely on a different set of suppliers for testing equipment. Once a chip has been designed, fabricated, tested, packaged, and assembled, only then is it ready to be used.

Because of the – literally atomic – size of many of the nodes, the companies which handle them have developed irreproducible expertise in their domain. In many instances, a couple of atoms out of place render the entire product unusable. For instance, the mirrors required for ASML’s extreme ultraviolet lithography (EUV) machines are polished to a smoothness of less than one atom’s thickness. To put that in perspective, if the mirrors were the size of Germany, the tallest ‘mountain’ would be just 1 millimetre high. This is the industry China is trying to disrupt.

Process nodes (chips) come in a range of sizes, for a range of use cases:

Large nodes (>180nm) are usually analog. Generally, they are used for taking in non-binary input and converting it to binary (like how sensors in EVs “see” the road and disseminate that information across the rest of the system).

Medium nodes (28nm-180nm) are majority logic nodes. They are the nodes most people think of when they think of chips – they’re the ones that handle process computation, like for CPUs and GPUs.

Small nodes (10nm to 22nm) are split 80/20 between memory and logic respectively. Most memory chips are those which underpin NAND (the permanent storage in SSDs) and DRAM (the temporary storage which your laptop relies on to keep all your Chrome tabs open).

Much of the buzzword tech relies on the leading-edge nodes. “Leading-edge” is technically anywhere from TSMC’s promised 1nm node to the 10nm nodes found in the iPhone 8. Realistically though, the most advanced node being manufactured at scale today is the 5nm in the 5G-enabled iPhone 12.

The minimum for 5G rollout at scale is 5nm nodes, so their production underpins AI advancement, 5G, and much of the datacentre progression. There is also a whole debate about whether compute will take place at the “edge” (where the data is sourced from; not to be confused with the phrase “leading edge”) or in the cloud. Either way, leading-edge chips will be the picks and shovels building this infrastructure.

Each type of node is dominated by specific producers, with specific expertise. Because analog chips (the large ones) are far easier to make, the competitive advantages of firms in this domain come from their breadth of products, reach of marketing channels, and scale-derived cost advantages. Texas Instruments (yes, the calculator company) is the leading analog producer.

As for the mid-sized nodes, these are mostly for memory chips. There are three dominant memory players globally. Micron, in America, and SK Hynix and Samsung in South Korea. Memory products are entirely commoditized. They are also some of the worst products from a unit economics perspective – companies have little visibility into the end-users (creating shorter order cycles), and have competed aggressively on cost in the past. Because memory chips require both capacitors (little charge-storers) and transistors (little gateways of open or close switches), they carry higher size constraints than the transistor-only logic chips. Memory chips are pretty much physically constrained to >10nm. I recommend reading Andrew Rosenblum’s 3Q2020 Investor Letter for a deeper look here. The summary is that the only way for memory producers to increase supply is to add new production lines by buying more equipment from semicap providers and training more staff to man the lines2.

Figure 6: We are hitting size constraints across the board for semiconductor progression. This is the death of Moore's Law (mule, 2020)

The whole supply chain outlined above, with the fabless designers, to the foundries, to the OSAT crew, was predominantly the supply chain for logic chips. As the infrastructure of compute, it is these chips that are the biggest focus of the Chinese industry and the hardest to replicate. In very general terms, here’s another picture for you.

Figure 5 (again, but different): Global logic chip semiconductor supply chain (Vineyard Holdings)

