Prediction: Agriculture tech is going to be big in China

An overview of a sector that should be cooler

Hi folks, getting closer to a schedule of posting on time today. Premium readers can access a compiled list of the agriculture startups at the end of the article.

A peculiar phenomenon swept through Chinese tech in 2021; founders1 stepped away from their hard-won tech empires to emerge as agricultural converts. Colin Huang is going deep into food science after leaving the role of Pinduoduo Chairman in March 2021. After a year of laying low, Jack Ma resurfaced, decked out in a white lab coat, the founder of Alibaba looked cheery as he traversed across Europe's greenhouses.

The image seems jarring. The visionaries who gave us the abstracted comforts of high tech living are going back to something as common and rudimentary as agriculture. But let's not forget, at our standing desks on Zoom calls, what truly sustains us.

Farming marked man's first use of technology, a key milestone towards civilization. The journey from being a slave to the elements to the management of nature was instrumental in creating the surplus to industrialise and urbanise. Reliable food sources are what ultimately sustains people and nations. Hunger was the dark beast that stalked our species for millennia, and it is a wonder that the audience for this newsletter is more likely to encounter it today through deliberate intermittent fasting than food insecurity. In our rush towards the metaverse, it is very easy to overlook the basics of what keeps life going.

But maybe it's time to go back to our roots, just like these Chinese tech billionaires.

Food production is not a solved problem for China. It has 7% of the world's arable land, which it uses to feed 20% of the world's population (in contrast to the US's 16.5% of the world's arable land and 4.27% of the global population). It has increased production in recent years by introducing higher-yield grains, better farming techniques and privatisation policies to incentivise farmers. However, it still lags in yield and food safety relative to developed countries with robust agriculture sectors. In addition, issues loom on the horizon with ageing rural demographics, environmental degradation, climate change, groundwater depletion, heavy metal pollution and a lack of technological adoption. Shocks to the system in the form of swine flu and Covid have seen rocketing food prices which squeeze the wallets of the masses and the livelihood of the ~350 million people employed in Chinese agriculture. The priority of the problem is such that it is a staple in Chinese government policy. In the 14th Five Year Plan, grain production capacity has been highlighted as a binding indicator.

Just like in ages of old, it's time for agriculture to embrace technology. So good news first — the market and opportunity in China for the agricultural sector is enormous:

The agricultural market is big and growing -The Chinese market for agricultural industries (Agricultural industries include agriculture, forestry, animal husbandry, and fisheries. This piece will primarily focus on agriculture) was 13.8 trillion RMB ($2.1 trillion) in 2021 and is growing at 3% annually. It also employs ~25% of the population. An expert estimated China’s digital agricultural economy to be about 600 billion RMB ($94 billion) and expected to double to more than 1.2 trillion RMB ($188 billion) by 2025.

Food is a core need for the individual and the nation - there is no more straightforward fact than people need to eat. Agriculture is the lifeblood that sustains a country. During the past three decades, the sector has increased yield while demand remains inelastic. The 14th Five Year Plan and leaders' working reports highlight the importance of achieving a minimum threshold grain output, increasing land cultivation and improving food security.

Ensuring that our people have enough food remains a top priority for our government - Premier Li Keqiang

Declining rural labour makes automation increasingly viable - a labour shortage in Chinese agriculture is imminent given urban migration and an ageing rural population. This makes it a suitable candidate for technological automation.

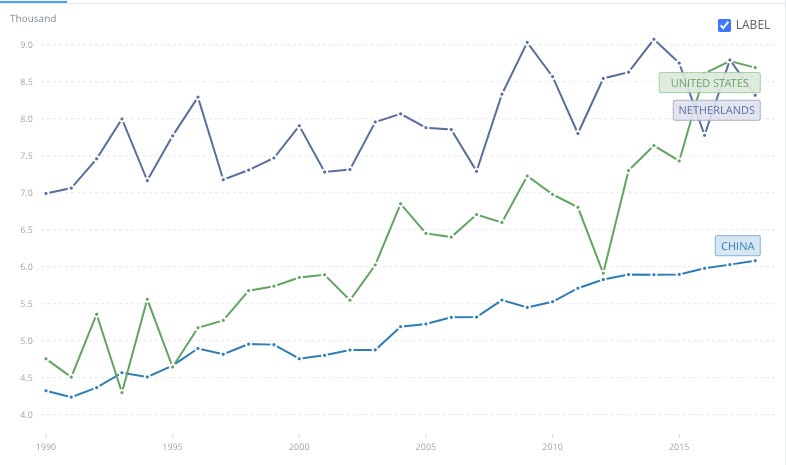

A Comparison of Rural Population Change for China and the United States: 2000–2019

