China, Semiconductors, and the Push for Independence - Part 2

Not your grandfather’s semiconductor industry

Hi folks, the Xiaomi deep-dive, Implications of opening WeChat traffic and Taobao walkthroughs (Circle community) are out for premium subscribers. Next month I want to switch things up a bit and keep a weekly posting schedule for premium folks on DTC, China’s data governance and SaaS business models - join us!

The hotly anticipated part II on China’s state of Semiconductors straight from Jordan Nel, writer and analyst at Vineyard Holdings. Do check out Jordan’s amazing work on Tencent, ethereum and Cartrack!

This essay is Part 2 of a two-part deep dive into the Chinese semiconductor supply chain. Part 1 was on the broader ecosystem for context, and on why China is pressing for independence. Part 2 will unpack China’s role within this context, who the various Chinese players are, and what their respective trajectories look like.

This is an incredibly complex industry, with stacks of literature out on every domain and angle, and this essay pulls from a variety of experts and sources. As often as I can, I’ve tried to link them. If I have left you out, please pop me a message on twitter, and I’ll link you ASAP.

Thanks, at the outset, to Randy Abrams of Credit Suisse, Jimmy Goodridge, Chris Thomas, and Dylan Patel.

Introduction

As a quick recap of Part 1, the semiconductor supply chain rests on a handful of quasi-monopolies, each of whom has gone through many boom-and-bust cycles over the years. They have consolidated over time and are now protected by high barriers to entry: in the costs necessary to replicate their production lines, in the IP they have built, and in the ecosystems which have evolved around them. The global chain has several segments, each of which are dominated by separate players.1 This is the what of semiconductors (Figure 1).

Figure 1: Global logic chip semiconductor supply chain (Vineyard Holdings)

What took the world several decades of development, China is looking to repeat internally in as short a time frame as possible. The motivations for Chinese independence range across the various actors pushing for it. On the one hand, it’s a market-driven concern as local players see the surging demand for chips and are pre-emptively trying to build out manufacturing capacity. On the other hand, it’s a geopolitical concern as most of China’s tech sector relies on access to US-controlled semiconductors.

The Chinese Politburo see semiconductor independence as a key issue in, inter alia, the 5-Year Plan release. Yet, this is not just a CCP thing. Many smaller Chinese firms know that their US partners may be encouraged to avoid Chinese-origin technology for geopolitical reasons and consequently push themselves for internal redundancy. At state levels, varying actors are vying for subsidies, hub-development, and political control, and punting semiconductors can help them. This complex web of different actors is the why for Chinese independence.

Knowing the what and the why, Part 2, this essay, will look at the who, the how, and the when of Chinese independence. The who is mostly surveying the landscape, but the how and the when is far more conjectural.

There’s conflicting desires around using local semiconductors in China. - Though the government broadcasts supply chain independence, private companies are not simply government drones: they have to be simultaneously global and local. Given the global sprawl of the semiconductor value chain, local-only companies don’t make it. Yet, Chinese company executives have just watched Huawei, SMIC (China’s leading foundry) and others get nailed by US restrictions. They are carrying heightened inventory to buffer against possible restrictions yet must balance this with the demand and supply mismatch in the industry. They are also fielding requests from local leadership for regional development, and they are dependent on CCP goodwill for local policy, talent, and cheap funding. Together, this combination of uncertainty, local policy, and strategic necessity means many local companies will prefer to buy local “commodity tech” (like CPUs/GPUs) if they can. It just helps with the tick-the-Buy-China-box stuff.

Local policymakers are facing the rush of non-semi companies, lured by the easy money, into semi-manufacturing.2 This is not unusual for Chinese industrial plans. There’s a finely crafted, handpicked set of national company “champions” who the policymakers are expecting to succeed.3 However, provincial leaders always have their say in the exact details of implementation.

The net result? Delinquency and low-return investment is common. It’s one thing to have the money and the drive, but it’s entirely different to be able to effectively pull the talent, IP, tech, and market dynamics together. This sows thorns in the path of leading-edge development.

As far as semiconductor buildout goes, China is progressing well in areas wherein lower labour costs are an advantage and where high capex is the main barrier to entry. This is mainly lagging edge logic, flash memory, some fabless, and all but the most advanced edges of outsourced assembly and packaging. They rely heavily on US EDA tools. They continue to lag in foundry growth, with national-champion foundry SMIC being refused EUV and critical semicap access and struggling to replicate the necessarily sophisticated talent and processes. They have a very low market share in equipment and materials – both are industries with high barriers to entry, scaled incumbents, and steep learning curves at advanced nodes. The critical chokepoint here is thus semicap, and design tools.

Figure 2: China's progress along with node development (Taking Stock of China)

China is progressing well in design. Relative to foundries, the barriers to entry here are far lower. Design is about pulling together existing components into one purpose-specific chip.

As SMIC and the leading NAND manufacturer YMTC have shown, the lagging edge can still be very profitable. M&A can drive fairly rapid growth in the unconsolidated sectors (again, OSAT and lagging edge), while cheap funding and a push for hard-tech education lay the groundwork for later growth in advanced manufacturing.

With all the money funnelling towards the sector, it’s likely there’ll be the creation of excess lagging capacity at some point. Certain types of businesses (usually high-volume, low-cost types) lend themselves very well to the Chinese landscape. Where consumers are tolerant of low quality is where China will make rapid progress.