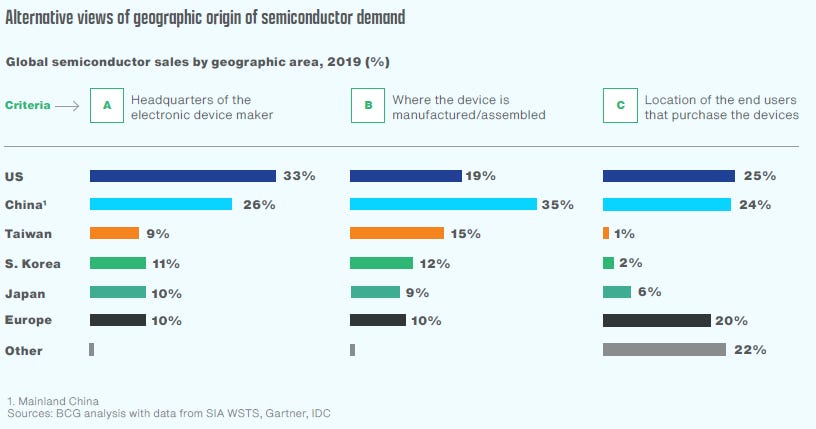

Figures 7 and 8 below show the regional demand and supply for semiconductors respectively. Note how large China’s demand is, and how small their supply is in all but OSAT. We’ll get to this later, but as a quick note now – the 16% market share China has in fabrication is really mostly Semiconductor Manufacturing International Corporation (SMIC). At their best, SMIC is rumoured to be producing some 7nm nodes (mostly ASICs for cryptocurrency mining), but at scale they are still on 14nm and above. Typically, companies do not skip a process node, usually progressing from 14nm, to 10nm, to 7nm. SMIC seems intent on jumping from 14nm to 7nm after seeing the effect the US sanctions are having on Huawei.

Figure 7: Semiconductor demand by geography, BCG/SIA (2021)

Figure 8: Semiconductor supply by geography and aspect, BCG/SIA (2021)

China has so far been great at providing cheap labour, but not so great at developing a capability for the more technical and critical steps. Their lower labour cost allows them to compete well in assembly and packaging, where the process is sophisticated but not nearly so much so as in semicap production or fabrication.

They are also growing in the design arena. As companies begin to need ever more purpose-specific chips, the general-purpose chips are coming under threat. Apple, Google, Amazon, Alibaba, Tencent, and many other household names are beginning to make their own chips, especially since the foundries make outsourcing design so easy.

Cadence Design System is one of the leading providers of design software who, along with Synopsys, have a quasi-duopoly on the market. Figure 9 below is their growth within China. The implications of this growth are that China is demanding more design software at a faster rate than the other regions Cadence serves. There is a good article by mule on Cadence’s 3Q20 earnings call which unpacks this further.

Figure 9: Cadence Financial Results (2020-2021)

However, the technological independence that the CCP and Chinese citizenry are looking for is not going to be found wrapping up already fabricated chips, nor even in designing the chips for fabrication. The only way China can become technologically independent is if the workers own the means of production. China needs foundries.

But foundries need equipment, processes, a large talent pool, clients, and an incredible amount of know-how. While money goes a long way to creating these, there are some things money can’t buy. Each equipment manufacturer has built up expertise developing that particular equipment (and maintenance) stack over decades of cycles and consolidation. For real independence, China needs to be self-sufficient not just in producing foundries, but also producing the equipment that foundries rely on. Otherwise, the chokepoint just moves further up the chain.

Thus far, I’ve avoided going into detail around the process by which the chips are actually made. It’s a little out of scope for this essay, but here is a 13-minute video by Infineon. If you’re interested further, ASML has a great explanation on their site. On average, there are about 500+ machines in a fabrication plant and about 1000+ steps in the chipmaking process. Because semiconductor chips are among the smallest things humanity has ever dealt with, they are potentially ruined by even a tiny speck of dust. Most fabs go to great lengths to avoid this, spending fortunes on air ventilation. The average fab is about 100-1000 times “cleaner” than most surgery rooms in hospitals.

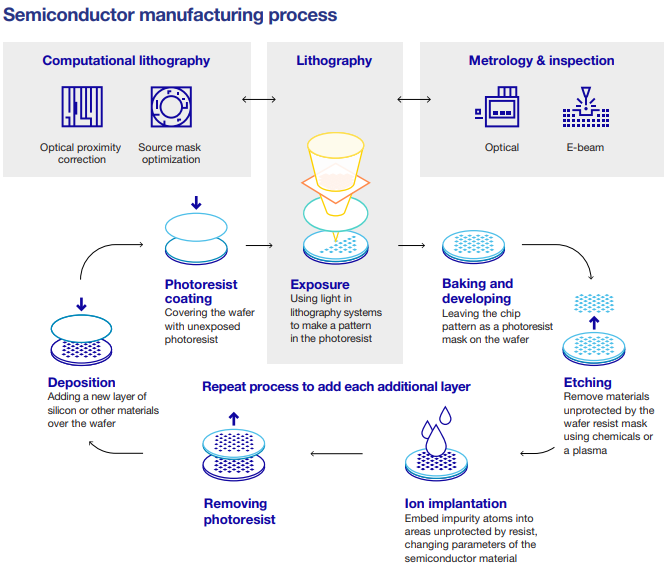

At a high level, modern chips are “tiny skyscrapers” (ASML’s analogy, not mine). They are wafers of silicon which are first layered with photoresist, a light-sensitive polymer, which dissolves on exposure to light. The chips go through hundreds of cycles of being exposed to patterned light, baking the non-exposed photoresist to develop the pattern, and etching off the materials that are not protected by the photoresist before finally removing the photoresist and processing the wafer.

