What’s the difference between content centred around utility versus entertainment?

Looking at Xiaohongshu (shortened to XHS), often referred to as "China's Instagram and Pinterest", can reveal some answers on what that playbook looks like and how the company developed its own identity and philosophy.

It's a content platform that decided to become more of a utility to users rather than entertainment. Relative to Instagram, which is vibe heavy and dependent on accounts followed, XHS concentrates on targeted searches and gives actionable to-dos. It’s a fascinating example of path dependency from XHS’ early days as an international shopping guide. Without further ado, let’s deep-dive!

Background

It was the summer of 2013. Air travel was open, and the young middle class was keen to see the world. They were flying off to locations in parts of the world they had long heard about: Hong Kong, Paris, Milan, London, New York, and more. And after taking the obligatory tourist stops, they had a burning question that needed an answer — what to buy?

Catching up over drinks, two old friends searching for startup ideas struck upon this question of the moment. Charlwin Mao was the GSB-trained ex-Bain capital haigui with one startup under his belt. The mobile app Orange Parc, an iOS-based app, helped users discover things to do through their friend list, but it wasn't taking off the way he hoped. Miranda Qu was a seasoned marketing executive with a proven track record. After riffing on a queuing app, it seemed more pragmatic (that is, appealing to investors) to do something related to the country's growing travel sector. After all, China’s bright young things were just growing into a new era of abundance, and the world was their oyster.

As such, XHS started its life as an “HK shopping guide,” a pdf guide passed around amongst friends when they went abroad. It noted what products (predominantly skincare and cosmetics) were good and where to buy them. When it gained momentum and investors’ attention, it started to move into cosmetics e-commerce, but logistics issues made that foray difficult. Pivots also came with other ups and downs, mostly in content moderation scandals from the various fake posting and excessively misleading recommendations (more on this later). This culminated with XHS being taken off the Android app store for two months in 2019.

XHS’ PR likes to brand itself as a ‘lifestyle bible’ and hyperbole aside. It does capture something of the brand's positioning in the millennial population. Namely, it's a trusted and quick how-to guidebook on anything lifestyle-related, from travelling to home renovation tips to how to lose weight fast. It is still perceived to be predominantly aspirational, and sometimes inauthentically so.

As of 2021, XHS has 200m MAU1. The user demographics skew heavily female, young and well-off. About 70% of users are women, 72% of users are below 30 years old, and 50% of users are from Tier 1 and Tier 2 cities. The affluent female-heavy user base has lent itself to a business model that monetises through advertising, which is where we find XHS today.

Currently, XHS is reportedly valued at $20bn after raising a total of $917.7m from investors such as Temasek, Alibaba, Tencent, GGV and Zhenfund. Rumours of IPO plans have been brewing for a while, with the latest news that XHS is opting for a Hong Kong listing, given the complications around cybersecurity reviews.

Product philosophy

Long-time readers know that the only game in Chinese consumer tech is to own the user’s attention (and eventually, their wallet). In my introduction piece on Bilibili, I called this "owning the user." In “Your superapp needs a content strategy,” I wrote about how the content strategy was a potent weapon in the arsenal to own the user by keeping their attention via a combination of status, entertainment and utility. Retaining users’ attention spans allows the platform to move them down the monetisation funnel faster.

XHS’ genesis as a practical shopping guide has lent a pragmatic path dependency to the content. Comparisons to Instagram and Pinterest overshadow XHS’ comparative advantage of utility-led content rather than entertainment-led content. Baidu’s failing search and Zhihu’s rambling answers have led to a gap in the Chinese market for actionable short-form content, which XHS has gladly stepped into.

Being closer to the consideration layer with utility-oriented content means XHS will be less substitutable for entertainment. Being closer to the conversion layer also lends its content to easy monetisation through either advertising or commerce. It’s also worth noting that when XHS goes off into aspirational aesthetic content, it tends to get moderated by regulators. So this is a segment that XHS has A/B tested thoroughly, and it knows where the sweet spot is.2

The content positioning was realised through a series of product decisions. Let’s review how XHS achieved that position:

More powerful search

This is not hard since Instagram’s search isn’t very powerful. Still, when I type keywords into XHS, I’m more likely to find actionable comparisons between products and how-to-wear guides versus Instagram’s aesthetic layouts, and that has value.