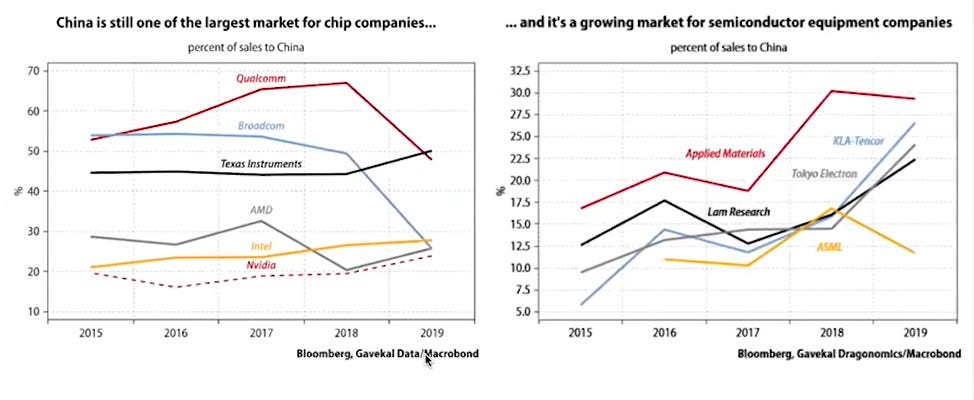

China will continue to struggle in the advanced tech spaces, where quality is the key driver of success. Through Intel and the semicap monopolists, the USA has long held the throne. Yet the last decade has seen China ramp up market share in many previously US-dominated domains (Figure 3).

Figure 3: China's progress in market share (Randy Abrams, Credit Suisse)

Chinese producers have the benefit of being the world’s assembly line. They also have the exorbitant privilege of being the world’s biggest single market. On the supply-side, there is rapid dissemination of process-learning, mistake-making, and IP-building.4 On the demand side, it is never-ending. An honest assessment of the Chinese trajectory notes their substantial progress and their realistic advantages and disadvantages. They have cheap labour, cheap capital, a way to learn fast, and a massive market to sell to. They also are not even mid-tier competitors, not even domestically, and have not yet managed to broach the monopolists’ domains.

Roughly a fifth of all semiconductor sales globally is reinvested back into R&D within the various firms (Figure 4). Since the bulk of those sales come from China, their market is a huge tailwind not just to themselves, but to California, Taipei, Israel, Veldhoven, Seoul, and any other major semiconductor hub. For each step Achilles takes, the tortoise gains a fifth.5

Figure 4: China's increasing importance in global demand (Gavekal Dragonomics)

Looking at the context today, with lead times for key fabs pushing 40+ weeks and wafer supply for 2023 already being negotiated, it’s evident the globe is short several billion chips or so. To this backdrop, state and private investors have bid up valuations for Chinese firms to absurd proportions. Even high-profile struggles from HSMC and CXMT (Changxin Memory Technologies) have not dented investor confidence in the sector.

Evidently, money is not the constraint here. Because of this, China will likely continue to take market share in mid-to-low-level OSAT and packaging, NAND flash memory, and lagging edge chips. They may also make some competitive progress in the fabless model. However, it is unlikely that they’ll be able to subsidize their way into a competitive leading-edge position for the next 5-10 years.

What China needs to do (to get semi-independence)

To build out a fully-fledged globally competitive supply chain, China needs to build up three major capabilities: talent, equipment, and process sophistication.

China’s future engineering talent base will be much bigger than today, but it might not be enough.

The bulk of top Chinese universities include ever more integrated-circuit and microelectronic programs. There is even a dedicated semiconductor university in Nanjing.6 Despite this, there’s an estimated shortage of several hundred thousand jobs around 2030. China currently fills jobs by enticing offshore workers to firms like SMIC and YMTC, but grassroots development will be needed for the future.7

The talent gap is because it’s nearly impossible to reverse engineer the complex processes involved in this manufacturing. In the short run, hiring experienced engineers is far easier than having local engineers figure it out independently. In the long term, this is unsustainable - it stunts native talent development and incurs the ire of offshore competitors.8

However, talent fragmentation is a key issue. In semi manufacturing, one cannot hire just two or three engineers and replicate the entire process. Several hundred are needed at once, all of whom must be used to the manufacturing line’s systems and components, and all of whom can work together. Since talent is so scarce and cash so common, new firms raise quick capital, poach talent from the incumbent and ultimately fragment talent across the ecosystem.

Bureaucracy in the local firms is also a challenge (typically, firms will also have some form of state ownership in their cap table). On top of the fragmentation and bureaucracy, this localisation across different parts of the supply chain is happening simultaneously. The net result of these is that – while talent is proliferating – there’s still a stack of mediocre projects without adequately experienced folk working on them.

Between the US denying them, and China not being able to make it themselves, China does not have access to crucial semicap equipment or design tools.

The US has opted to implement fairly strict export control on semicap providers like Dutch ASML and increasingly Lam Research, KLA-Tencor, and Applied Materials. These companies are both limited in ability to sell to SMIC and other Chinese champions and also, by selling to TSMC and Samsung, continue to entrench the incumbent fabs.

Now, not all sales are banned. For instance, deep ultraviolet (DUV) lithography machines are sold along with lagging edge systems from the other semicap chaps. These can only facilitate 14nm processes and above, and China needs leading-edge EUV for true independence.

Currently, the leading players in Chinese semicap are SMEE (lithography), ACM (clean), AMEC (etch), and NAURA (deposition). Between these four, China serves maybe 1.5% of the global market. A couple of these players are capable of producing equipment for 5nm chips, but as SMIC can’t get EUV lithography systems, much of the other equipment is moot for independence.