Figure 10: Front end semiconductor manufacturing process (ASML Annual Report, 2020)

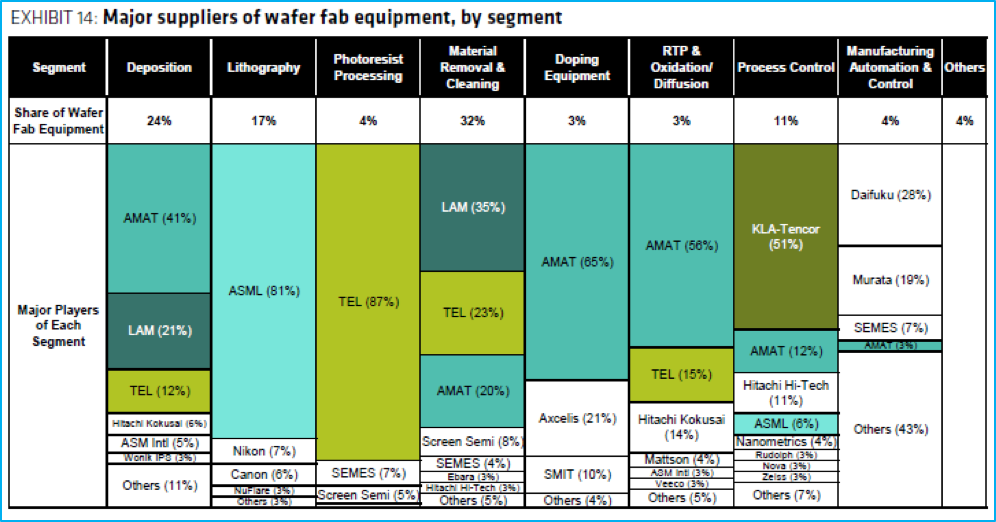

Figure 11 below shows the level of dominance certain firms have over the semicap space. Applied Materials (AMAT), Lam Research (LAM), ASML, Tokyo Electron (TEL) and KLA-Tencor are the key players to take note of. Of the five, only Tokyo Electron and ASML are outside of America.

Of those two, ASML’s one-of-a-kind, 180-ton EUV machines are the key enabler of fabricating anything leading-edge. About 25 of these machines are made per year, of which the majority go to TSMC, and they cost around $130m per unit. To date, partially because of their reliance on American parts, partially because of geopolitics, and partially because of their relationship with the rest of the US-dominated supply chain, ASML has been forbidden from selling EUV machines to SMIC and other Chinese foundries.

Figure 11: Gartner and Bernstein Analysis (2019)

Most of what I’ve described above is the “front end” of semicap. The “mid” and “back” ends are mostly advanced packaging (wafer level) and traditional packaging respectively. This is mostly the realm of KLA-Tencor, Teradyne and FormFactor. It involves equipment for measuring, packaging, assembly, and testing. I recommend mule’s article on advanced packaging and Christopher Seifel’s industry overview for those interested.

For a (dated) discussion on the relative costs to develop each phase of the chain, I recommend gwern’s discussion on Moore’s Law, and this research paper by Brown and Linden. The cost per leading-edge fabrication plant is estimated to be anywhere between $5 and $15 billion and is doubling every 4 years or so.

For China to develop an independent supply chain, these kinds of semicap dependencies must be circumvented. Developing foundries alone is hard, but to simultaneously take on a range of borderline monopolists globally is a very tall order. Now that we know what China is looking to disrupt, let’s have a look at the why.

The Chinese Incentive

The “why” of China’s move. It boils down to a combination of market demand and strategic priority. China does not want to depend on the rest of the world, and there is a massive amount of demand (present and future) for chips, especially as AI development grows.

China imports more chips than it does oil.

As we’ll see later, they have also made it evident that they are looking to lead the world in AI and industrial automation. This makes semiconductors not just their biggest chokepoint should international tensions exacerbate, but also their biggest constraint in achieving their tech growth goals.

