When is technology regulation not technology regulation?

And what I think it actually is. Musings post mountains.

I spent a week in the mountains of Shangri-La and accumulated some karma. I came down from the mountains but do not know whether I bring wisdom.

To open Twitter and the news these days is to be consumed with the three poisons. After days away and a family member's passing, I felt overwhelmed by the turmoil and focused instead on tending to my life tasks. However, the world beckons and I have returned.

The byline for Chinese Characteristics is 'Chinese tech longform analysis,’ a non-descript summation, which I freely acknowledge before anyone else. But there's logic there too. To get the 10x returns VC firms aim for, they don’t simply invest in technology but instead in the catalysts for societal change. The big question VCs ask themselves during the due diligence process is, “what needs to go right for this to become big?”. That is, "what changes need to happen in the world and to the world?" I guess the ability to be a subtle societal kingmaker makes up for the lower salary to PE. While society plays a crucial role, technology is still the conduit and the tool. In the eyes of the CCP, it is the means to an end.

Pick your favourite variant of the Solow growth model; permanent growth is achievable only through technological progress. Technology shapes society and it is shaped by society. Disruption nowadays is talked about in localised industry terms, but the history of technological development is the history of society's disruption. It changes incentive structures and reallocates economic gains, but Matthew effect’s on income reign supreme in the platform age. Nothing Schumpeter hasn't said before. But what theories and intellectualisation often miss are the costs. As a classic Chinese song goes — we only see the smiles of the winners but who hears the tears of the unfortunate?

Chinese society went from where a job was for life, and every meal was a communal meal to where owning a house is beyond the imagination of the skilled and unskilled migrant workers in first-tier cities. This is true for every modern metropolis, but the difference is the pace it took for China to catch up to the millennial condition. Within living memory, a generation modernised. Their children went from having a world of possibility to knowing that they can never escape the compounding effects of wealth. In China, the what-ifs of what a twist of luck could have provided or taken away are very real. My middle-class parents worked in factories as new graduates in the 1980s, and look at ex-colleagues who remained lifelong factory workers with a sense of "there but by the grace of God go I." In developed countries, these stratified path dependencies took place over centuries. In China, it was mere decades.

Status anxiety pervades the Chinese middle-class, who realise how precarious their situation is. The path to maintaining their new way of life diminishes with a levelling GDP. When the pie is no longer getting bigger for everyone, the knives are out to fight for a bigger share. Everyone’s very tired of running in the Red Queen world, and some are lying down. Like millennials worldwide, they can no longer guarantee their offspring or even themselves the quality of life that their parents had. Life used to be simple1. In the age of platform economics that is gone. There is mounting frustration that the rags-to-riches stories that belied the Chinese dream are coming to an end.

To paraphrase American writer Langston Hughes — What happens to a dream deferred? Does it wither on the vine, or does it explode?

Chinese populist sentiment has increasingly turned against the inequality perpetuated by the capitalist structure. And it's not too different from global anti-capitalist sentiment as people realise their tomorrows might hold less than their todays. What is pertinent in China is how fast this change has happened; in 2015 the sentiment was to let a thousand entrepreneurs bloom, and in 2021 the red tide is rising.