Lower yields than some developed countries alongside concerns about environmental degradation- While China's cereal yield (kg per hectare) has been improving, it still lags behind the US (or the small but mighty Netherlands). A combination of environmental erosion and water depletion has heightened the concerns for long-term national food security.

So far, the 'technology will save agriculture' pitch is good. But as with any large and fragmented market, many systemic issues prevent technological adoption and upgrades. These include:

Traditional land policy allocation and limited access to finance mean scaling is complex - PRC's historical agricultural policy distributed arable land evenly amongst farmers to guarantee employment and a livelihood. Over 98% of farmers are small scale farms averaging less than 6km2 (For comparison, the average US farm size is about 1,800 km2). The smaller farm holdings and lack of sufficient rural finance mean that investment in large scale agriculture technology is not economically viable.

Lack of talent and digital knowledge in the industry is a barrier to effective upgrading - Agriculture is not a magnet for talent. People usually work to escape farming and not return. In China, compounding factors of economics, prestige, and culture have seen a brain drain from rural regions to cities. The farming population is not digitally savvy and finds navigating new technology and farming techniques difficult.

Poor foundational infrastructure - Many rural areas suffer from poor internet connectivity and coverage issues, making more advanced digital technology hard to adopt with such weak foundations. The "Digital Agriculture and Rural Area Development Plan 2019 to 2025," highlighted that rural penetration of the internet was at 38.4%. Many new agricultural technologies such as IoT sensors require significant hardware deployment and bespoke software implementation before results can emerge.

Lack of standardisation in agriculture production - Soil quality, water, temperature, climate differ vastly from region to region in China. That makes a standardised and unified production process hard to scale up nationally. It requires the efforts of many actors to create agriculture tech solutions that are suited to regional conditions. This slow industry thus takes years to see gradual improvements compound.

While the issues mentioned above are thorny, a combination of government policy, data as a factor of production, cloud adoption, ubiquitous 5G deployment, and big tech players’ entrance may cause a new inflection point.

Policy and government-directed focus on agriculture

It should be clear now that agriculture is a high policy priority. Post the mass campaign for poverty alleviation; agriculture looks to be the next frontier where the government will encourage the pursuit of common prosperity. Policy initiatives such as the "Digital Agriculture and Rural Area Development Plan 2019 to 2025" have set ambitious targets for the next five years, which will be lighting many fires under ambitious regional officials and tech giants too. It's been subsidising technology initiatives (JD has their farm projects at least 50% funded by government subsidies)

The government also sees the potential to elevate agriculture to the next level. The digital agricultural plan is peppered with initiatives that highlight the usage of data platforms to share big data across regions. Data will be one of the key factors of production.

The entrance of tech giants and internet thinking are getting interested

After searching for the next fengkou and the proverbial hand slapping from community group buying tech giants have focused on going deeper into agriculture. These efforts include: Taobao villages dedicated to e-commerce, Tencent's $7.68 billion environment and social pledges, Pinduoduo's $1.6 billion agriculture fund and AI-enabled strawberry growing competition, Meituan’s training program for rural e-commerce leaders and JD.com's blockchain investment. These players bring money, expertise and some much needed high-tech glamour to the industry. Also, it gets the VCs going as they jostle to attach themselves to the tailwinds, so there's that.

The timing of tech giants entering the field is a natural continuation of the e-commerce tech platform's aggregation theory strategy. Livestreaming e-commerce and community group buying are variations of this theme through combinations of online and offline distribution channels. With demand secured, the platforms have been developing Consumers-to-Manufacturer strategies in other product SKUs such as washing machines and glasses. They are now ready to tackle agriculture too. With a consolidated downstream buyer, the thinking goes, there could be more secure demand streams for produce and less need for intermediaries. That could enable farmers and agriculture co-ops to plant and produce at a larger scale. While national governments have played this role in core crops, the guarantee of demand can now expand to other agricultural products with a shorter shelf life.

