Computer water damage, travelling schedules and life admin meant last week's edition took a back seat and then some. But never fear, now we're here.

As I planned for a trip to Changsha recently, I realised the blue pill worked. A year ago, when I landed in China, Chinese apps seemed like a confusing hodgepodge of coloured buttons and distracting photos. As time went on and I swiped and weaved my way up, down and across the screen, I realised that the matrix of buttons had become a familiar workflow and the photos transmitted valuable information. The ones and zeros merged, and I had become one with the simulation. (You can also look forward to this month's upcoming premium edition on the Chinese metaverse).

Once I plugged into the Chinese tech ecosystem, everything was illuminated. Be it food recommendations, shopping, or travelling apps, content was everywhere. Spilling out of the screen as incandescent scrolls whispered promises of exotic destinations near and far. The old Western tech world seemed terribly drab in comparison.

To my surprise, the content bar is high enough that my trip planning was all done within the Ctrip travelling app with a few scans of XiaoHongShou (XHS). This was a far more streamlined experience than the Lonely Planet/online forum/Instagram/Tripadvisor/friend recommendation trawl that I was used to making.

So what have Chinese apps figured out about content that their western counterparts have not?

Is it how to build a moat in the fickle Chinese consumer tech world? Longtime readers can recite my mantra as well as me at this point: Own the user through owning the funnel and close the loop by incorporating entertaining status machines into the product.

Content is one of the last pieces of the puzzle. Content as a product strategy closes the growth loop and helps platforms acquire, segment, monetise and retain users. While the format is content, its function is both utility and entertainment and serves as an additional boost to the product offerings.

I refer back to Eugene Wei's framework in Status-as-a-service (with further extrapolations from me) about the golden triangle of consumer product stickiness:

"The golden triangle of utility, social capital and entertainment provide a potent mix. People come for the tools, stay for the social capital, which is stabilised, obscured and legitimised by the entertainment on the platform." (premium users can see further details in Bilibili deep-dive)

Content captures all three attributes, thus making it a desirable addition to any product offering. However, it is hard to get right. Encouraging User Generated Content (UGC) and Professional Generated Content (PGC) requires capital investment, strong moderation and curation capabilities, political antennas to deal with regulators and patience, all as mere starting points. Whether it ever takes off is another question entirely.

The harsh reality of the dwelling demographic mobile dividend in China leaves platforms little choice but to adopt a content strategy. The war for the attention of a defined user pool becomes increasingly competitive with the entrance of the time sink that is short videos. Every platform is investing in moats by adding content and becoming entertainment status machines.

The focus on content-based sales is exemplified by Taobao, which has pivoted its branding and product positioning to focus on lifestyle content consumption in recent years. In May 2021, Taobao disclosed that up to half of the monthly users will browse without purchasing, their total usage time accounting for ⅓ of total time spent in-app. As of September 2021, about ⅓ of Taobao orders came from content ‘seeding’ on Taobao. Following a product organisation that sees increasing prominence of content browsing and community sharing in the app, Taobao officially rebrands their slogan from the utilitarian ‘Search until you find something good’ to the entertainment-oriented 'It's so fun to browse' in August 2021.

To paraphrase Eugene Wei from Gamification of Chinese consumer apps:

"In the always-connected mobile phone era, all forms of entertainment are starting to be fungible. In a previous era, different forms of entertainment were more segregated markets with natural structural moats. Those mainly don't exist anymore. That means companies compete with the best qualities of any form of entertainment now, not just competitors’ strengths in their direct market."

What is happening in Chinese tech is a sign of things to come for Western tech. Every platform will be looking for additional growth and retention drivers, and UGC and PGC are proven bets that have worked in the Chinese market. Let's go into the details of how content does so much with so little:

Content as utility and entertainment

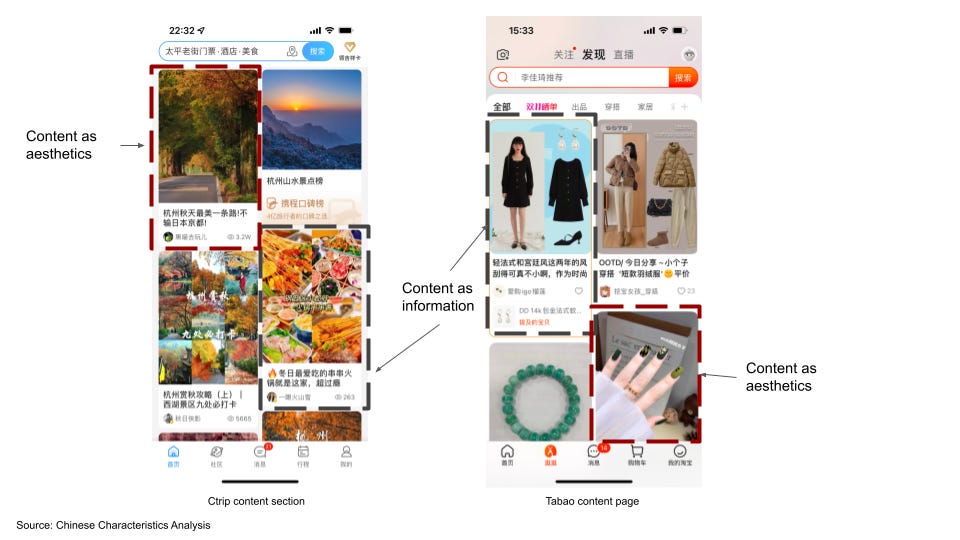

While the form is the same, there are many functions in two columns that display images and moving videos. Images convey both information and aesthetics, blending utility and entertainment during user journeys.

The dual intent is further emphasised with product design. Knowing that a customer search journey combines structured planning and unstructured exploration, Chinese apps allows for both. Algorithms push relevant exploratory content to the user, and collections and boards features allow structured material gathering. XHS and Taobao provide structured content sections once it senses a user is searching with intent.

Content as the growth flywheel booster

When we overlap the functionalities over the growth flywheel, we can see the specific functions driving each stage towards the next.

Content closes the growth flywheel by integrating many functions with a single set of features. It brings users through the purchasing channels and retains them for further LTV optimisation.