When we say things like “capable of producing equipment for 5nm chips”, it’s important to qualify the meaning of this. Firstly, the difference between production at an R&D level, and production at a scale level is a big jump. Secondly, although these machines may work in fabricating ~5nm nodes, that doesn’t necessarily mean they’re competitive with Lam Research or KLA machines. Workability is not the only consideration. Fabricators also look for reliability, uptime, price/performance ratio equipment support, system intelligence, and mean time between failures (MTBF).

All these firms are key suppliers to Semiconductor Manufacturing International Corporation (aka the already-mentioned SMIC). As the country’s leading fab SMIC, is apparently having success with 7nm R&D-level nodes, but without access to EUV machines, mass production is impossible.9

Independence is one thing, market share is another. Semicap incumbents have the virtuous cycle of being able work more closely with their handful of customers, solving problems together and increasing value-add. If the US openly sells semicap equipment to China, this market dynamic would likely continue to play out. Given the difficulty of reverse engineering, collaboration here doesn’t carry much IP risk - it would likely serve to entrench the position of US incumbents within the Chinese foundry ecosystem.

Necessity is the mother of invention. The current US position of restrictive access mandates that the Chinese work overtime to build independence, which costs a shedload and is radically difficult to do - a lose-lose proposition for both parties.

Aside from talent and semicap equipment, China needs elite-level processes.

Dan Wang’s How Technology Grows breaks down tech capabilities into three forms: tools (read: semicap), direct instructions (like blueprints or IP), and process knowledge (economists refer to this as tacit knowledge). We’ve just discussed tools. I’d contend that China can get direct instructions with the development of talent, both poached and home-grown. So that leaves them having to build the process knowledge. Dan describes process knowledge as something that’s “hard to write down as an instruction: you can give someone a well-equipped kitchen and an extraordinarily detailed recipe, but absent cooking experience, it’s hard to make a great dish.”

Unless process knowledge is practised, frequently and intentionally, it is lost. China lags where the processes are the most complicated (Figure 5). For both logic and memory, leading-edge fabrication is heavily influenced by folk having access to, and training in usage of Electronic Design Tools (EDA) and semicap. The more China relies on US semicap and EDA tools, the less the internal capabilities are grown.

Figure 5: China's constraints to effective semiconductor independence (SIA Webinar, Vineyard Holdings)

The chip manufacturing process has roughly 400 steps, with approximately 500 various inputs along the way. All these interact with each other intricately, and almost none can be safely skipped. Chris Thomas put it well:

“If you change a tool, you have to change a chemical, which means you then have to change some other process step, which impacts all of the other process steps, all of the other inputs and all of the other chemicals... Every decision inside a fab to localise has massive downstream and upstream impacts, and it all has to move in lockstep.”

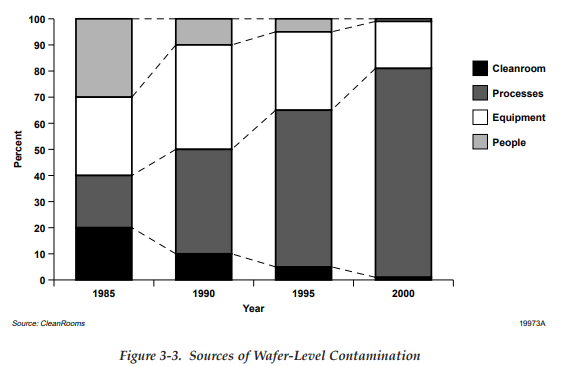

Given the continual investment cost of these processes, a key feature of the industry is die yield. A die is the bare IC chip after fabrication but before end-packaging. Die yield is the number of good dice that pass through the wafer testing at the end. Ideally, fabs would have 100% of the dies that come out of the assembly line working, but given the complexity of processes here, it’s almost impossible that every single chip is perfect.

Understanding die yield is key to understanding barriers to entry in the ecosystem. When a company is trialling a new technology, yield can frequently be under 40%. The process of identifying where the faults are coming from, quantifying them, and improving on them is called yield learning. Here’s a little dated graphic, but you can see how much the complexity of the process has become the cause of faulty chips (Figure 6).

Figure 6: Sources of Wafer-Level Contamination (1985-2000; IC Engineering)

Managing this yield is what allows for a supply chain to operate at scale. The better that Chinese fabs can systematically analyse and improve their yield processes, the better their shot at independence. Practically, this means they need experience using, building, and improving EDA tools and semicap and integrating those systems into full fabrication value chains.

Last but not least, China faces numerous hurdles in building the supply chain.

No company is an island; every company is a piece of chain, a part of the main. Currently, every semiconductor company is a global company. Synopsys and Cadence dominate EDA, ASML dominates lithography systems and TSMC and Samsung dominate the fabrication process. Every one of these firms is dependent on all the others.

Even if China were to build out the entire process locally, they’d eventually have to become cost-competitive with international firms. International trade is based on utilising competitive advantage, and without subsidies, the Chinese firms’ unit economics simply don’t work.

Figure 7: Chinese foundries have unsustainable capex without their cheap funding (Randy Abrams, Credit Suisse)

Chinese chip CEOs are still CEOs.10 They still have to produce economically viable products at competitive price points and quality levels. They still have to make economic decisions about which supplier to buy from and which piece of equipment to use. In this decision-making, nationality and state policy are only two of several factors. Unless the local equipment manufacturers and chemical suppliers can produce at competitive levels, the fact that they are Chinese won’t help them sell their product.