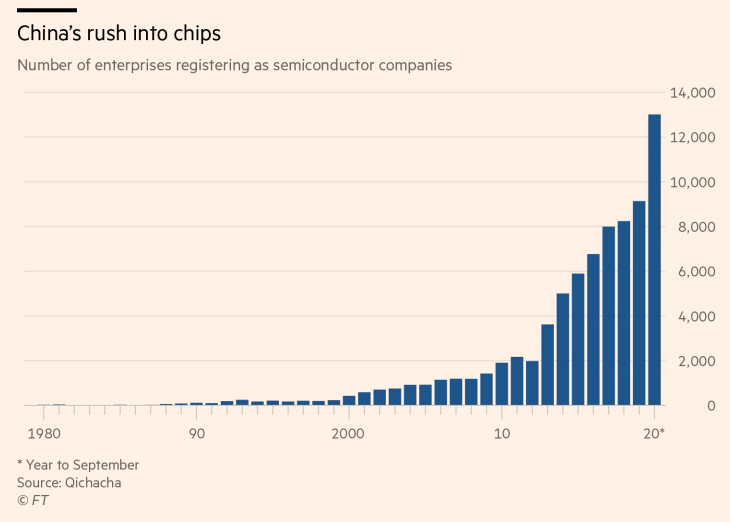

Because of this, semiconductor manufacturing has become a national priority. The number of firms registering as semiconductor companies have grown by more than 700% in the last decade (Figure 12). Both state and private bodies are funnelling money into building out this capability. This is not just a CCP-driven, executive order. After Washington banned Huawei from using Cadence & Synopsys’ EDA platforms, there is also considerable private concerns within Chinese companies around who else the US might ban.

So, what would incentivize the CCP to pour $73 billion into a single industry? Partially the same reason that would incentivize TSMC to invest ~$100 billion over three years to increase research and capacity. It’s because there’s an immense demand. However, in China’s case, it’s partially also because it’s strategic policy.

Figure 12: The number of "semiconductor companies" in China (Financial Times, 2020)

China creating a large amount of hype around a particular industry is not entirely novel. The combination of easy funding, national interest, local interest, and market demand all creates an energising buzz around a particular industry. In the far past, it’s been entrepreneurship and urbanisation. In the last couple of years, it’s AI and big data. Today it is semiconductors.

National Strategy

Thematically, the industry is abuzz with the idea of a US-China decoupling. Where the US depends heavily on China for low-end production (such as the bulk of the key medical equipment and N95 masks used for COVID-19 relief), China reciprocates in semiconductor dependence. As mentioned earlier, the bulk of semicap and fabless companies are US-based, most foundries have prioritised US relationships, yet most demand comes from China.

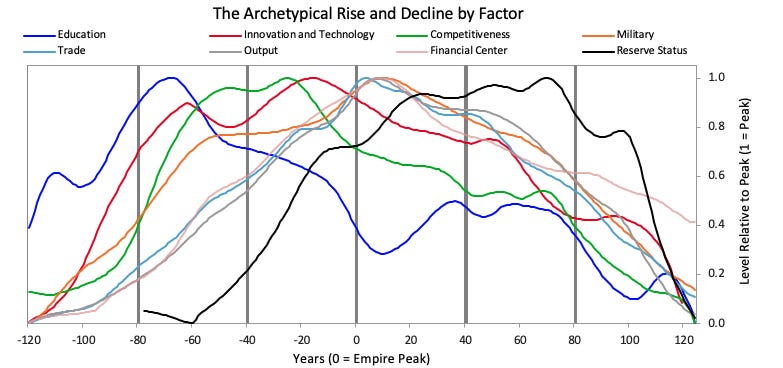

How these two nations navigate trade and dynamics is beyond the scope of this essay. The Asia Society on YouTube has a good series of panel discussions by policymakers and industry leaders on The Future of US and China. I recommend this episode on technology for a discussion on semiconductors. Ray Dalio’s The Changing World Order is a good read on the shift in power from nation to nation over the centuries. The takeaway from Dalio’s book is that power does shift and that as it shifts there are key patterns of development that emerge.

