Last reminder from me, if you haven’t completed the Chinese Characteristics Survey, please do so here! As a reward, you can pick from access to a bonus article, first access to the State of Chinese Tech report or a discount code for the premium subscription. Premium subscribers also got my analysis and notes on the 14th Five-Year Digital Economy Development Plan earlier this week.

It's time to go chasing unicorns.

Unicorns are that elusive species in the startup world — worth over $1 billion, privately held, and a symbol of how much magic is happening out there in the business world.

So let's take a look at a snapshot of the state of Chinese unicorns and potential companies for future listings. By the end of 20211, China has 295 unicorns2. That compares to 497 mythical creatures in the US.

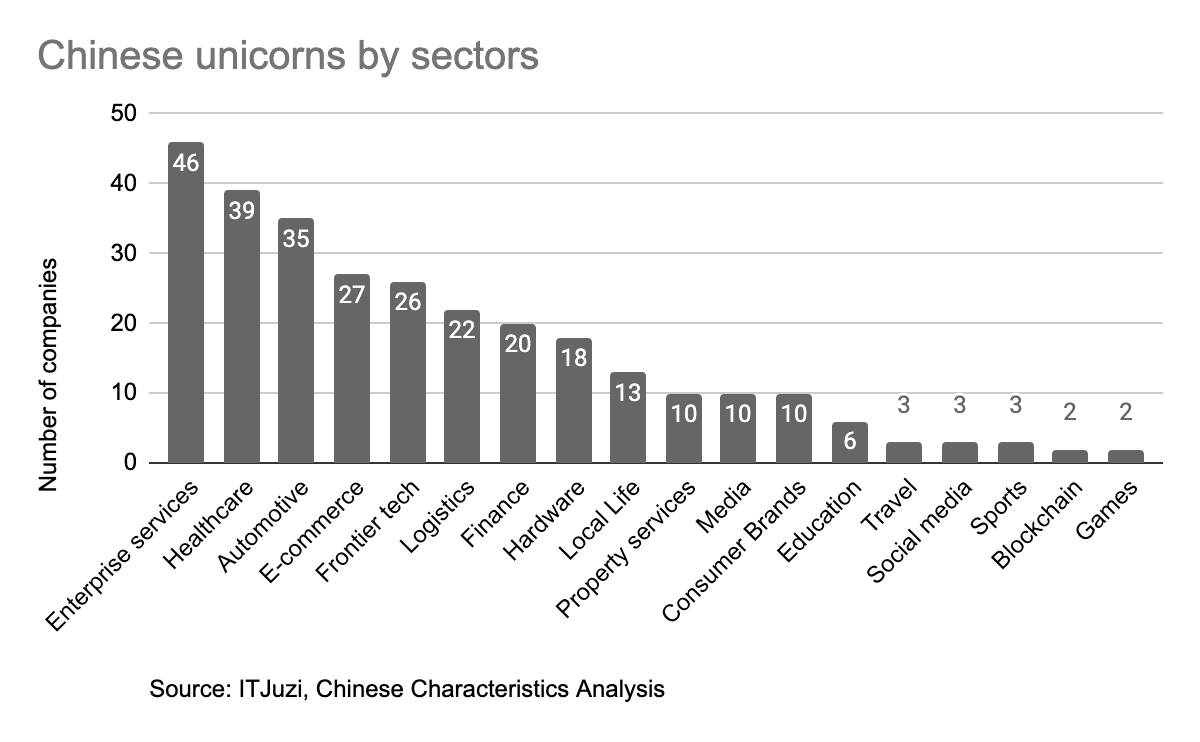

Unicorns by sector

In terms of sector spread, most unicorns are in enterprise services, healthcare and automotive.

A closer look at the sub-categories (aka one level down from top-line categories) reveals deeptech and integrated circuits to be the fields with the most unicorns. Companies such as SenseTime, CloudTech (云从科技), MEGVII (旷视科技), Yitu Tech (依图科技 ), Fourth Paradigm (第四范式), Moore Threads (摩尔线程) and Biren Tech (壁仞科技) are among those represented.