In a similar vein, the local upstream suppliers are a disparate bunch. At a high level, they’re all generally between 5-10 years behind global champions. These companies face a tough row to hoe: Focusing on the Chinese localisation market, they compete with low-cost, high-quality imports. While the build-national-redundancy narrative is entirely accurate, many local vendors are conversely also trying to de-risk their China exposure by moving their supply chain outwards into countries like India.

These economics are tough to make work – if a company expands upstream into the Chinese fabs, they are targeting at most 5% of global capacity. This is a small percentage of a TAM to try and build a business on. On top of this, the stiff competition from imports will put margin pressure on firms targeting these fabs. The fabs, meanwhile, will be trying to balance their local and global partners as local partners build out their capabilities.

All considered – building a local supply chain is tough.

What is helping China do this

China has three primary pull factors: there is extensive policy support, the global manufacturing hub, and the biggest market in the world.

So, the stage is set. We know broadly how the semiconductor industry functions, what the drivers for demand are, and why China is so intent on gaining independence. We also now have an idea of what China needs to build out to compete with the incumbents.

Comprehensive strategic policy support

Under the nation's Made in China 2025 industrial plan, 70% of the semiconductors it uses are to be produced domestically by 2025. Currently, they’re hovering around the 20% mark.11 The man appointed to face down this herculean task is Liu He – a Politburo member who has served extensively in the financial and economic arena. He has a background in economics and is one of the go-to negotiators in US-Sino relationships.

While Liu is the figurehead (and has thus far taken an active role), he is not alone in developing policy. As always, the Five-Year Plan guides the policy at a national level, while local officials implement these guidelines via their own efforts. Covington has a good article covering the specific policies here. The important thing to note is that there are a metric shedload of them (LL’s note: I think that is the technical term).

Some of the highlights:

The first ten years of corporate income tax for IC manufacturing firms developing beyond 28nm is waived.

Design firms have their first five years of income tax waived after turning profitable and are taxed at half the going rate thereafter.

There are now no import tariffs on equipment, raw materials, and consumables for mid-to-leading edge logic and advanced OSAT firms.

The second national IC Fund has been raised at $29bn for state investment into the ecosystem.

All firms have access to accelerated IPO processes.

Over the past five years, semiconductor grants as a percentage of firm net income has grown from 25% to 125% on average. At an industry level, the state has funnelled roughly $32.5bn in 2020 alone. This is up 407% since the prior year.

Beyond these fiscal policies, there are many enablers at a geographic level. Quite a few places are pushing for their region to become Silicon Valley-type innovation hubs. The idea is that if lots of smart people are in one area, they’re apparently more likely to stumble upon the dark arts of leading-edge process node fabrication.

China is the world’s factory

I mentioned earlier that process knowledge is a critical need. Fortunately for China, they are rapidly learning the world’s advanced processes as everyone else outsources to them. While this is not entirely true for leading-edge semis, the Made in China 2025 strategy seeks to cement this across many other advanced tech products (Figure 8). Of course, making high-performance medical devices is very different to fabricating chips. But the fact that China is capturing the lion’s share of marginal process knowledge positions them well to attract talent, drive tech progression, and replicate the more simplistic capital equipment.

Figure 8: Made in China 2025 (Kearney)

To (again) quote Dan Wang:

“China is now responsible for around a fifth of the world’s total manufactured exports because few multinationals have resisted moving production there. US, German, and Japanese firms like to say that they’ve kept the most valuable work domestically. That’s true for the most part, but they’re betting that the Chinese workforce many of them are training will fail to digest foreign technologies and replicate it. That bet has failed at least in technologies that include high-speed rail, shipbuilding, and telecommunications equipment. And I expect that as China’s economy grows more sophisticated, its absorptive and learning capacity will improve as well.”

Yes, China has an aging population. And yes, China has historically relied on cheap labour costs. This means their low-cost, high-volume strategy of the previous decades won’t work as well. This is also partially why they’ve shifted to advanced manufacturing. The more smart people there are, the less cheap labour is an advantage.12

With a blowout growth in the number of folk with Masters degrees or above, and with the majority of those coming from STEM fields, China is ever more in the realm of tech pioneering. More Chinese are employed in higher-margin jobs by funnelling this talent into industrial development, leading more R&D, and cycling more money back into the economy. This is a positive feedback loop. It is arguably the same loop that led the development of the Bay Area as the semiconductor hub of the ‘60s. Seems smart people want to work where the smart people are.

Beyond policy and manufacturing expertise, China is massive. Entrepreneurs need real use cases and applications for their investments in building capabilities to make sense. The domestic market demand for semiconductors is insufficient to justify the national capex required in the bulk of the world. But in China, this is less the case.

They are the global leader in 5G infrastructure, smartphones, digital health, robotics, autonomous transport, and smart cities. Their rapid development of an advanced technology capability over the last several years has been remarkable. The primary drivers for this development: large markets, a strong exporting capability, impressive entrepreneurship, easy funding, and simple necessity.

Figure 9: Spheres in which China is [debatably] the global leader (Handel Jones, Vineyard Holdings)

Some quick stats:

China produces more electric vehicles than the rest of the world combined.

China has nearly twice as many Internet users as the U.S. has people. McKinsey called the Chinese consumer the “growth engine of the world” and identified digitisation as the number one trend in China over the next decade.