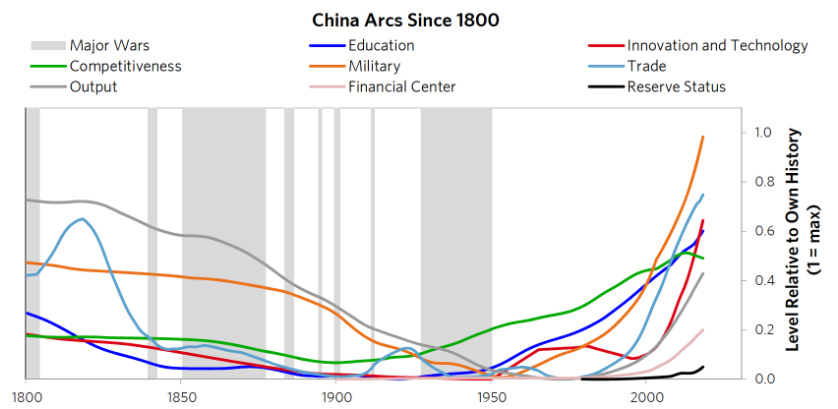

Figure 13: The patterns of a world power's rise and fall (Ray Dalio, 2020)

Figure 14: China's progression along the varying arcs (Ray Dalio, 2020)

So yes, China looking for tech independence is a bid for national power. It is also something that has played out nation by nation over millennia of varying empires. I realize it’s a little grandiose to frame a discussion on semiconductors in the context of world history. However, given how essential chips are to our world’s future, it is probably the most important framing one can have around this industry. Semiconductor manufacturing is not like automotive manufacturing. It is far more winner-take-all, and far harder to replace the winners once they’re entrenched.

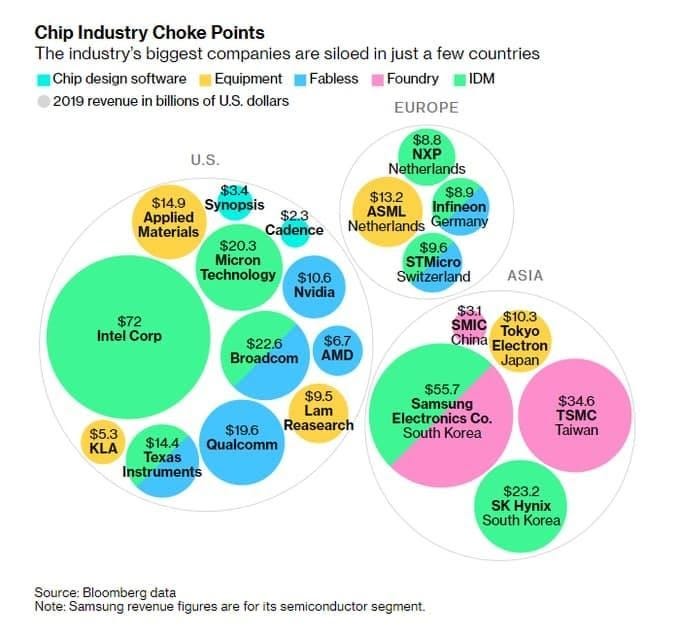

China’s bid for power needs to be further framed given how concentrated the industry is in America today. Looking at Figure 15, it’s easy to see how China views an internal semiconductor capability and a secured supply as intrinsically linked to their economic and national security. This is not without reason: in recent years US policy has increasingly taken aim at Chinese supply chain vulnerabilities. This is a chicken-and-egg situation. China looks to internalise because America wants to prevent China’s growing power. America wants to prevent China from internalising because it makes China more powerful.

Figure 15: Semiconductor companies by revenue size (Bloomberg, 2019)

The “tech cold war” was all the rage before COVID-19 stole media headlines. More recently, Huawei and several other Chinese compute champions were banned from having their in-house processors fabricated using American equipment. Since Lam, KLA and AMAT are basically monopolists here and TSMC (Huawei’s largest partner) depends heavily on them for semicap, Huawei was essentially run out of the chip industry.

That such policy could efface a previous market leader is a worrying thing for many smaller Chinese firms. As such, the push for technological autonomy is not simply state-directed. Many smaller market players are also trying to balance their existing US relationships with developing a local contingency in the case of another policy amendment. It is important to see that this is not just a whimsical Xi opting for a punt at dictatorship. Rather, this is the combined efforts of national directives for security, existing market members introducing redundancy into their supply chains, and a flood of new entrants chasing easy subsidies.

