So I'm not meant to be writing today - it's a discussion week, but hey, would love to hear your thoughts on this.

Packy M of Not Boring recently released a 9,000-word glowing review of Alibaba, and yours truly took issue with it. To quickly summarise Packy by quoting him:

Alibaba trades at a 72% discount to Amazon, and serves a market that is growing faster. It is running its patient, long-term playbook with Alibaba Cloud, and expects to start turning a profit on that business this year. It quietly powers a drop-shipping economy that has exploded during Coronavirus, and is likely to continue to accelerate as more influencers, who have audiences but no manufacturing expertise, build robust businesses around themselves.

Alibaba has some of the world’s strongest moats and important category leaders:

The world’s largest retailer by GMV.

China’s largest cloud provider.

A contender in the local O2O delivery wars.

The most ambitious logistics platform in the world.

The most complete understanding of the Chinese consumer.

It started on Twitter, and I thought I'd flesh out my argument below. My tweet for the background (the typos are deliberate, it's a power move):

My basic premise is that I think the competitive environment for Alibaba is fierce, and there are few credible growth opportunities for Alibaba to access. It still has a strong data moat (tweet below) but its days as a hyper-growth stock are over.

A quick reminder, Alibaba has numerous products lines, and each faces substantial competition from established billion-dollar players such as JD, Meituan, Kuaishuo, Bytedance and Ctrip, among others.

Facing one of these opponents is a good battle, but wolves on every side make it hard to win. Alibaba has been getting slower and showing their fallibility; they lost in the Online-to-Offline war to Meituan. They quit early in the short video wars which gave rise to TikTok / Douyin. I will commend them for betting the Taobao house and winning on livestreaming e-commerce (having birthed the number 1 livestreamer Viya in their incubation program). But Kuaishuo and TikTok are coming for that segment. In the recent Community Grouping Buying war, Alibaba's not even making much of an appearance, did they give up?

Having many offerings means that Alibaba is not focused on any of them. We see this in Meituan's ability to own 65% of the food delivery market share when they were considered the underdogs to Elema (Alibaba’s product). IQiyi, Tencent Video and Youku have been locked in a content war for the last few years. The fact that Alibaba does not break out the figures of Youku*, a once public company, should indicate its (lack of) profitability. A few bright spots are Cainiao (logistics) and Cloud offering (which Alibaba loved to highlight as growth vectors). Still, in terms of adoption for B2B cloud services, digitalisation of Chinese companies is nascent, and it will take a while for Alicloud to start hitting its stride.

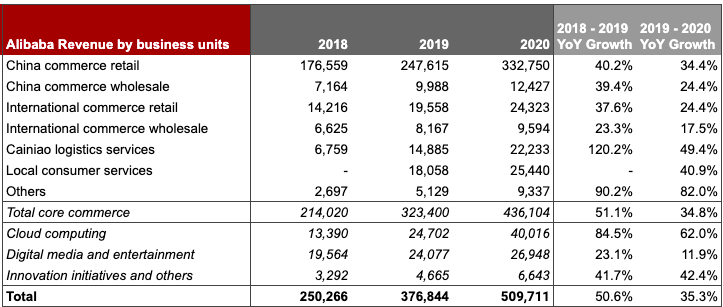

We can see this in the growth breakdown for Alibaba's different business units. FY 2020 (ending in March) has seen slower growth rates than previous years while profitability continues to improve. While Cainiao and Cloud units are growing above 40%, they still represent 5% and 9% of the business, hardly a chunky minority.

The core business of Alibaba remains to be from Chinese Commerce retail, which are revenues coming from Tmall and Taobao.

My take here is that if we segment the Chinese consumer market into high-end, mid-tier and lower end, Alibaba faces intense competition from JD in the high-end, and Pinduoduo in the lower end. With the rise of internal circulation, Pinduoduo stands a better chance of taking over the middle-tier as their existing lower-tier customers upgrade their consumption. At the same time, Alibaba faces the innovator's dilemma of being unable to move into the lower segments.

We'll use city tiers as a proxy for consumer's economic status (as I wrote in The Product Philosophy of Kuaishou, about 67% of the population still reside in tier 3-5 cities)

When we look at data from users by different tiers, this 2018 chart clearly shows that JD has a firm grip on tier one and tier two cities. So while their market share hasn't been changing too much over the last few years, they have a good stronghold in the high-end customer segment. The preference for JD results from their quick delivery guarantee and perceived better product quality.