Optimised to be actionable

XHS is designed to help users find relevant information, whereas Instagram is more concerned with giving out vibes. A search for “Changsha” (a popular second-tier city) in XHS will lead to a list of actionable sub-headings to enable a guided search experience. Having such clear subcategory headings also indicates more precise data labelling and modelling on XHS' part. They are thinking about what these sub-verticals mean for their business model.

High intention layout

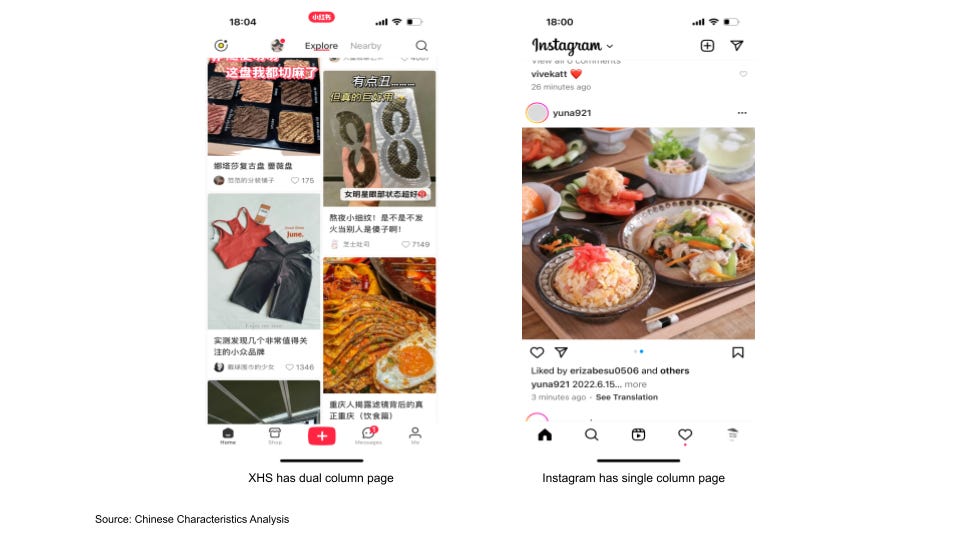

The double-column layout for XHS has a double-column layout to allow the user to show more intention while browsing content. Empowering users with these choices will give XHS a tighter feedback loop for recommendations, creating a virtuous cycle that serves both the user and the company.

Prioritises the collection function

XHS shows the number of times a piece of content has been ‘collected’. XHS posters note that the algorithm prioritises content that has been ‘collected’ instead of ‘liked’ since that’s a more robust signal of usefulness.

The separation of signalling for entertainment versus utility creates more signals for the user. It allows good content to have a longer shelf life on XHS.

Say less and say it with pictures

XHS has a character limit of 1,000 and a nine-picture limit to the no-word limit of Zhihu.3 The format’s constraint means posters are more focused on being actionable. That is also more friendly for new users since the barrier to posting isn’t an essay but rather a few sentences. This can go some ways to explain XHS’ stat of 43 million creators.

Lifestyle focus

From its earliest incarnation as a shopping guide to a UGC-content platform focusing on cosmetics and beauty, XHS has been related to lifestyle. While they’ve branched out in more categories, including travel, fashion, food, life hacks and home decoration to name a few popular verticals — it still revolves around stylised living for the semi-affluent. XHS’ focus on lifestyle is easier to generate actionable content than Bilibili’s initial focus on AGC. But similar to Bilibili, XHS captured a group of young users and grew with them into different areas as they progressed through life.

Cracking the virtuous circle

Like Keep, Ctrip, Dianping and others, XHS has mastered the art of mobilising content creation. Either through incentivising new posters with a small monetary reward or a surge of user traffic to new posts. XHS has been able to follow and support its community in creating new volumes of content on emerging topics such as glamping and snowboarding.

Monetisation strategy

XHS’ content being close to the comparison layer versus the awareness layer means it is closer to transactions and can monetise through advertising or e-commerce quicker. However, this also puts them more in the competitive spheres of both e-commerce and entertainment platforms.