Per the SIA, in 2020, China imported a whopping $378 billion in semiconductors; assembled 35% of the world’s electronic devices; accounted for 30% to 70% (depending on the product) of the global TV, PC, and mobile phone exports; and consumed one-quarter of all semiconductor-enabled electronics.

All of this is to say, this is an enormous market.13

But markets, markets, everywhere, nor any drop to drink. A Politburo-web of incentives, subsidies and tax breaks all stunt competition, and these policies murk the true size and prowess of the Chinese market. While it's possible the ~$100bn sunk into China's semiconductor market since 2014 has yielded optimal returns, it’s unlikely.14 Not to say the magnitude of China’s market is not an enormous pull factor, simply that it may not be optimally allocating resources.

So far, we’ve outlined why China is lagging, where they need to improve, and what is helping them do so. We’ve already unpacked some of the who during our brief look at Chinese semicap. The next little segment further answers the who, how, and why questions of Chinese independence.

The Who, How, and When

The who is an introduction to China’s key players. The how is an outline on their progress, challenges and some potential KPIs. The when is a rough guess as to a timeline for true independence.

The Who

For the sake of a recap, let’s dive into a quick-and-dirty overview of the Chinese semiconductor industry. The top three players will really tell you all you need to know:

HiSilicon – the fabless arm of Huawei, earned roughly as much revenue in 2019 as AMD (~$7.5bn). They are elite, designing high-end SoCs for Huawei.

JCET – the second biggest OSAT company (behind ASE Tech) globally. Again, they are world class, even if this is a lower-value-add part of the supply chain.

SMIC – the foundry-champion of China. They compete really well in lagging edge nodes, but are many years behind TSMC/Samsung, partly due to an inability to source semicap.

There’s still a long road ahead before China reaches her independence. That’s not to say they haven’t shown remarkable progress. Figure 10 below unpacks some of the domestic logic supply chain – they’re advancing in low-value-add offerings like OSAT. Even Empyrean and SMIC have been successful in their arenas. But EDA and semicap are bottlenecks that China hasn’t been able to spend her way through.

Figure 10: China's threadbare logic supply chain (Vineyard Holdings)

Fabless - the prowess of Tencent, Alibaba and Baidu and their growth into industrial, enterprise and AI – provides a key local market for chip designers to feed into. As these companies require tailored designs, opportunities will grow for Chinese designers to enter the virtuous cycle of working closely with and generating more bespoke products for these big tech companies. HiSilicon has been exemplary, and we could well see Oppo and Xiaomi following their path.15

Foundries - SMIC is really the big name here. As the fifth biggest global foundry they have excelled in developing lagging edge nodes at scale. However, they’ve struggled to get yield right for <14nm nodes since 2019 and haven’t managed to compete beyond this. Practically, these guys are around 7-8 years behind TSMC and Samsung, both of whom produced 14nm at scale in 2013.16 One massive constraint for SMIC is the US’ insistence that ASML not sell EUV systems to them. This effectively prohibits anything from 7nm and beyond.17

Figure 11: SMIC's market share gains (Randy Abrams, Credit Suisse)

Memory (not shown in Figure 10) – NAND flash has been a remarkable area of progress for China broadly, particularly for Yangtze Memory Technologies Company (YMTC). To butcher nuance, think of DRAM as short-term storage, and NAND as long-term storage. Both are essential for developing an AI capability and 5G rollout, but DRAM generally has more attractive unit economics given the higher manufacturing complexity.

A quick word on YMTC – because they are probably the best example of China’s success. They have rapidly built out capacity for bleeding-edge competition (128-layer NAND). This has come off the back of a novel way of packaging the chips (wafer-on-wafer bonding), and genuinely is a fairly innovative step. They may take around 6-8% global market share, depending on the mix of process nodes over the next couple years. I recommend Dylan Patel’s article on them for those interested further.

While YMTC (and CXMT) are still behind in DRAM (Samsung, SK Hynix and Micron are the only real global players here), they have the potential to grow market share. China’s massive effort to upgrade its manufacturing industry creates big demand for sophisticated servers – DRAM and 3D NAND are both critical here. As a result, Samsung, SK-Hynix and even Intel have key fabs built in China to serve this market. China also isn’t burdened by legacy systems or massive investment in 2D NAND.

It’s important to note how much of memory’s success has been built on the back of talent poaching and IP-theft. The 2019 Micron v. UMC case, the poaching of Korean engineers, and the state’s turning of a blind eye combine to cast Chinese memory producers in a fairly negative light globally. Even with IP, without process knowledge, NAND is unlikely to reach the technology frontier (DRAM as well, although most 1z-nm and all 1a-nm require EUV).

Assembly, packaging, and testing – this is obviously the place where China is most internationally competitive. Having everyone outsource low-value electronics manufacturing to them has been a boon in building this. China’s leading OSAT players are among the top 10 globally and hold roughly ~38% of the market combined, with >30% of their manufacturing facilities based outside of China.

Materials, equipment, and software - these are key constraints as nothing works without inputs. For silicon wafers, polishing liquid, photoresist technology, gases, plating solutions and sputtering target materials, only between 5% and 20% is made locally.

Boiling down to it, the two chokepoints are EDA tools and EUV equipment.

On the EDA front, any manufacturing process requires the systems from US’ Cadence or Synopsys. Dependence on these companies excludes the local ones from working alongside key customers to develop solutions. So, while China’s Empyrean Software is progressing well, when asked if they could replace US suppliers they said “it would be like we sold cars, but Huawei came in and asked us to build airplanes or even rockets for them”.