So while there are many B2B companies on the surface, once we dig deeper, it is apparent that most of the current unicorns are more deeptech offerings targeting enterprise customers. As I’ve also remarked, these advanced technologies are often looking for a use case, and the underlying companies are sometimes more similar to technology consultancy than a western SaaS company.

Where are they?

Innovation happens in clusters, and Chinese unicorns are no exception. The top unicorn city is Beijing with 100, then Shanghai with 60. Shenzhen follows with 35 and Hangzhou with 20. All of this is related to relevant ecosystems. The closer you are to VCs, talent (in the form of top universities and other startups), and customers, the easier a unicorn can grow.

In China, there are also some geographical path dependencies concerning tech industry development. Beijing for consumer internet and all things government (which is a lot), Shanghai for life science, finance and retail, Shenzhen for hardware, Tencent and international facing businesses and Hangzhou for e-commerce. While Beijing has reigned supreme as the consumer internet darling for the past ten years due to its wealth of top universities, I predict this will change going forward given the mix of industries coming into favour. Consumer internet is out of fashion while enterprise software, life science, IoT hardware and new manufacturing is in. This predicts the rise of Shanghai and Shenzhen as the next nexus for unicorn startups.

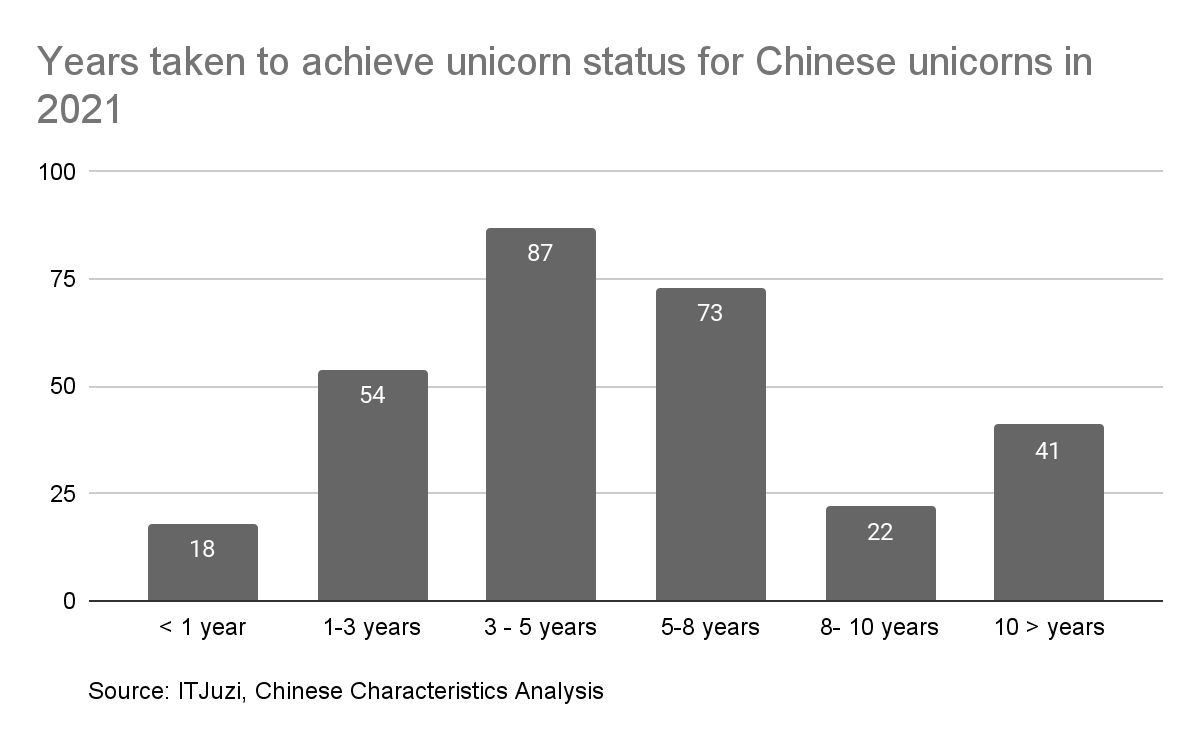

Time to reach unicorn status?