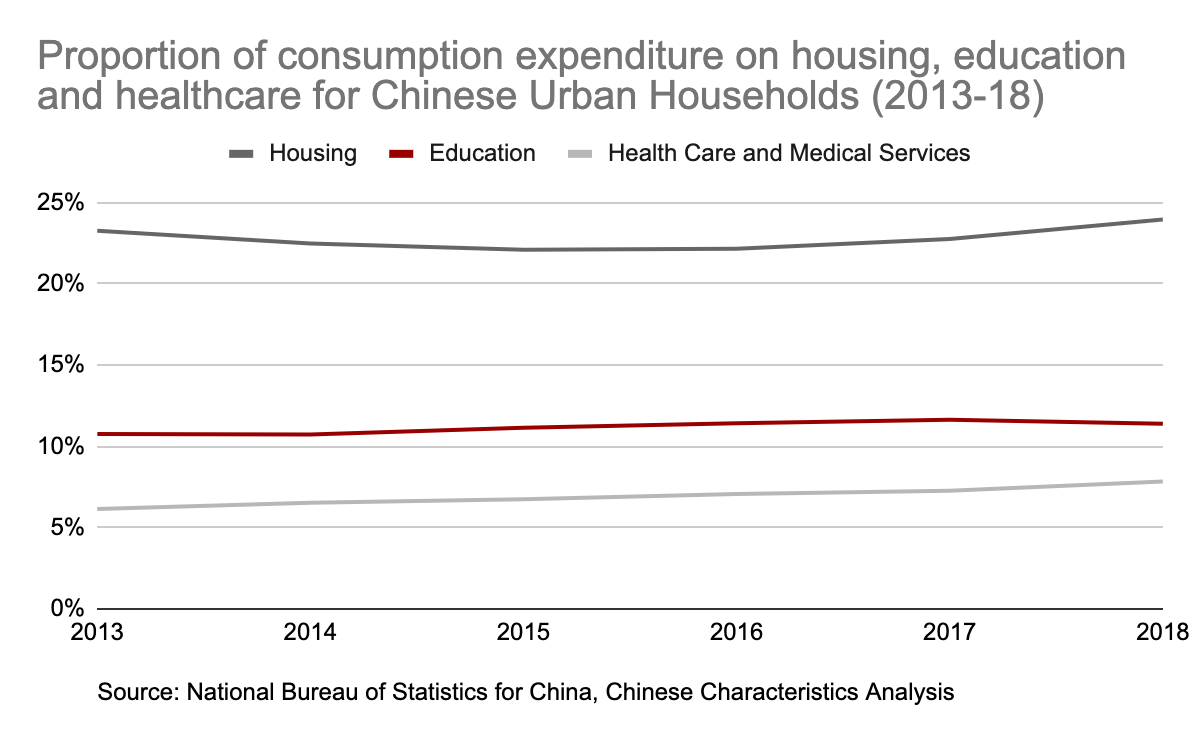

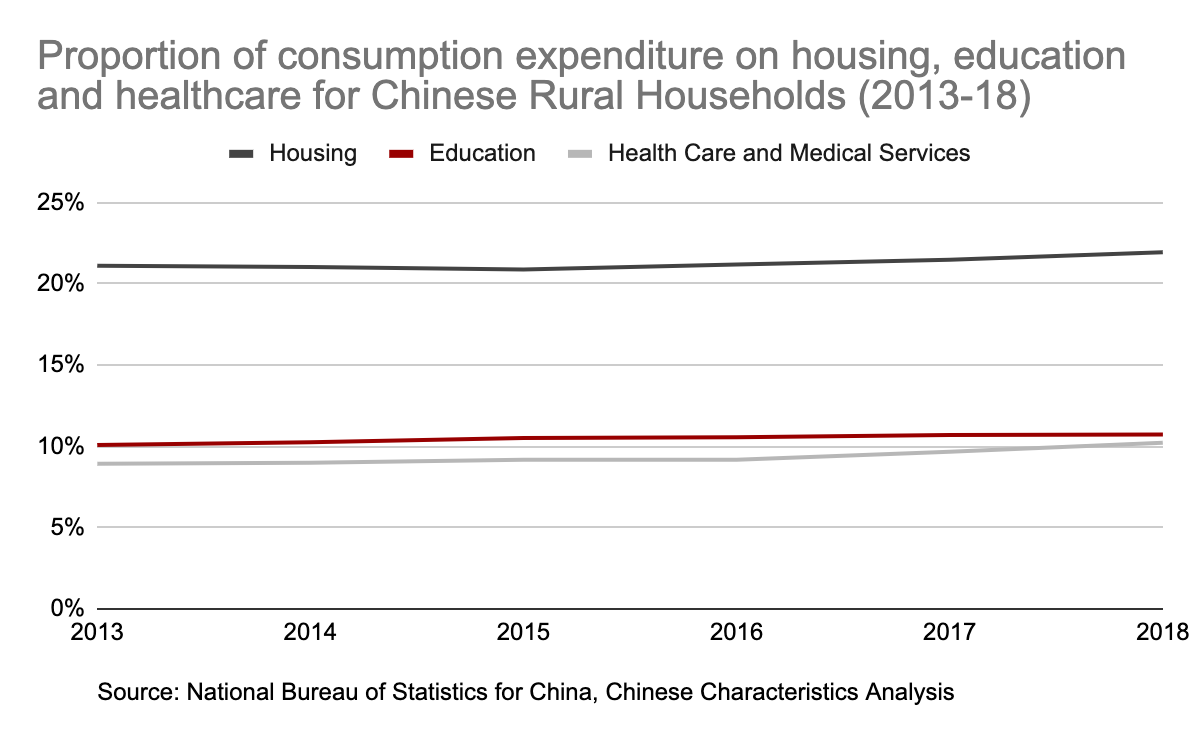

In my view, the recent education regulation and housing prices adjustment are all part of a fundamental restructuring of Chinese society. As bullets have stopped flying, there's less risk of hurting future innovations, and more focus is given to equality over efficiency of growth. To promote 'common prosperity'2, regulations have been coming to limit the biggest buckets of a Chinese household's expenditure. It's what Deng would have wanted and good for internal circulation.

From data from the National Bureau of Statistics for China, we can see the "three mountains" of a Chinese family's household expenditure — education, housing and healthcare are substantial. Had I had more time, I would have done a proper comparison against the OECD and developing countries, but in lieu of that, here’s some comparison for the US.

Technology has been changing the rules of the games in China, as it has globally. All sectors are slowly becoming enabled by technology, but does that make them technology companies? Suppose an education company uses livestreaming to broadcast their content and acquires customers through online marketing. Does that make them a technology company or simply an education company that has adapted to the internet age? To frame the current regulations around just a technology crackdown is too narrow a scope.

Better to avoid Occam’s razor narratives that the Chinese government hates big tech or powerful entities (though not saying these narratives have no merit, just not full descriptive power). Instead, as the world gets eaten by software — retail, education, finance, the list goes on and on — it is almost impossible to implement changes without touching any technology-enabled firms. As for the future of these edtech firms, those that can pivot to other lines of education work have done so, and others have cut their losses. In speaking to folks, there's a sense that further reforms are will still come to further level the educational playing field.3