I wrote in my deep dive on Tencent that:

“The CCP’s 14th 5 Year Plan includes a tech-centric focus, with blockchain and fintech being mentioned by name. It’s easy to write these off as buzzwords, but the strategic priority that the government has made 4IR tech suggests a strong top-down push for global leadership in many of these areas. China knows they have a competitive advantage in manufacturing and are looking to propel this forward by developing these use cases. Distributed ledger technology can improve supply chains, cloud compute can link varying points of the value chain (see Context: Beyond WeChat – Manufacturing), and AI and IoT progressively enable automation of production.”

You can find the Chinese version of the 14th 5YP here, with English annotations highlighting the parts on semiconductors, courtesy of Covington Research. Chinese Characteristics readers will be likely familiar with the plan already. The 14th plan refers to several specific areas of semiconductor manufacturing that will receive special focus:

IC design tools (EDA)

Semiconductor equipment and materials (semicap)

Advanced memory tech

Wide-bandgap semiconductors (like silicon carbide or gallium nitride3) – these are potential contenders for the next wave of semiconductor process nodes

“Clusters” of advanced manufacturing industries

In Part 2 of this essay, I’ll unpack some of the policy at a lower level that stems from the 5YP.

So far I’ve framed China’s semiconductor independence as a national strategy, an injection of redundancy into the supply chains of hundreds of businesses to prevent American dependencies. There is another motive: there is just an absurd amount of market demand.

Market Demand

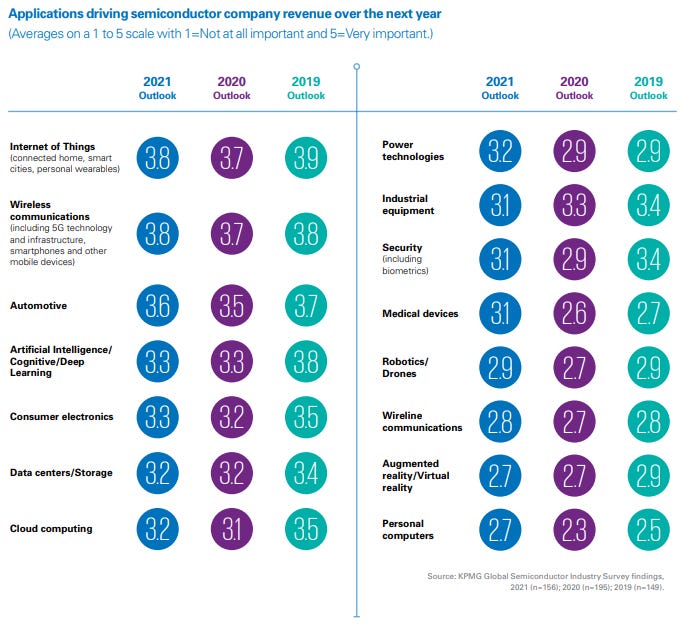

There are numerous sources giving numerous reasons why the demand side of semiconductors is set for unprecedented growth. These graphics from Lam Research’s Investor Day encapsulates the zeitgeist around the industry nicely. As for current demand, KPMG’s 2021 Industry Outlook shows some of the drivers. It’s pretty much what you’d expect - anything with tech in it relies on semiconductors to some extent.

Globally, we are generating more data than ever, training better AI/ML models than ever, and - through the rollout of 5G – use more stuff that collects, sends, and receives data than ever before. This is the basis for IoT. There are growing improvements in autonomous vehicles, deep learning, robotics, industrial automation, data centre demand, cloud computing, AR/VR, and cryptocurrencies.

Figure 16: Lam Research Investor Day (2020; Figure not to scale)

Figure 17: KPMG Global Semiconductor Industry Outlook (2021)

Vladimir Putin threw out a comment in 2017, that “whoever becomes the leader in AI will become the ruler of the world”. Kai-Fu Lee, the author of AI Superpowers, reckons “AI is going to change the world more than anything in the history of mankind. More than electricity.”

Currently, China leads the world in AI publications and patents, making up ~28% of the total research papers published worldwide on the topic. Research alone doesn’t provide a durable advantage, but data generation, data management, and computer science talent might.

Between Alibaba, Tencent, and Bytedance, the Chinese computer science ecosystem is among the best in the world. There is also far less privacy concern when mandated by the state. China’s enormous databases (compiled mostly by their tech giants) are a key reason why China is on the frontier of AI development4.

In this Seagate report, the world growth rate for data generated is somewhere around 26%. China’s is around 30%. By 2025, China will be the country which generates and captures the most data globally - mostly driven by having so many interconnected devices.