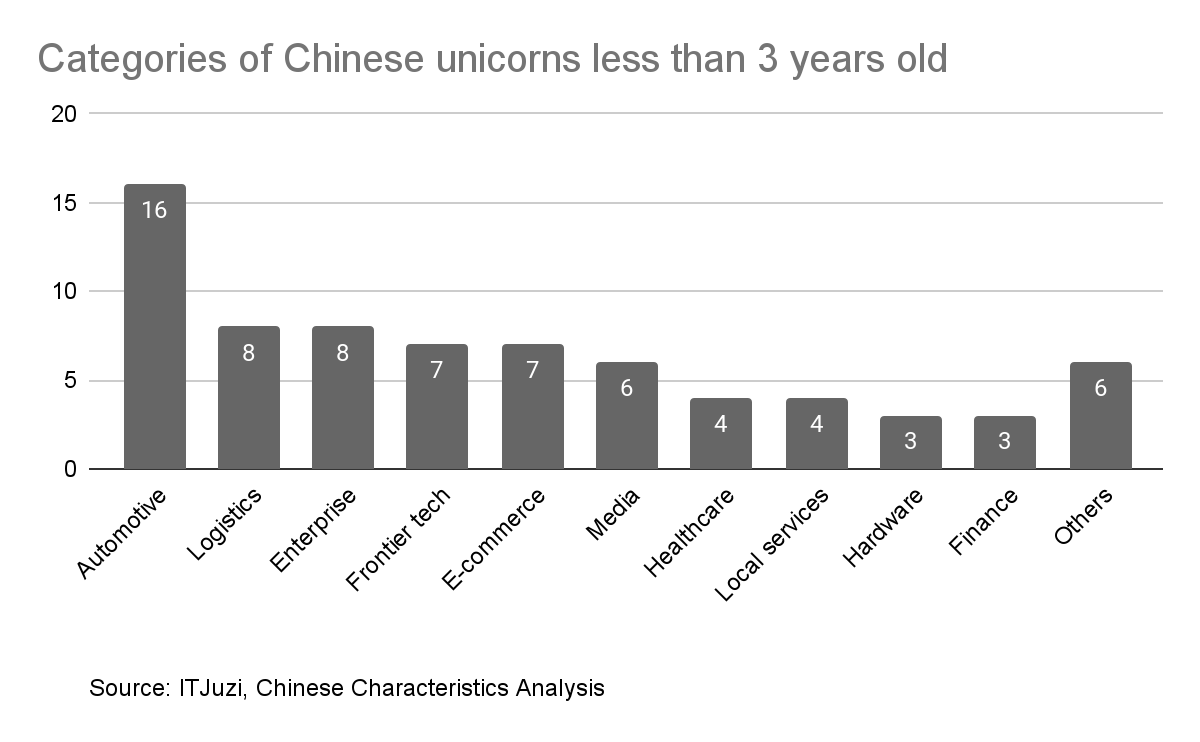

Upon first glance, Chinese unicorns don’t need as much time to reach unicorn status. However, this is due to the prominence of certain EV, autonomous driving, logistics, integrated circuits and certain B2B services startups that require large initial capital infusion to get started. In layman’s terms, if I’m starting a business that will require significant Capex investment throughout and I want to retain a decent share of my company. One method is to set a high valuation for my startup, so I am not diluted out with each fundraise.

As China continues to focus on deeptech sectors in the future, I expect we’ll see a steady increase of young unicorns that take less than three years to get to unicorn status. This also means unicorns may increasingly become a signifier for how capital intensive a sector is rather than a startup’s revenue and growth traction.

There's also a fair amount of spin-out from tech giants, as 27 unicorns on the list were previously an internal division of a listed company. This explains the short time from inception to unicorn status. Most companies made the 0 to 10 journey inside the tech platform mothership and are looking to an IPO for additional value creation.