After amassing 200m users and 43m creators4, XHS has monetised through various advertising formats. These include screen advertising upon opening the app, influencer-led marketing coordinated through a platform called PGY and consultative-style advertising services that leverage XHS’ user insights, dubbed IDEA strategy. According to XHS, there are currently 130,000 brands on XHS from more than 200 countries and regions worldwide.

The XHS cycle of using influencers to create awareness before leading them to the relevant product is well known to the Chinese internet. It’s the so-called planting, nurturing and then harvesting cycle. It introduces a product to a user via posts and then slowly shows more reviews to the user until they ultimately buy. It has entered popular lexicology and has been closely associated with XHS. There is a strange power when your frameworks are known to the audience. On the one hand, it does signify a moment of recognition the platform has on the mainstream culture. On the other hand, users are now educated about the manoeuvres they see on screen. Does this make them less willing consumers?

Going forward, XHS’ is gearing up to tackle e-commerce by allowing purchases to happen directly in the note posts scroll.

This marks the second foray into direct e-commerce, and the bet is that 3PL infrastructure will be stronger in 2022 than in 2014. This is a deliberate follower move as other content platforms such Douyin, Kuaishou, and Bilibili have pursued their own e-commerce strategies. XHS might have advantages in e-commerce monetisation against the others whose content has been more entertainment-heavy.

The moderation issue

Content which focuses on utility also means that trust in the content is paramount. Trust is slowly gained but easily lost, so timely moderation is critical. By contrast, entertainment content only has to worry about whether its creators are creating sufficiently engaging content.

XHS and every other platform must play a moderation cat and mouse game in the public’s eye. Too heavy a hand, and it makes posters antsy about what can be said. Too lenient, and all sorts of fake reviews and ostentatious posts that do not correspond with socialism with Chinese characteristics pop up. XHS has had many controversies over this, from fake reviews, photoshopped scenic spots, excessive wealth flaunting, underaged photos, and female user harassment. I list these to make the point that every internet platform has a moderation problem and the Chinese regulators are watching the space closely.

The more popular a platform is, the more likely it will have these content issues as there’s no better place to post to gather online traffic. The influx of fake or problematic content then lessens users' trust in the platform. This is why growing a community is a slow process, not a straight line. Whether XHS will succeed is still a matter of debate, although its moderation team has always responded swiftly. What is unknown is how much user trust has been lost along the way.

Conclusion

XHS has come a long way from the shopping guide for the affluent. It has shifted with the times to become the go-to life guide for living a better life for the growing Chinese middle class. To chart a path in the tricky content space that is the Chinese internet is no easy task, and XHS has done this by focusing on content that is more utility in nature than entertainment. The focus on the content being actionable is deeply reflected in their product design and functionalities.

As XHS is relaunching their e-commerce efforts in partnership with a cohort of brands, they’re about to go into open competition with every big player in the field. But given the dwindling growth space in the Chinese internet, this was almost foretold. Will XHS be able to compete well as a later-comer in the e-commerce wars?

The future will require further growth of the user base into regions that XHS is not as unfamiliar with - the male population, the lower-tier cities population, the over 30 population - groups that are not the typical garrulous and aspirational set that XHS is used to. Will these dilute the community culture? Almost certainly. Will utility-based content be hard to compete against entertainment-based content? Will XHS keep its spiritual centre, or will it evolve with its new users? While Douyin changed to become more like Kuaishou as it expanded, Bilibili is trying5 to stick to their guns as a Gen-Z+ lifer. Let’s see what XHS decides, shall we?

The saying goes: when people want to pontificate, they go to Zhihu. When they want to find out how to do something, they go to XHS

While Instagram has a 2,200 character limit and 10 picture limit per post, the considerations are different. Since Chinese is a character-based language, it should be recognised that XHS has a 1,000-word limit to Instagram’s 2,200 characters.

impressive stats if true since it means about 21% of the MAU base has posted

The key note is trying, but they are expanding the age range of what they define as ‘young’ these days

This is a well considered and informative article. Love to receive more pieces like this!

I was looking for something like this! XHS has been fascinating for me as I heard multiple colleagues mention it in HK as the go-to for recommendations. I now understand them better.