While not strictly EDA, Arm is one of the most important global semiconductor design firms – they’re involved with everyone from Amazon to Intel. A couple of years ago, Arm sold a 51% stake in their China joint venture to a bunch of Chinese investors and – while they maintained control – the venture was given the exclusive right to distribute Arm’s IP in China.

In 2020 Arm decided to oust Arm China CEO, Allen Wu. Allen decided he didn’t want to leave, and so hired personal security for Arm China. He then, along with some Chinese investors, has rebranded Arm China as 安谋科技, started developing IP not under the Arm Limited banner, and is now operating entirely independently. Dylan Patel calls this the semiconductor heist of the century.

The implications here for Arm are tough – they’ve lost their second-biggest market and, although no IP was stolen, they now cannot license directly to any Chinese firm. They have to go through 安谋科技. The implications for China: while this sets a precarious precedent for international firms with Chinese operations, China now has a fairly secure line to licensing Arm technology.

As the second chokepoint is lithography, ASML’s EUV systems are a critical need for Chinese foundries. There’s a list of the most important semicap players in the appendix, but the TL;DR is that SMEE - China’s answer to ASML - is nowhere near competing in EUV. (Goodness, that's a lot of acronyms). In summary, if SMIC can’t get access to ASML's EUV machines, they can’t develop <7nm nodes.

Throughout the supply chain, China is dependent on foreign companies for tech, equipment, and IP. This is not just at the advanced processes. Per the inimitable John Donne: no semiconductor company is an island. Even if China benefits from a global division of labour favouring their cheaper manufacturing costs, they still won’t have control over core technologies. So how would they go about getting this control?

The How

China’s top-down, state-led, investment-driven approach to playing catchup has met mixed success. The primary shortcomings here are the suboptimal allocation of resources, the tech transfer stuff that comes with the geopolitical dance, and mid-term talent problem.

The combination of market and state covered in Part 1 of this essay is pretty essential here. Whether local companies are looking to build redundancy (de-risking both US and China dependence), design their own chips (ala Alibaba and Tencent), or just build out capacity for a surge in secular demand, they’re all investing aggressively in the ecosystem.

However, the state is heavily invested too. The STAR market (Shanghai’s NASDAQ equivalent) has seen dot com bubble level valuations and a boom of new listings. Roughly 70% of the money flowing into semiconductor valuations comes from state-affiliated bidders, with Big Tech playing second fiddle, and venture only third. Of all the 90+ chip fabs in China, only one is privately financed. The rest are part state-owned.18

Currently, producers are trying to land-grab share in memory and mature node logic.19 They do this because (as with OSAT) they need to be competitive at certain parts of the supply chain. The state’s $16bn investment here since 2016 has yielded good results, and the buildout of lagging-edge fabs is an area where China looks set to grow a distinct competitive advantage. Since TSMC and Samsung have focused on leading-edge – a full-time job on its own – the market is open for middle-of-the-range chips (which, in terms of an actual number of chips produced, is the vast majority).

This is also the area where investment will likely yield the highest ROI, both financially and in terms of immediate self-sufficiency. TSMC has the scale economics to justify spending 30-50% of sales on capex (~$28bn). Even if SMIC could spend similarly, it won’t see half-decent ROI on that money, given all the other factors (processes/market positioning/talent) discussed.

However, like fabless, the lagging-edge foundries spend far less on R&D and capex. 28nm is the most popular node globally. So increasing market share here would help self-sufficiency, the demand/supply mismatch, and would position China with a more sustainable competitive advantage.20

A strategy of dominating lagging edge logic and progressing to leading-edge memory would take longer. It would also be more financially rewarding, more sustainable, and would encounter less opposition from international bodies.

In the medium term, the Chinese state will continue to subsidize unit economics until a certain level of scale is achieved (Figure 12). This arguably leads to zero-sum games between the US, EU and China. While everyone subsidizing chips is beneficial in meeting global demand, it distorts markets and sustains otherwise uncompetitive firms past their sell-by date.

Figure 12: China's subsidies make their chips far more competitively priced (SIA).

Once China has established itself on the lagging edge, the next target could likely be advanced DRAM and analog. Both of these pose tougher challenges though, as 1a-nm DRAM requires EUV to manufacture, and 1z-nm is hard to scale without EUV (although Micron is currently doing this through multiple patterning). 21

Analog is another story too. These two excellent writeups by Rasmus Jakobsson unpack some of the industry economics, why the ability to embed within a customer’s supply chain is so advantageous, and thus why incumbents are so tough to displace. In short, analog is a small part of the customer’s total system cost. Customers also use a wide range of chips for each system, and thus often prioritise for selection breadth, component availability and service level.22 Cost is thus not the issue - scale is. Whereas the barriers to entry in logic and memory are physical, financial, and technological, the barriers in analog are more market-driven – product diversity, and longevity are the key differentiators creating a 20-year head start for incumbents.

Looking at the composition of the National IC Fund (Figure 13), and the spread of China’s IC market by segment (Figure 14), it’s fairly obvious they are prioritising logic development. This suggests an emphasis on geopolitical security over financial return. How long this approach will last is tough to say.

Figure 13: The breakdown by segment of China's National IC Fund (SIA, 2021)

Figure 14: China's IC market by segment (Coughlin Associates; 2018-2020)

Perhaps controversially, over the long term, I expect China to continue to become increasingly competitive. Although they are a decade or so behind in many aspects, it’s foreseeable that they eventually reach the leading edge and push it forward.