After 20 years of e-commerce battles, the top tier cities are already saturated. The lower-tier cities are the future of Chinese consumption (see community group buying for reference). That's where PDD has been thriving, and its growth is coming at the expense of Alibaba's Taobao market share. That's not even getting into the minor players (at least right now) such as Kuaishou, TikTok and Bilibili. They are all vying to become e-commerce channels with embedded payment and fulfilment centres.

Taobao still has more active users in absolute numbers, but PDD’s app has been growing more MAUs year on year.

I also want to get ahead of the counter-arguments here:

Customers love Alibaba's ecosystem, and there are switching costs - I think the idea of switching costs doesn't hold as much for Chinese consumers. They are, on average, incredibly adaptable. They are a group who experienced 200 years worth of industrialisation in a few decades. They know it's an existential risk not to adapt. Plus, every consumer app is a super-app now. In the quest to own the customer, every app has extended into multiple offerings (while copying each other's UX) and paradoxically rendered themselves as commodities in the process.

Alibaba's PDD clone will beat PDD - Taobao Special Edition app, was launched as a low-cost e-commerce platform in March 2020 as a direct competitor to PDD. It's too little too late, in my opinion. It's unclear how Alibaba will give this app traffic (this is a standalone app whose products can't be viewed in Taobao, unlike Tmall). It’s a fundamental innovator's dilemma at play here. Taobao has worked hard to leave the low-cost image, and it's a strategy has been to divert traffic to the higher end Tmall. I'm highly doubtful that management will turn the ship around for Taobao Special. Without the traffic of Taobao or WeChat, Taobao Special Edition will have to burn through a lot of ad revenue to get users.

In conclusion, I don't think Taobao's going to be able to beat PDD's at their own game any time soon.

So how has Alibaba's core commerce been growing so far then?

Consumer credit loans via Ant

We know that Ant's consumer credit product (Huabei) was created to help consumers finance their purchases on Alibaba and other platforms. Ant's prospectus shows that over $253 billion consumers loans have been made relative to $65bn SMB loans, that's ~80% of their credit products. Incoming regulations that curtail Ant's lending abilities could drastically impact top-line revenue growth for Taobao and Tmall. It's unclear how much of the consumers' loans are spent directly on the Alibaba platforms, but with some quick maths, it's not hard to see how much it can impact the GMV. Younger users, typically the most spendthrift group, are already getting tighter credit limits on their Huabei.

Now that Ant will be reined in by regulation and their new growth seeds (Cainiao and Cloud) are gestating, where is Alibaba's next engine of growth going to come from?

I think Alibaba has created an incredible data moat with its ecosystem for the record, and I don't think a fall will be swift. But I see it more as a value investment with a robust financial profile than a growth stock.

There end my musings, would love to hear your thoughts.

Premium subscribers will get my take on the growth strategy of Perfect Diary (the hottest DTC beauty brand in China right now) tomorrow, so look forward to that! If you want in and also get additional cool benefits such as being able to suggest topics, feel free to join.

Reply to this email to let me know what you think, or find me @lillianmli where I write about what didn’t make it into the post. I’m currently doing a thread a day challenge for January in a shameless bid to get more followers.

* My initial email said IQiyi here rather than Youku, sorry about that!

"Incoming regulations that curtail Ant's lending abilities could drastically impact top-line revenue growth for Taobao and Tmall".

Not so sure, its going to have that big an impact. Not sure how you got the $250B+ consumer book, but the Ant prospectus says 2K/average loan and 500m consumer credit users. that's 1000b RMB in consumer credit. Thats 13% of Taobao/tmall GMV, assuming all of it was baba. Assuming half was baba, its <6% of mktplace gmv.

1)Prior to BABA'S acquisition, Ele Me was already behind Meituan. Given the revitalization put in place starting from last year, such as, using alipay to provide traffics to Ele me, Ele me may start outperforming in terms of growth. 2) Competition from livestreaming is mirror. A platform with strong traffic, such as DOUYIN & KUAISHOU, does not mean they will succeed in ecommerce. Think FB or Tencent.

3) the user side analysis across different ecommerce platforms is just one part of the stories. The merchants is another side we should not ignore. BABA'S competitve position in the categories of apparel and beauty ( high margin and high penetration) is well understated. Hardly image other platforms will be able to complete.

4)Growth opportunities: new retail has lot of potentials to go, the digitalization need from the merchants on its platform is huge. Remember the rhino smart manufacture announced last September or October?

5) Corporate culture. BABA has one of the best corporate culture in China and the optionalities, along with its innovative culture (think about how it got started and what it has now) make me not too worry about its growth particularly given its current valuation.