These are the times that try men’s souls, or at least their margin of safety. This is in part an exercise of trust in the management of China inc and how they are disrupting existing engines of growth to foster new ones. You will all have to make up your minds about whether this is more in the spirit of Zuckerberg buying Instagram for a billion or Theranos raising its next round of capital. The cruellest thing to utter to investors (especially to foreign investors) is that this is not about you. The Chinese government performs its actions in two markets, one international and one domestic. As their legitimacy is built on providing Chinese citizens with better lives, they have to accommodate that in each economic environment. The Chinese government is doing what it has always done, adapting.

As the sentiment goes, though, life is never simple

Aka the party phrase for sustainable and equitable growth

On the gaming crackdown topic, I feel like taking all the fun out of youth is a favourite pastime here in China. There was the 2018 gaming crackdown, and in the 2010s, it was web cafes. The 2000s were marked by moral panic around teenagers dating. Snark aside, most of the gaming companies in Shanghai have been incubating international games since the success of Genji Impact, so I’m not too worried unless the West follows suit with similar regulations restricting minors.

i think you brought back perspective, which, in some ways, is wisdom.

the status game is alive and well... but, it's not the only path. i'm building tools to stop that shitty hamster wheel of insanity. "more" is not the answer anymore. https://john.do/more/

thanks for your continued sharing!