Supply-side workers are engaging with more process learning than any other nation, and the enormity of the Chinese market (and growing global demand) will continue to pull forward their capability. Given enough time, it’s likely China replicates their success within semiconductors as they have in most other forms of electronics. Besides – no country, company, or person in history has monopolised technology eternally.

The will to power, growing talent pools, and steep learning curve are structurally underpinning this trend, with easy money funding it in the short-to-mid term. The question is largely not if but when?

The When

China’s goal of locally fabricating 70% of the semis used by 2025 is highly ambitious. The best odds of this would be for YMTC to rapidly gain NAND and low-end DRAM market share, and target building scaled capacity for >28nm. Measured in dollar spend, China is unlikely to produce even 50% of its chips this decade (Figure 15), in terms of actual chips used, 70% may be achievable around 2028. These would be mostly lagging-edge.

Figure 15: Forecasted Chinese semiconductor supply (Handel Jones, IBS; 2006-2030)

Even to achieve a semblance of leading-edge independence, China is at least a decade away. The need for lithography and design tools is only going to increase for tech beyond 7nm, and neither SMEE, nor Empyrean are close enough to ASML and Cadence/Synopsys to offer competitive systems. Like the US, China relies on TSMC and Samsung (among others) to produce 100% of their advanced chips. It’ll be interesting to see what levers China can pull with TSMC going forward to move the needle here.

Increasingly, Chinese firms could begin to challenge Western competitors – both as they creep up the lagging edge (as YMTC has done) and begin developing their own technologies (as the semicap players are experimenting with). There have been some investments into non-silicon processes as a workaround, particularly with the advent of electric vehicles increasing the demand for power-focused chips. However, the outlook for these is mixed at best. Still, it’s a good reminder that in the 1990’s the incumbents took a speculative fling on ASML’s immersion lithography machines to avoid buying machines from Japan. Sound familiar?

As for true independence, I’m sceptical. The entire supply chain is so globalised today, and the benefits of specialisation so entrenched that it’s almost impossible. Having one country design, fab, package, and sell a leading-edge chip is already super tough. To do that all without that chip, or any of the equipment that helped make it, ever crossing a border is almost unthinkable. Yet China has no interest in true-blue isolationism. China’s interest lies in strategic removal of dependence on the US. To this end, semicap and design tools are the biggest hurdles.

Conclusion

To recap the key themes of this essay:

Part 1 covered what the global supply chain looks like, what the barriers to entry are, and why China is trying to gain independence. The industry boils down to a handful of pseudo-monopolists where barriers to entry are high capex cost, extreme process expertise, scale, client integration, and talent ecosystems built around the incumbents. China is trying to gain independence to support her AI/5G future leadership, build capacity for upcoming demand, and secure geopolitical autonomy.

This second part looked first at what China needs to do, the tailwinds helping her do these things, and how far along she is in doing these. In unpacking who the key players are, how China could possibly progress, and when she’s expected to achieve varying levels of autonomy, the final conclusion of this behemoth of an article was that China is maybe a decade behind leading firms.

The biggest constraints are a lack of advanced lithography equipment (SMEE doesn’t have the capability, and ASML is prohibited from selling EUV systems). The industry is still heavily dependent on the EDA tool providers, with Empyrean being insufficient to meet the growing design demand. The US’ restrictions on semicap and blacklisting certain Chinese entities have reinforced the necessity of rapid development and revealed how dependent many flagship champions are on the global incumbents.

China is already incredibly competitive in OSAT and mid-level packaging and has had remarkable success with 3D NAND in YMTC. There is every likelihood that China increasingly takes lagging-edge market share in memory and logic – supported by a generous policy via the IC fund, grants, tax breaks and listings on the STAR market. The high valuations of companies here act as a cheap source of funding – enabling growth and spend which would otherwise be untenable.

As a final recommendation – an open and conflict-free trade environment would be beneficial to all players. As one of every five dollars that China spends on US semicap is reinvested back into the US ecosystem as capex, the US firms need China for demand almost as much as China needs them for supply. Beyond this, the semicap and EDA firms’ systems are impossible to reverse engineer – selling them would encourage Chinese dependence. For China, receiving these machines means they can progress with establishing talent and process development rather than trying to tackle all three hurdles at once. Open trade would also lessen the odds of decoupling or open conflict.

Nevertheless, the extreme demand and the fact that China is increasingly the world’s advanced manufacturing hub gives her the inside track on growth here. Regardless of how this plays out, to butcher a turn of phrase: this is not your grandfather’s semiconductor industry.

Appendix

The appendix is where I dump some of the info that supports the stuff I said earlier, but which is too granular to be included in the body of the text. See in-text links.

Key Chinese semicap players

Shanghai Micro Electronics Equipment (SMEE) is developing equipment for 28nm process nodes – which TSMC, Samsung and Intel were already producing around 2013.

As lithography is one of the most crucial aspects in making chips smaller, SMEE’s progress is one of the major KPIs for Chinese independence. As of June 2021, their flagship device, the “600 series” is capable of >90nm processes. It’s possible that multiple patterning enables some more advanced capabilities, but at best they’d be able to work 14nm processes without EUV. This puts them roughly a decade behind world leader ASML.

ACM Research, who do wafer cleaning (a lower barriers-to-entry market) are reasonably competitive globally. While their share of their respective markets globally is <1%, they are shipping leading-edge equipment and could expect to gain market share over the coming decade.