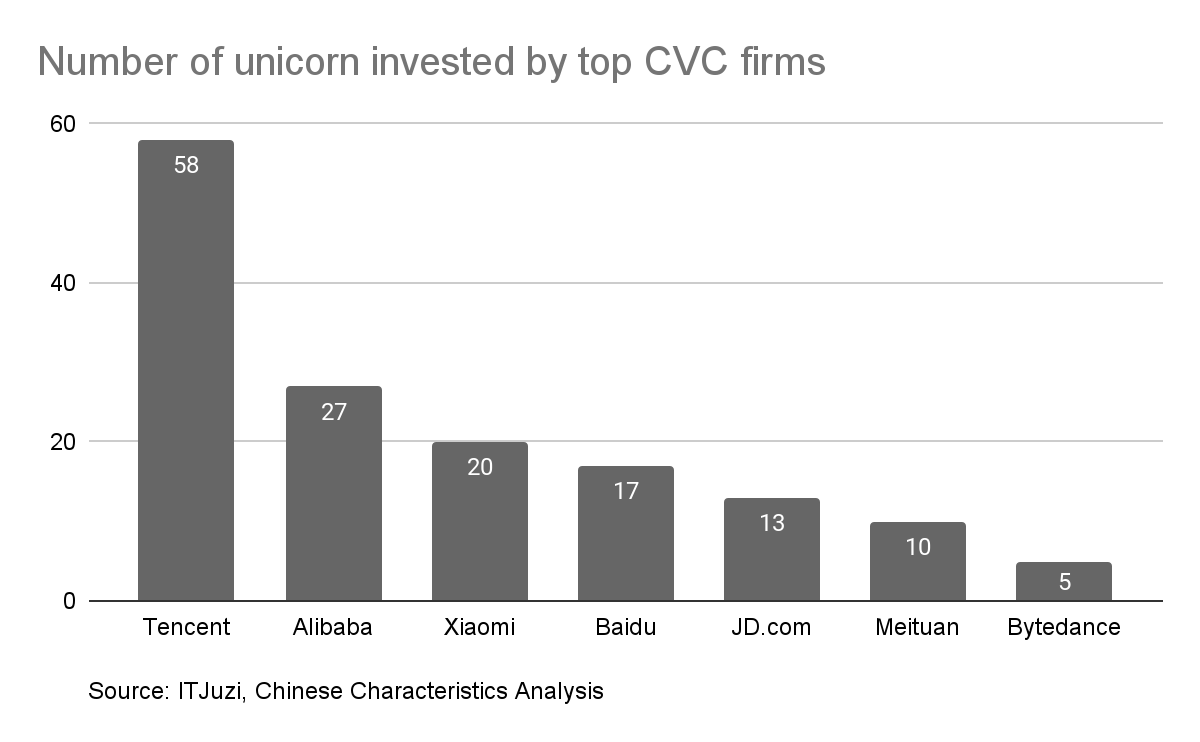

Who’s investing?

We knew the top players would be Sequoia China and Tencent, but who else?

Since the shadow wars between Alibaba and Tencent, it shouldn’t surprise us who the top two players are. Xiaomi, the hardware powerhouse sneaking in at the number three CVC investor is clear to long time premium readers. A dynamic that I’ve seen in the Chinese ecosystem is that the startups often value CVC’s involvement since they bring actual value-add in the form of distribution channel, internet traffic and product expertise (and can prevent competitors from getting the same help from strategic). Overall, there’s less disdain for strategic players investment from founders relative to the West.

For the top Chinese VC funds, the brand effect continues from the consumer to the post-consumer era. The top-tier players are Sequoia China, IDG Capital, Hillhouse Capital, and Matrix Partners.

How did companies leave the unicorn status?

2021 had a bumper crop of unicorn exits though often not for the best reasons. Aside from the 24 IPOs, government regulations influenced the valuation of seven unicorns and the rest exited unicorn status from devaluation or bankruptcy. Typically the buckets for exits are not so drastic but 2021 has proven to be an exceptional year.

Who’s next to IPO?

The question of who will be IPO’ing next can be forecasted in a few ways. One is the number of years on the list, though that is not the best predictor since companies can remain private for longer if they so choose.

A better bet is to see which companies haven’t raised capital in the last few years, which could indicate that a public fundraising round (or bankruptcy) is imminent. Premium subscribers will see the top 47 startups at the bottom of the article.

The top 50 Chinese unicorns by 2021 EoY

Lastly, here’s a list of the top 50 Chinese unicorns at the time of writing.

Link to a Google sheet with the full list of unicorn startups