The direct positive effect of the tech giants might not be high calibre candidates heading into agriculture tech (though that is more likely given the waves of recent layoffs and it does look like more young bright faces are entering the field), but rather an inspiration. Deep domain expertise is still needed in agriculture, but experts in the field can see the advantages of internet thinking. Why not use software to solve issues that were previously thought to be in the realms of farmer training programs? Why not get venture capital to fund ambitious endeavours that could be disruptive? After all, this has worked before in other categories; why not farms? The subtle spillover effect might be the willingness to engage in multidisciplinary collaboration which can be very fruitful.

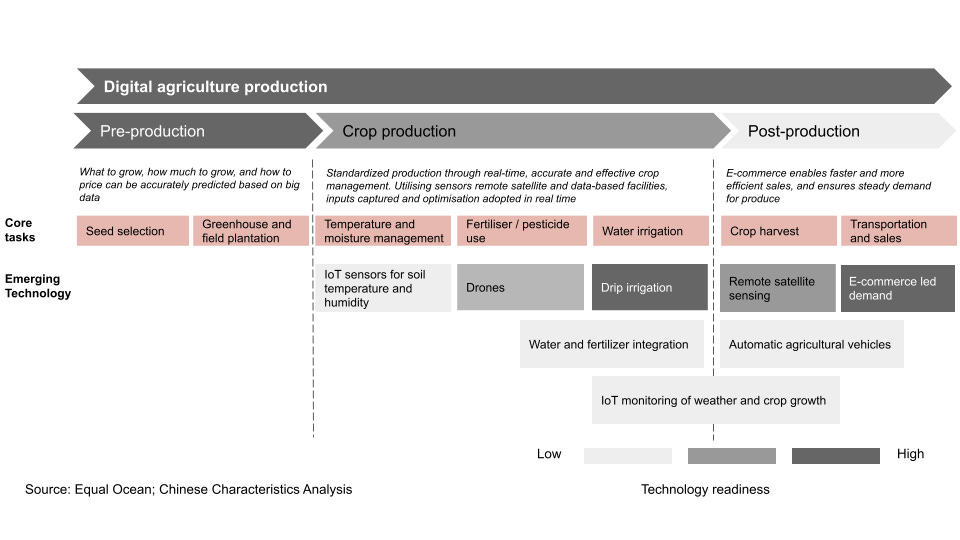

But what's the destination? Let me paint you the vision of digital agriculture utopia:

Digital agriculture is a modern agriculture that uses data as a new agricultural production element and uses modern information technology to visualise, digitally design, and manage the agricultural objects, environment and the entire process. Digital agriculture enables the effective integration of information technology and all aspects of agriculture, which greatly transforms traditional agriculture and agricultural production methods. - Zhong Zhen, deputy dean of the School of Agriculture and Rural Development, Renmin University of China

Many startups are still in small scale pilot mode, with academic frameworks that propose new types of farming initiatives. A common theme with agriculture tech is that hardware installation will prove to be a key driver of data collection, which will require access to finance and personnel to deploy properly.

Interesting video for what the future for precision farming could look like in this Pinduoduo video.

Inflection points can be reached in a few ways. It requires young talent infusion in the sector, large landholding structures, technology needs to mature and government based mass investment into the space. But change is taking place. Co-ops are slowly emerging, Pinduoduo’s been beating the drum on making agriculture sexy, and Chinese government policies will evolve as they always do. As for the technology side, there are a handful of players emerging, but this is still a greenspace by Chinese tech terms. I have not seen VCs go crazy with deployment into there as of yet. (Premium readers can access a compiled list of some of the agriculture startups who raised so far)

The reality with agriculture is that it is still nature. It will take time to see results. This is not a sector that can generate a million increase in daily users over a few months. Agriculture is a worthy sector if anything can be called that. The rural folks in the sector are some of the most economically precarious groups in the world. In the time of a pandemic, as some of us dream about becoming proto-gods in the metaverse, tech should consider long and hard about what actually makes the world a better place. What is actually a core need for everyone. Food, it turns out, is one.

Thanks to Dylan for help with research this week!