Advanced Micro-Fabrication Equipment (AMEC) are China’s answer to Lam Research – the etch folk. They’ve been taken to court several times on IP-theft, and have had little success breaching the Tokyo Electron/Lam Research/Applied Materials etch triopoly. Where they stand to gain, however, is in deposition on non-silicon components. Here they have roughly 40% of the global market share.

Finally, NAURA Technology Group – who are also in deposition (and partially etch). Technically speaking, NAURA is capable of producing equipment for 5nm chips, but in reality the bulk of their capability is for >14nm.

Industry summaries

The Weak Links in China’s Drive for Semiconductors – Institut Montaigne

China’s Bold Strategy for Semiconductors – Zero-Sum Game or Catalyst for Cooperation?

China’s Techno-Industrial Development: A Case Study of the Semiconductor Industry

Chinese Semiconductor Industrial Policy: Prospects for Future Success – John Verwey

Chip War: Taiwan’s role in China’s Semiconductor Industry Policy

Additional interesting reads

ChangXin Memory Technologies: China’s Rising DRAM Manufacturer – Coughlin Associates

Rise of the "Big 4" - The semiconductor industry in Asia Pacific - Deloitte

Rapid Advance: High Technology in China in the Global Electronic Age – Susan Mays

Semiconductor Design and Manufacturing: Achieving Leading Edge Capabilities - McKinsey

Lastly, for those who are in China and want to join, there is a semiconductor conference happening in Shanghai from March 23-25, 2022. Registrations are open.

The NDRC has said they’ll start cracking down on this.

There is a difference between subsidized private companies and SEOs.

“Rapid”, of course, being a loosely used phrase in context.

Traditional espionage is fairly useless. It is near impossible to reverse engineer the complex processes involved here. Consequently, prominent Western outlets have accused China of IP-theft in their attempts to copy leading tech. But what is IP-theft anyway? Many Chinese firms have taken to offering lead engineers several times their regular salaries, lifestyle benefits and even building out “home-away-from-home” type environments. SMIC once famously set up a Church on campus for Taiwanese evangelicals and has built a mini-Taipei nearby for a similar reason.

In the US and Mainland China, computer science is attractive because of the tech giants being predominantly software companies. In Taiwan, electrical manufacturing is the goal for kids because TSMC is the aspirational go-to. It is partially the intention of the CCP to shift the childhood aspirations from building the next food delivery super-app towards building the next hard tech innovation.

Per Jimmy Goodridge, fab managers are usually Chinese-American or Taiwanese-American, the tech director managing fab operations is maybe from Japan or South Korea and then there are hundreds of line managers still living in Taiwan or South Korea who still commute to China 5 days a week.

This practice is expressly part of China’s Thousand Talents program and has been the source of a fair amount of controversy

There are also prototypes for a laser-based lithography inside of China (via SINANO), but this is still several years away from production.

Stakeholder management is also a big-time constraint for the CEOs. There are many, many government bodies which the CEOs must engage with and balance the priorities of.

These chips needn’t be leading-edge, although to neglect leading-edge independence is to relinquish control of the AI/5G stack. It seems very unlikely the push will not be for leading-edge independence too.

I strongly recommend this article by EqualOcean. It’s a great look at the various steps towards this advanced manufacturing capability.

I recommend Visual Capitalist’s infographics for a quick overview.

Here, China’s policy distortions play an interesting role. In 1987’s Wall Street Gordon Gekko notoriously declared that greed “captures the essence of the evolutionary spirit. Greed, in all of its forms: greed for life, for money, for love, knowledge, has marked the upward surge of mankind.” Or, in short, greed is good. For much of the last century, laissez-faire economics has been the hallmark of Western progression. We built Rome on free-market policy and rugged individualism.

But over the last 30 years, capitalism’s shoddy ability to distribute wealth has been eyed with scepticism by the emerging China. Xi Jinping’s populist steps towards common prosperity are perhaps borne from this scepticism. Whether this is a wise economic policy will be one of the biggest questions of the 21st century; is guided capitalism better than Smithsonian thinking for a world of increasing returns to scale? However this plays out, the barbarians are at the gate for America’s Rome – we are at the start of the Asian Century.

There was a debacle with Wuhan Hongxin last year wherein they misled investors, ran head-first into bureaucracy and proved “a nightmare” for management and politicians alike.

China’s fabs are already running at full capacity, with SMIC to build a new 28nm fab in Shenzhen for production to start in 2022.

According to VLSI, China’s memory and foundry capacity is expected to grow at a CAGR of 14.7% over the next 10 years.

SMIC is already producing 14nm and 28nm for high volume applications such as mid-end smartphones and can churn out the 40nm at scale (low-end smartphones). China can come to dominate 14nm and 28nm – aside from mid/low-end smartphones, industrial and automotive demand can also absorb a lot of the supply of these chips.

I recommend Coughlin Associates’ 2021 whitepaper on CXMT for a review of China’s DRAM leader. Advanced DRAM is increasingly reliant on the logic transistors inbuilt, so leading-edge progress here will face the same hurdles of advanced logic.

An incumbent like Texas Instruments has over 80,000 different products, each of which has a unique design. For a Chinese start-up to compete within this decade, they’d need to create roughly 8,000 new products per year. TI meanwhile launches 300-400 products each year, spends little on capex relative to sales, but a lot more than any peer in absolute terms.