Seagate reckons, by 2025, every connected person in the world (about 75% of the total population at that time) will engage with data over 4,900 times per day, about once every 18 seconds. To quote Westfield Capital Management:

“90% of the data available in the world today was generated in the last 2 years – and it is expected to grow to 180 zettabytes (that is 21 zeros) by 2025. To put a zettabyte into context, storing just one requires 1,000 data centres, or about 20% of the land area of Manhattan”.

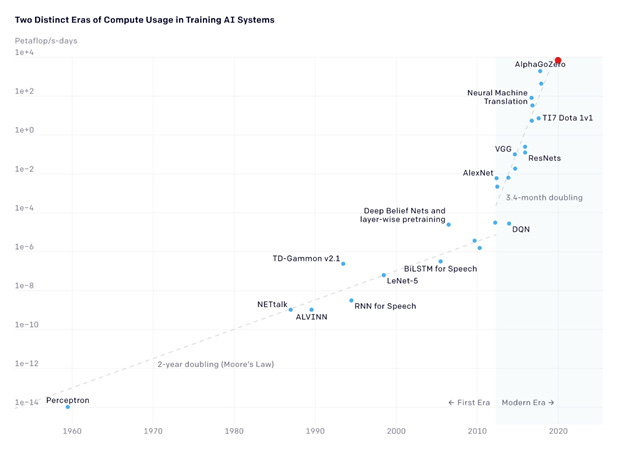

All this data is pivotal in AI research. This is why Chinese technological independence is so important to their economy. There is a whitepaper by Kaplan et. al. on how neural language models (the tech for AI) scales. To summarize it:

The performance of a model is tied to scale. Beyond model architecture, scale is tied to:

the number of parameters,

the size of the dataset, and

the amount of compute available.

This will likely be true for a while yet, at least until we hit whatever the upper bound of that scale relationship is. This is the scaling hypothesis, and it’s pretty controversial.

The idea, as presented here, is that once we find a scalable architecture, which, like the brain, can be applied fairly uniformly, we can simply train ever larger neural-nets and ever more sophisticated behaviour will emerge naturally. More powerful neural-nets are “just” scaled-up weak neural-nets, in much the same way that human brains look much like scaled-up primate brains.

Figure 18: GPT-3, the most powerful AI trained to date, is the red dot (~3624 petaflop/s-days; OpenAI via mule; 2020)

So, the three constraints here are data, compute, and the dollar cost of both of those. Let’s assume that cost is not an issue for the big tech companies, or for motivated sovereigns. So, the constraints are data and compute. But we’ve established that we’re barely keeping up with the data we are producing, so really compute (storage and processing) is the main constraint.

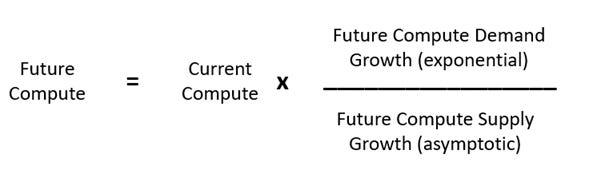

The consumption equation for future compute will look something like this:

Figure 19: Future compute consumption equation (mule, 2020)

If training models begin to scale for scaling’s sake, the demand for compute will be pretty steep. Yet, setting aside the fact that there are exponential demand expectations (we’ll get back to this), let’s have a look at the future supply growth.

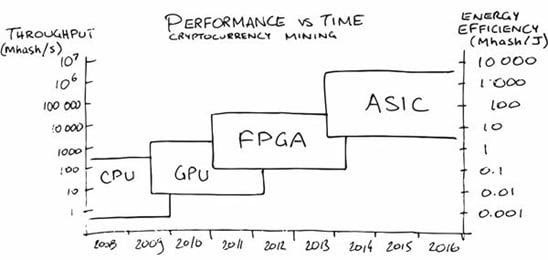

To improve future supply of compute, we used to rely on geometry shrink and power scaling. But we’ve hit a wall on both of these. Chips, at least those built on silicon, won’t get much smaller than the hypothesized 1nm. So we either build chips on not-silicon (like GaN or graphene), which means we’d need an entirely new tech stack. Or we progress through heterogeneous compute (as we’ve done with the CPU to GPU to ASIC progression).

Figure 20: The progression of heterogeneous compute (mule, 2020)

Heterogeneous compute, which is a fancy way of saying building purpose-specific chips, works by making chips that are really good at one thing, but nothing else. Fuchs and Wentzlaff have a study on the possible limits of this method, and the TL;DR is that various applications will have various rates of diminishing returns but returns for all will diminish over time. There’s a limit here too.

Another suggestion is to just stack a shedload of “dumb” chips together and brute force algorithms through having a massive amount of chips. The big problem with this is the energy cost. While having a stack of inefficient chips working together can do really complex algorithms, the more advanced the algorithm gets, the more expensive this approach becomes. This makes it unsustainable in the long term, and not economically competitive in the now.

At the end of the day, it is a Malthusian exponential increase (in demand) over an asymptotic plateau (in supply). Semiconductors are valuable now, and compute is not the current constraint. In the future, compute will definitely be the constraint, and semiconductors will become even more important.

Currently many AI/ML projects are more constrained by input/output speeds than they are logic processing. Fixing this means having better memory speed. This could come in the form of automatic in-memory caching, but more likely it means growth in NAND and DRAM. Either way, if companies or countries want to develop competitive AI processes – and China does – then it is imperative they control their compute and memory supply.

Conclusion, for now

We’ve discussed the “what” and the “why”. Next we’ll look at the “who”, “how”, and “when”. It’s a nuanced space, and different parties all want different things. This will be covered in Part 2.

Here we come to the end of Part 1. We’ve discussed the semiconductor industry globally, the high costs, challenges, and constraints to developing a completely independent supply chain, and the various processes which would need to be built out. This is what China is trying to disrupt.

We’ve also looked at why China is trying to disrupt it. In trying to meet market demand, preserve national resilience, and make a bid at controlling the most important resource of this century, China’s desire for a semiconductor capacity is both necessary and nuanced. To say “China’s desire” suggests there’s some monolithic entity which booms its voice across the rice farms, proclaiming the hive-minded intent of all of China. This is grossly inaccurate.

China is made up of myriad parties. Businesses, public and private, have relationships global and local. They are influenced by people, by families, and by governments at all levels. Trying to balance these relationships is tough. Many businesses are yawping into the fray, excited by the high valuations the state bids up for “semiconductor” branded companies. Others are stepping carefully, trying to balance relationships with their US and China-based suppliers alike, all the while avoiding US sanctions and complying with Politburo localisation mandates. In sum, it’s probably very much like any business you’re familiar with.

Trying to unpack the dynamics within China’s nascent industry will be the attempt of Part 2 of this essay. Until then, thanks for reading.

I’m butchering the naming conventions here, I know. Bear with me as this overview is intended for many who are unfamiliar with the specifics. Each semiconductor process generation is named for the smallest feature that can be produced.

The bulk of China’s focus is competitiveness on leading-edge (logic) chips. While independence for memory and analog is important, they have separate supply chains (but many of the same suppliers). China’s first port-of-call is to alleviate dependence on leading-edge imports as these are the primary constraints to widespread AI adoption, more advanced manufacturing and 5G rollouts.

To speculate, wide-gap semiconductors as replacements to silicon for leading-edge nodes is still very theoretical. However, if China can gain an edge here and are able to produce gallium nitride (GaN) chips at scale, they may be able to circumvent a large portion of the existing silicon supply chain. Currently, GaN chips are very specifically used for high voltage uses (like optoelectronics and select solar/military instances). They are much harder than silicon and can withstand greater electrical charge. The flip side is that they also require higher charges to work, making them ill-suited for low-voltage uses.

As a wildly speculative aside, there’s a whole project dedicated to the upload of a human brain into a computer as a form of technological singularity. Some pretty serious research has gone into it, and the de facto roadmap reckons that brain emulation could be feasible by the 2040s. If China can fab its own leading-edge chips by then, there’s a good chance they will be the ones to induce a singularity.

Do check out more of Jordan’s work at Vineyard Holdings. His deep-dives on Tencent, ethereum and Cartrack are your new summer readings!

Great post, but I wouldn't have included Arm in the EDA section of your graphic. They design Core IP, not software tools. Probably closer to Fabless Manufacturer than anything else.

The audacious goals of CCP are something to appreciate.. With all the geopolitical tensions flying around, this article just brings a wholesome perspective to why these crossfires will continue and investors will have to embrace the same while the arms race goes on.. keenly looking forward to part 2...